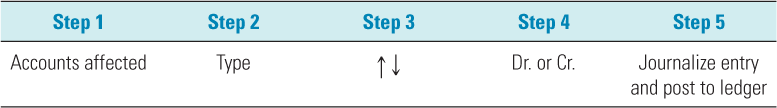

To properly record, or journalize, transactions in the general journal, it is helpful to complete a five-step process. Steps 1 through 4 analyze the transaction for the journal entry, and step 5 reflects the journalizing of the transaction and the posting from the journal into the accounts in the general ledger.

Step 1 What accounts are involved? Example: Cash, Accounts Payable, Salaries Expense, etc.

Step 2 For each account involved, what type of account is it? Is it an asset, a liability, or one of the stockholders’ equity accounts? Example: Cash is an asset.

Step 3 Is the account balance increasing or decreasing? Example: If you receive cash, then that account increases.

Step 4 Should the account be debited or credited? Example: Cash is an asset and it increases; increases in assets are recorded as debits.

Step 5 Record the entry and post to the accounts in the general ledger.

The five-step analysis looks like the following in chart form:

Applying Transaction Analysis

Example: Check out how the transactions for the first month of operations for Bold City Consulting, Inc., are analyzed and recorded.

Note that for illustration purposes, journal entries are shown being posted to T-accounts within the accounting equation. In actual practice, the journal entries would be posted to four-column accounts in the general ledger.

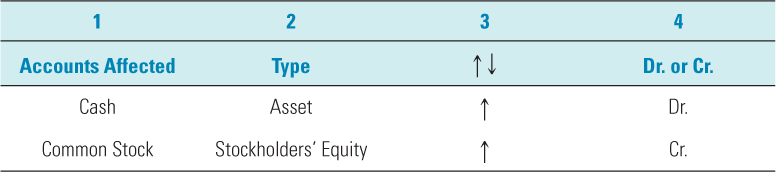

1. Sale of stock. The business sold Brian Miller $10,000 of common stock for cash.

Analysis of Transaction (1)

Step 1 What accounts are involved? The business received cash in exchange for stock, so the accounts involved are Cash and Common Stock.

Step 2 What type of account is it? Cash is an asset. Common Stock is an account within stockholders’ equity.

Step 3 Does the account balance increase or decrease? Because cash was received, Cash is increased. Common Stock also increases because more stock has been issued.

Step 4 Do you debit or credit the account in the journal entry? According to the rules of debits and credits, an increase in an asset is recorded with a debit. An increase in Common Stock is recorded with a credit.

The first four steps can be summarized as follows:

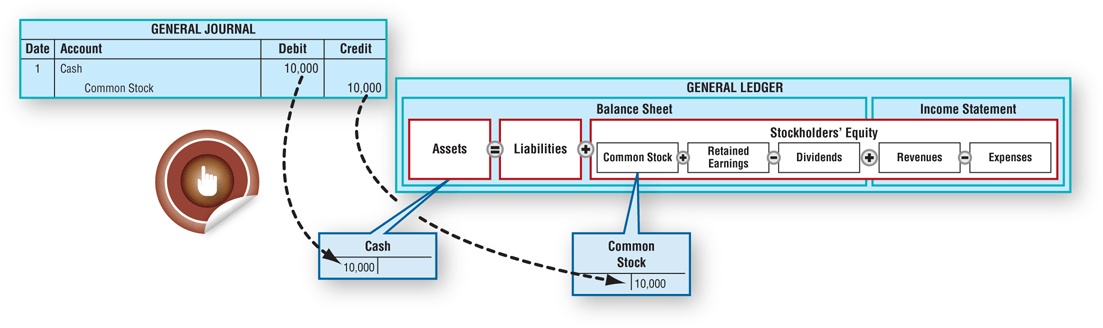

Step 5 Journalize and post the transaction as follows:

Notice that the name of the account being credited is indented in the journal. This format is a standard way to differentiate the accounts that are credited from the accounts that are debited.

