Trial balance

A list of all the accounts of a business and their balances; its purpose is to verify that total debits equal total credits.

Once transactions have been recorded in the journal and posted to accounts in the ledger, a trial balance is prepared.

Trial Balance Preparation Steps

- The first step in preparing a trial balance is to complete the heading. The heading should show the company name, the statement name, and the date of the trial balance.

- Next, the name of each account is entered into the first column of the trial balance in the order the accounts appear in the general ledger.

- Now, two columns are created, one labeled “debit” and the other “credit,” and the balance of each account is entered into the correct column.

- Finally, the debit and credit columns are totaled.

- The first and last amount in each column have a dollar sign placed before them, and the last amounts in both columns are double underlined.

Trial Balance Purpose

Its purpose is to summarize all account balances to be certain that total debits equal total credits after the entries have been journalized and posted.

A trial balance can be prepared at any time, but it is most commonly done at the end of the accounting period. An accounting period is usually defined as a month, a quarter, or a year.

Accounting period

In general, the time period reflected by a set of financial statements.

Example

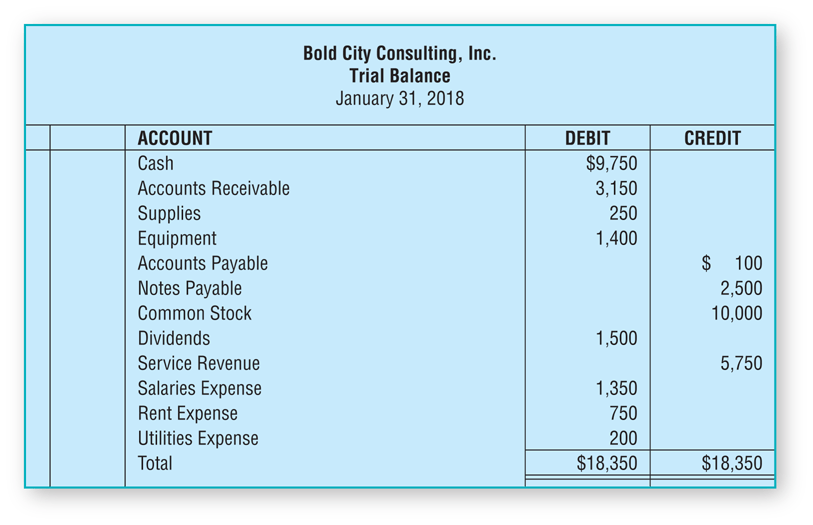

Figure 1 shows the trial balance for Bold City Consulting, Inc., after all transactions have been journalized and posted for January 2018.

Figure 1: Trial Balance Example

Trial Balance Uses

After completing the trial balance, you can use it to prepare the financial statements because it shows all of the accounts with their balances.

- First, set up the financial statements.

- Now, using the account balances from the trial balance, insert the account names and their balances into the financial statements, starting with the income statement, then the statement of retained earnings, and finishing with the balance sheet.

- Make sure the balance sheet is in balance! That is, total Assets equal total Liabilities plus Stockholders’ Equity.

