What was once called finance is now referred to as financial management, reflecting the current emphasis on the importance of having all managers in a business participate in making important decisions that affect the company as a whole.

Financial management ensures that a company uses its resources in the most efficient and effective way: maximizing its profit (or earnings), which ultimately increases the value of a business (its net worth or equity).

Objectives of Financial Management

Financial management deals with two things: (1) raising funds and (2) buying and using assets to gain the highest possible return.

An important objective of financial management is to ensure that the assets used in business produce a return that is higher than the cost of borrowed funds. For example, suppose an individual borrows money from a bank at, say, 6% interest and lends the money to a friend. He would certainly charge his friend more than 6%.

In the above example, we have two transactions. First, the individual borrows money from a bank. Second, the person lends it to a friend, creating an investment. Businesses function in the same way. Managers borrow money from lenders and invest it in business assets to earn a profit.

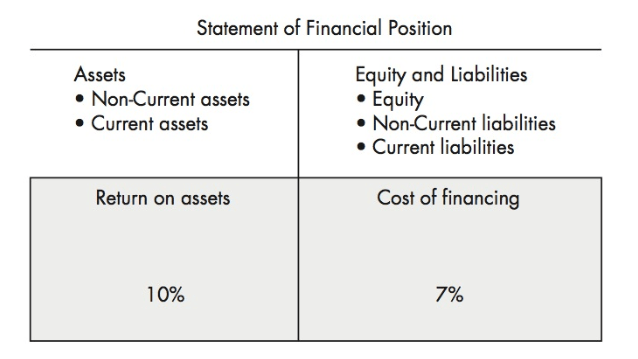

Figure 1: Relationship between ROA and Cost of Financing

As shown in Figure 1, the objective of financial management is to ensure that the return on assets (ROA) generated by a business (here, 10%) is higher than the cost of money borrowed from investors—that is, lenders and shareholders (here, 7%).

The statement of financial position has two sides. On the left, it lists the assets, such as non-current assets (e.g., cars, buildings, equipment) and current assets (e.g., inventories, trade receivables), that a business owns; on the right, it shows the money raised from investors, such as equity (shareholders), non-current liabilities (long-term borrowings), and current liabilities (line of credit).

Example

In the above example, if the business invests $\$100,000$ in assets (left side) and generates $\$10,000$ in profit, it has earned a 10% return ($\$10,000\text{}\div\text{}\$100,000$ ). If the business borrows the $\$100,000$ and pays $\$7,000$ in interest for it, the cost of financing is 7% ($\$7,000\text{}\div\text{}\$100,000$ ).

Responsibilities

Financial management must answer five important questions:

1. How are we doing? Everybody—managers, short- and long-term lenders, shareholders, suppliers, and so on—wants to know about a company’s financial performance in terms of its profitability, liquidity, prosperity, and stability.

2. How much cash do we have on hand? How much cash a company has on hand determines its liquidity and its ability to pay its bills (suppliers, employees, and short-term lenders) on time.

3. What should we spend our money on? Money can be spent on (a) operating activities, such as salaries, advertising, freight, promotions, and insurance, including current assets, such as inventories and trade receivables; and (b) investing activities, that is, non-current assets, such as property, plant, machinery, and equipment.

4. Where will our funds come from? Once managers have identified how much money the business needs and how much cash it has, they have to determine where more cash can be obtained. Suppliers? Bankers? Long-term investors, such as shareholders, venture capitalists, or mortgage companies?

5. How will our business be protected? One of the most important responsibilities of managers is to protect the investors’ interests. Managers are employed by shareholders and should therefore act on their behalf.

Example

ROA and Cost of Financing

A business earns $\$1.2$ million in profit on a $\$10$ million investment. The owners were able to obtain a $\$600,000$ loan. The yearly interest charges amount to $\$50,000$. Calculate and compare the company’s ROA and the cost of financing.

Solution

- Return on assets (ROA) is 12.0% ($\$1,200,000\text{}\div\text{}\$10,000,000$).

- Cost of financing is 8.3% ($\$50,000\text{}\div\text{}\$600,000$).

- The company’s ROA exceeds the cost of financing by 3.7%