Also, note again that every transaction affects at least two accounts and that the total amount added to the debit side equals the total amount added to the credit side. This demonstrates double-entry accounting, which keeps the accounting equation in balance.

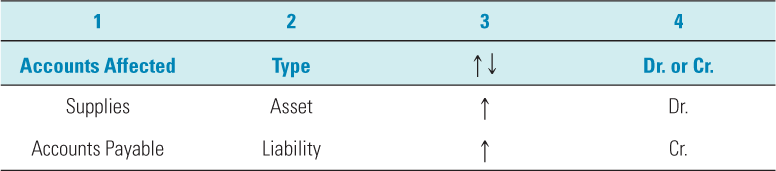

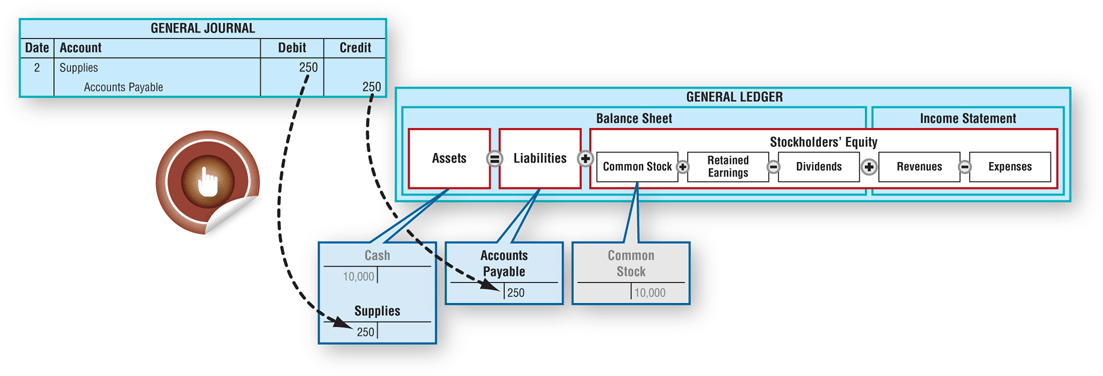

2. Purchase supplies on credit. Bold City Consulting purchases office supplies, agreeing to pay $250 within 30 days.

Analysis of Transaction (2)

Step 1 The business received supplies in exchange for a promise to pay cash to the supplier next month. The accounts involved in the transaction are Supplies and Accounts Payable.

Step 2 Supplies is an asset; Accounts Payable is a liability.

Step 3 The asset Supplies is increased. The liability Accounts Payable is increased because the business owes more than it did before this transaction.

Step 4 An increase in the asset Supplies is a debit; an increase in the liability Accounts Payable is a credit.

Step 5 Journalize and post the transaction:

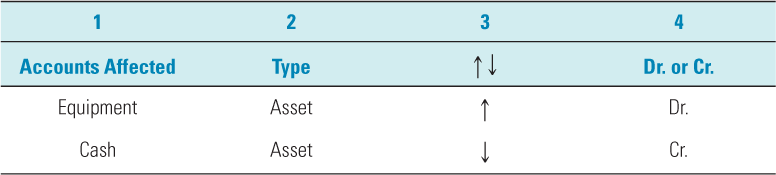

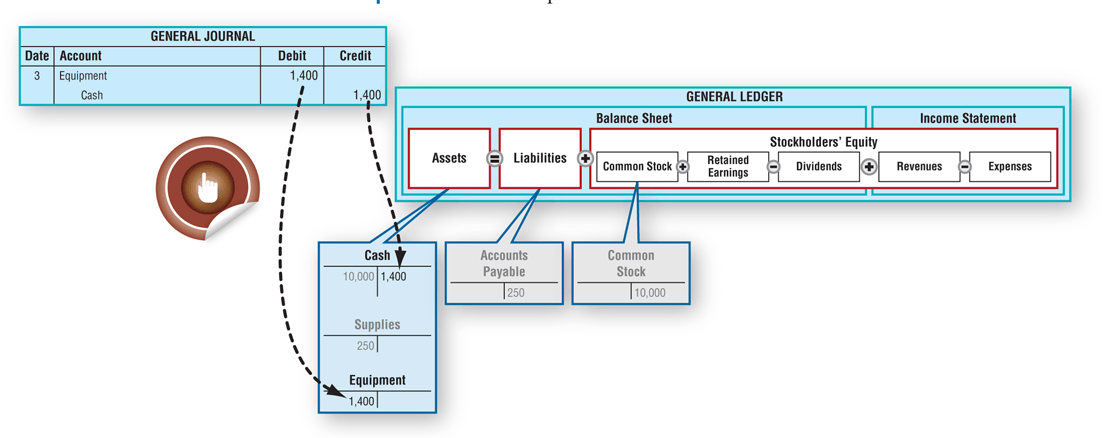

3. Purchase equipment for cash. The business purchases equipment, paying cash of $1,400.

Analysis of Transaction (3)

Step 1 The business received equipment in exchange for cash paid to the equipment manufacturing company. The accounts involved in the transaction are Equipment and Cash.

Step 2 Equipment and Cash are both assets.

Step 3 The asset Equipment is increased. The asset Cash is decreased because a check was written to pay for the equipment.

Step 4 An increase in the asset Equipment is a debit; a decrease in the asset Cash is a credit.

Step 5 Journalize and post the transaction:

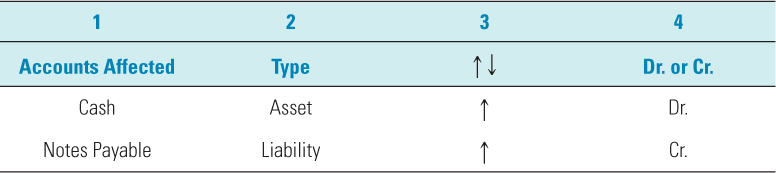

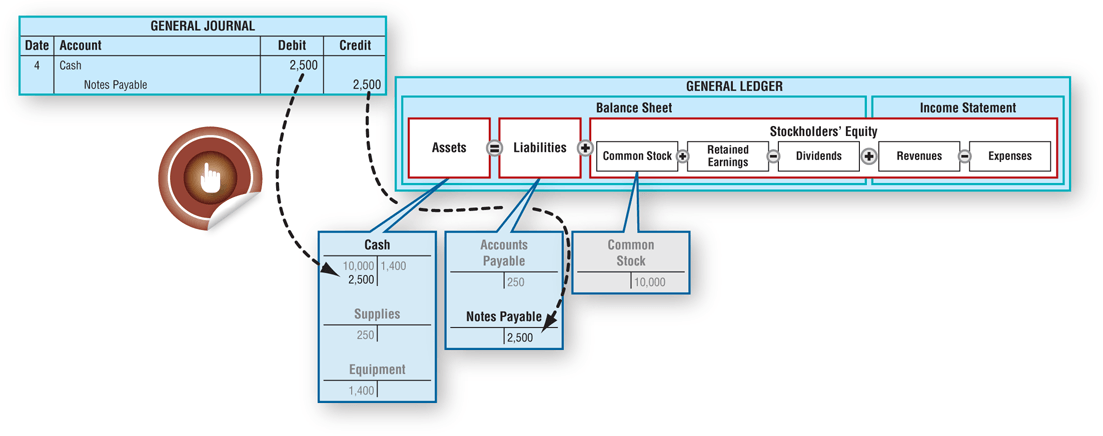

4. Borrow cash from the bank. Bold City Consulting borrows $2,500 cash from the bank and signs a two-year note payable to the bank.

Analysis of Transaction (4)

Step 1 Bold City Consulting received cash from the bank in exchange for a signed note agreeing to pay the cash back in two years. The accounts involved in the transaction are Cash and Notes Payable.

Step 2 Cash is an asset; Notes Payable is a liability.

Step 3 The asset Cash is increased. The liability Notes Payable is also increased because it represents an obligation owed to the bank.