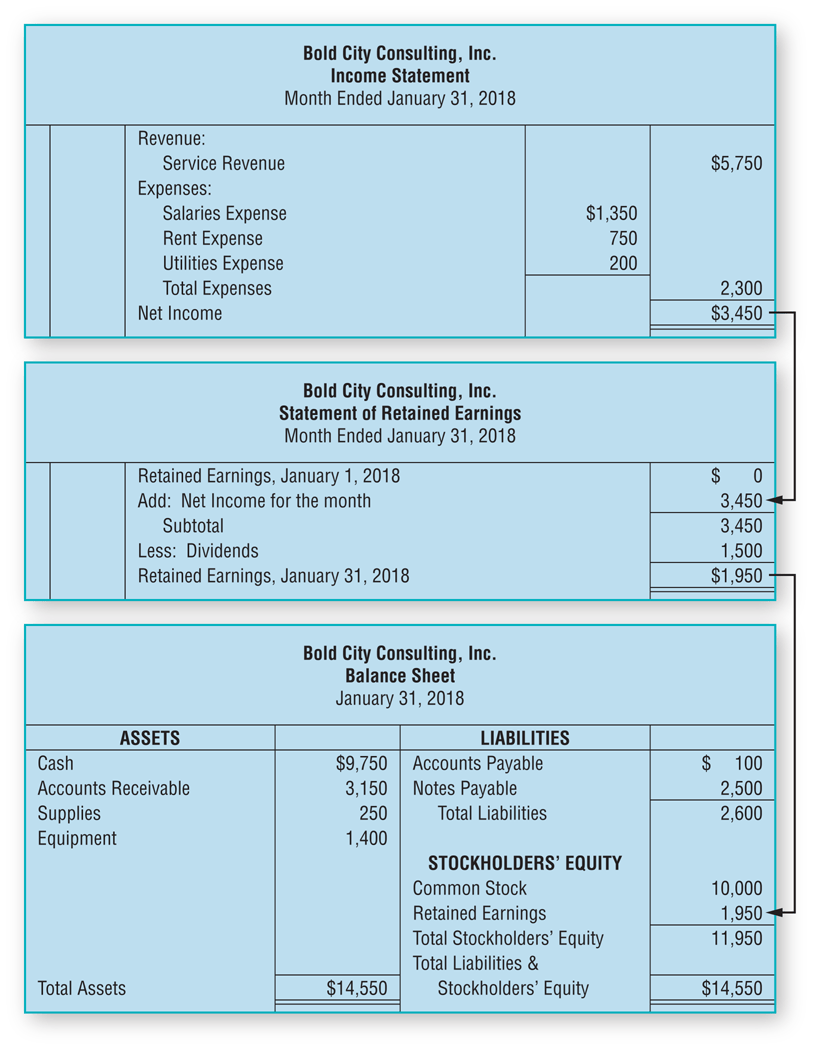

Figure 2 shows the income statement and statement of retained earnings for the month ended January 31, 2018, and the balance sheet at January 31, 2018, for Bold City Consulting, Inc.

You can see once again how the information flows from one statement to another.

Figure 2: Trial Balance Application

On the income statement above, we see detailed information for revenues and expenses.

Accounting Cycle

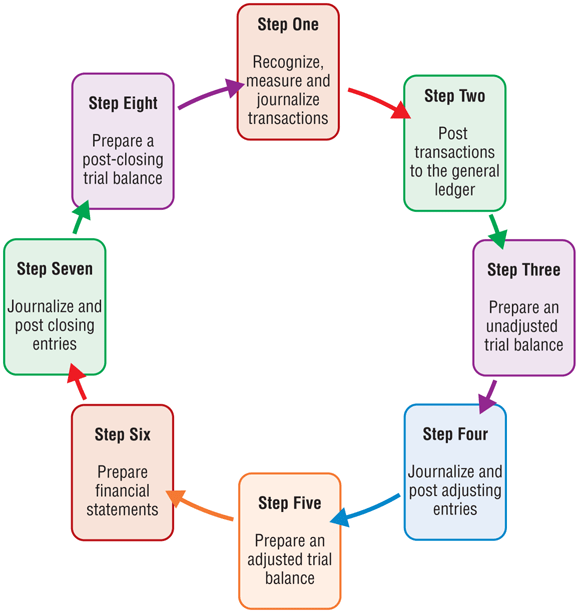

The process of analyzing transactions, entering them into the journal, posting them to the ledger, preparing a trial balance, and preparing financial statements is only a part of what is called the accounting cycle.

This accounting cycle is completed by a business for every accounting period, and then it is repeated for the next accounting period, and the next, and the next, and so on. The following is a visual representation of the accounting cycle:

Accounting cycle

The sequence of steps used to record and report business transactions.

Figure: Accounting Cycle Steps