Step 4 An increase in the asset Cash is a debit; an increase in the liability Notes Payable is a credit.

Step 5 Journalize and post the transaction:

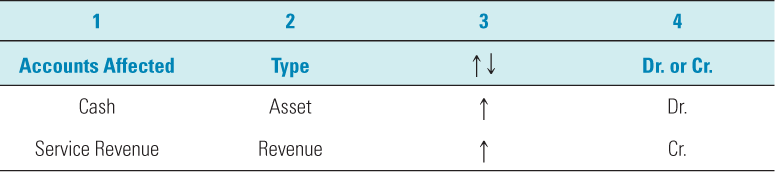

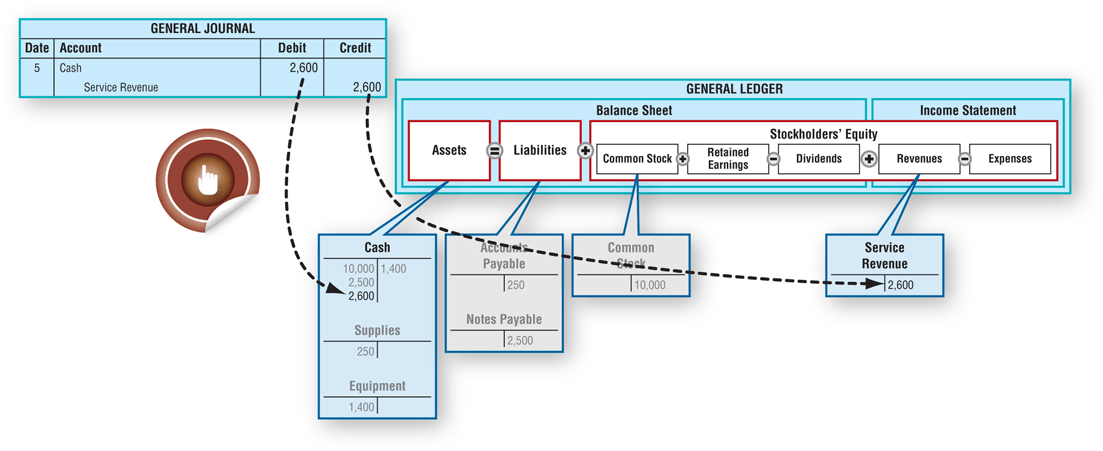

5. Provide services for cash. Bold City Consulting collects $2,600 cash for services provided.

Analysis of Transaction (5)

Step 1 The business received cash in exchange for consulting services. The accounts involved in the transaction are Cash and Service Revenue.

Step 2 Cash is an asset; Service Revenue is a revenue.

Step 3 The asset Cash is increased. The revenue Service Revenue is also increased because the business has earned revenue by providing services.

Step 4 An increase in the asset Cash is a debit; an increase in the revenue Service Revenue is a credit.

Step 5 Journalize and post the transaction:

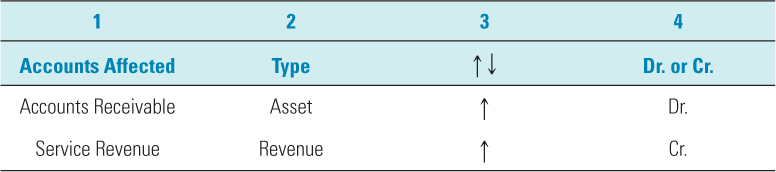

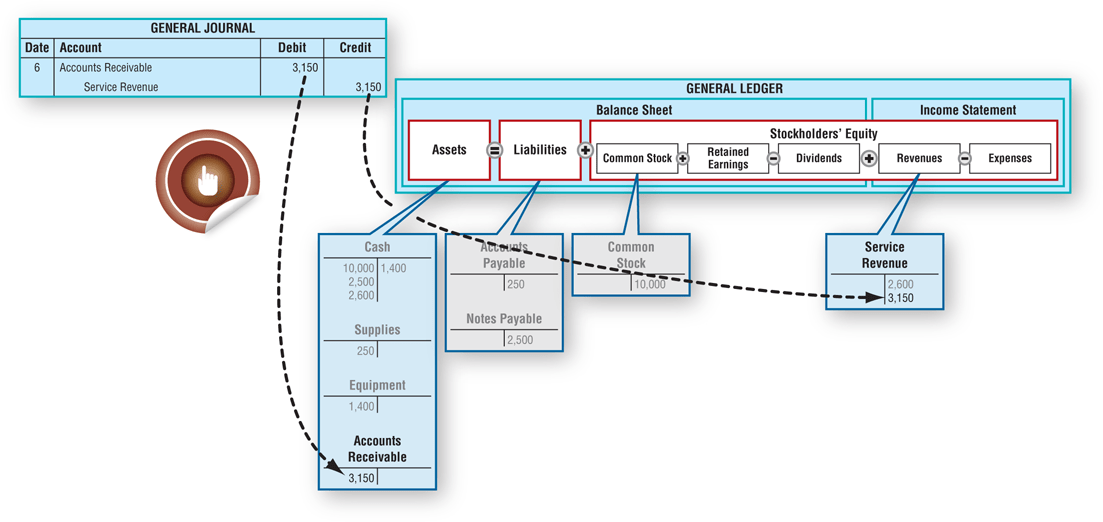

6. Provide services on credit. Bold City Consulting performs $3,150 of services on account.

Analysis of Transaction (6)

Step 1 Bold City Consulting received promises from customers to send cash next month in exchange for consulting services provided. Again, the business earned this money, although it has not received it yet. The accounts involved in the transaction are Accounts Receivable and Service Revenue.

Step 2 Accounts Receivable is an asset; Service Revenue is a revenue.

Step 3 The asset Accounts Receivable and the revenue Service Revenue are both increased.

Step 4 An increase in the asset Accounts Receivable is a debit; an increase in the revenue Service Revenue is a credit.

Step 5 Journalize and post the transaction:

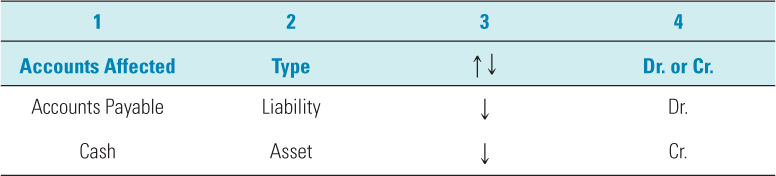

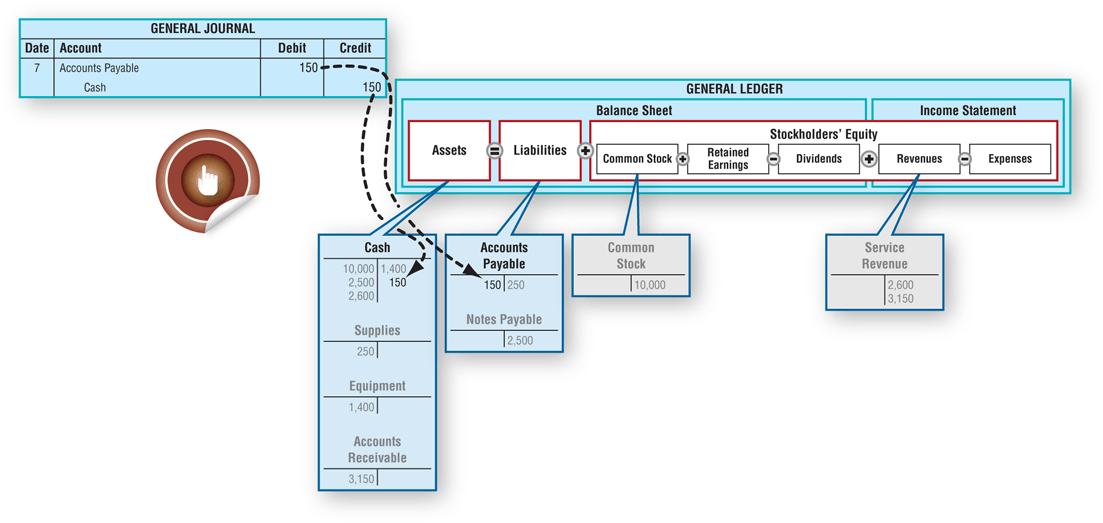

7. Partial payment of accounts payable. Bold City Consulting pays $150 to the store where it purchased $250 worth of supplies in transaction (2).

Analysis of Transaction (7)

Step 1 Bold City Consulting paid $150 of the $250 it owed to a supplier. The accounts involved in the transaction are Accounts Payable and Cash.

Step 2 Accounts Payable is a liability; Cash is an asset.

Step 3 The liability Accounts Payable is decreased. The asset Cash is also decreased.

Step 4 A decrease in the liability Accounts Payable is a debit; a decrease in the asset Cash is a credit.

Step 5 Journalize and post the transaction:

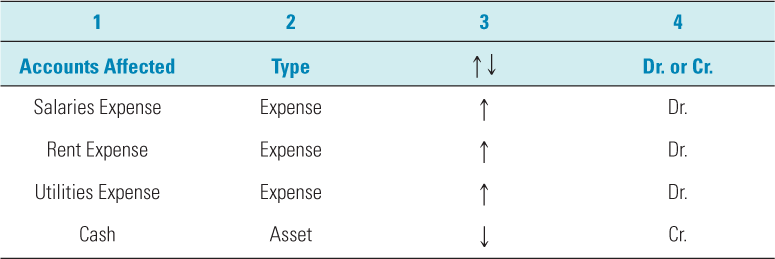

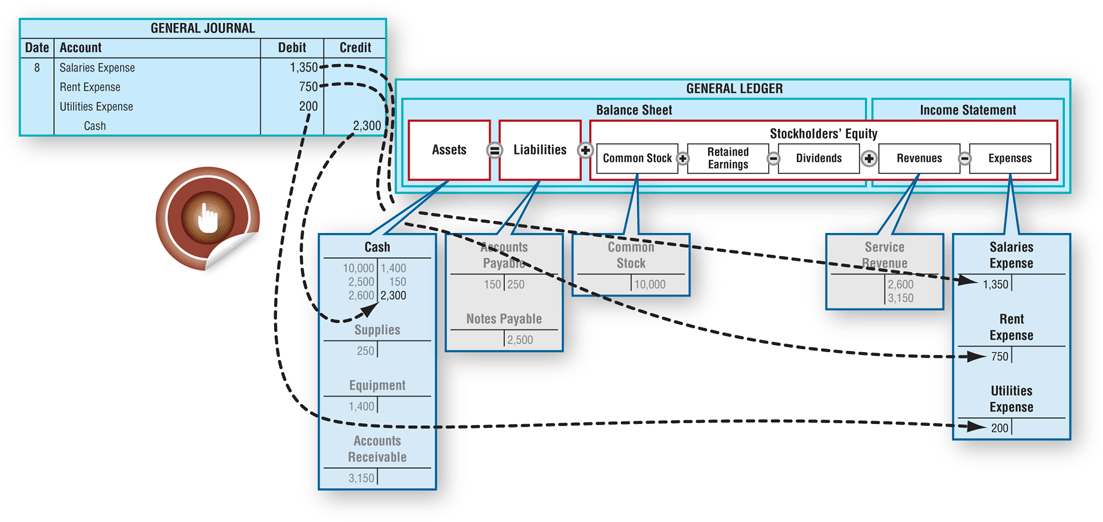

8. Payment of expenses. During the month, Bold City Consulting paid $2,300 cash for expenses incurred, such as salaries (1,350 dollars), building rent (750 dollars), and utilities (200 dollars).

Analysis of Transaction (8)

Step 1 The business paid $2,300 in exchange for employee services, for the use of the building, and for utilities consumed as part of operating the business. The accounts involved in the transaction are Salaries Expense, Rent Expense, Utilities Expense, and Cash.

Step 2 Salaries Expense, Rent Expense, and Utilities Expense are expenses; Cash is an asset.

Step 3 The expense accounts are increased. The asset Cash is decreased.

Step 4 An increase in an expense is a debit; a decrease in the asset Cash is a credit.

Step 5 Journalize and post the transaction:

As we can see by this entry, more than two accounts may be used in an entry. This is referred to as a compound journal entry. Note that the total amount of debits must still equal the total amount of credits.

Compound journal entry

A journal entry that affects more than two accounts.

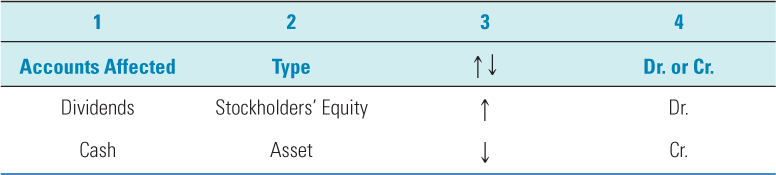

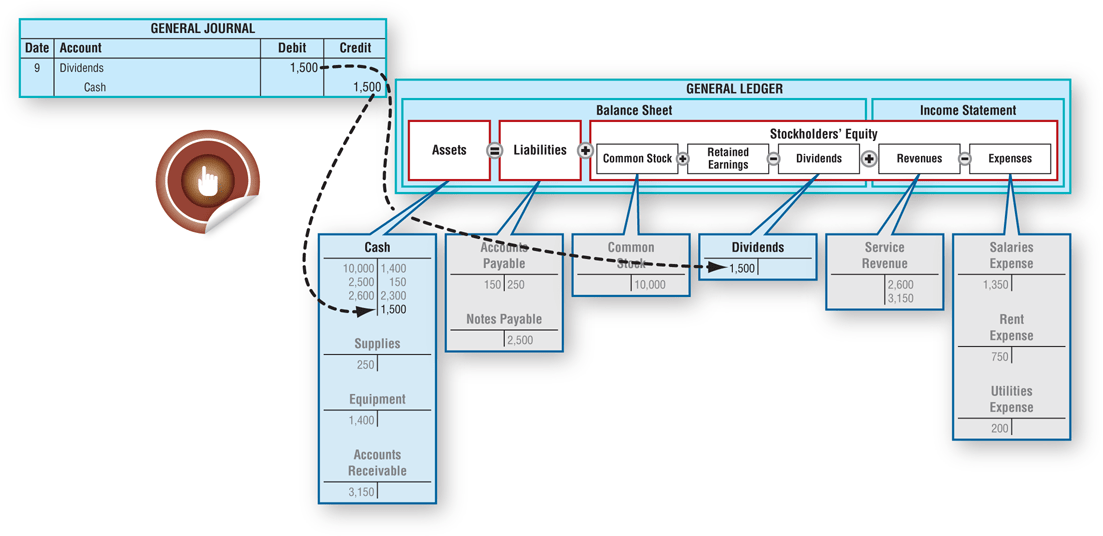

9. Cash dividends. Bold City Consulting pays $1,500 of cash dividends to Brian Miller, the stockholder.

Analysis of Transaction (9)

Step 1 The stockholder received cash dividends. The business reduced the stockholders’ equity interest because of dividends paid to the stockholder. The accounts involved in the transaction are Dividends and Cash.

Step 2 Dividends is an account within stockholders’ equity and Cash is an asset.

Step 3 The Dividends account is increased because dividends have been paid. The asset Cash is decreased.

Step 4 An increase in Dividends is a debit; a decrease in the asset Cash is a credit.

Step 5 Journalize and post the transaction:

Decision Guidelines

| Decision | Guideline | Analyze |

|---|---|---|

| When does a business recognize and record a transaction? | Examine the transaction to determine its impact, if any, on the company’s accounting equation. | If the transaction immediately increases or decreases assets, liabilities, or stockholders’ equity, then the transaction should be recorded in the company’s accounting records. |