By the end of this article, you will be able to learn:

- What is the expenditure?

- What is the cost?

- What is the expense?

To fully appreciate the interrelationship of the statement of comprehensive income and statement of financial position, we need to consider the definitions of and differences between three terms: expenditure, cost, and expense.

What is Expenditure?

Expenditure refers to any outlay of cash or other consideration. We say ‘the business’s expenditure for supplies was 1200 dollars’, which means that 1200 dollars were spent on supplies. But this statement does not tell us whether we still have the supplies on hand and available for future use (so that the expenditure is classified as an asset on the statement of financial position) or whether they have already been consumed (so that the expenditure is classified as an expense on the statement of comprehensive income).

The term expenditure also does not tell us whether an immediate cash outflow occurred. We may already have paid or only promised to pay in the future.

What is the Cost?

A cost refers to the amount given to acquire an asset. If an expenditure is made to acquire supplies, then the cost is the amount paid in cash to acquire those supplies – for example of 1200 dollars. However, the supplies could also be acquired on credit. Therefore, knowing that an asset cost1200 dollars does not tell us whether a cash outlay has occurred, nor does it tell us whether the supplies are still available for future use (an asset) or whether they have already been used (an expense).

A cost can be created by an estimate of future expenditures. For example, if the company sells 200,000 dollars of electronic equipment in cash with a warranty to repair defects for one year after the sale, then an estimate of future expenditures related to those repairs is made – let’s say 30,000 dollars. No immediate expenditure has been made, but the business has incurred a cost.

What is the Expense?

An expense refers to decreases in economic benefits. Because an expense is always reported on the statement of comprehensive income, it is a cost that has already been consumed – ‘expired’ – and therefore has no future value to the business.

If we say ‘supplies expense was 1200 dollars’, then we know that supplies that cost 1200 dollars have been consumed and are therefore no longer available for future use in the business. However, the term expense does not tell us whether payment has been made or not.

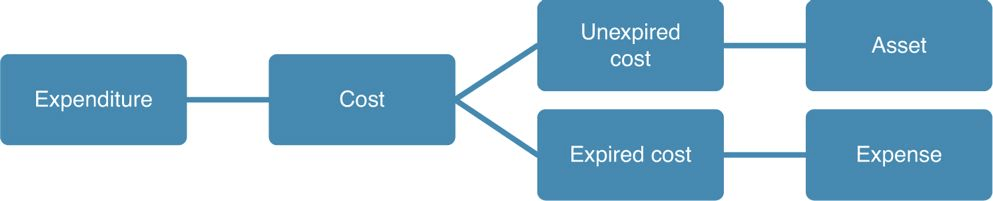

Figure 1 provides a graphical overview of the relationship between these terms.

Figure 1 Expenditure, Cost and Expense

Figure 1 shows how costs are expenditures that are either unexpired or expired. If unexpired, the cost is classified as an asset. If expired, the cost is classified as an expense. Also, as an asset is consumed, it too expires and therefore becomes an expense.

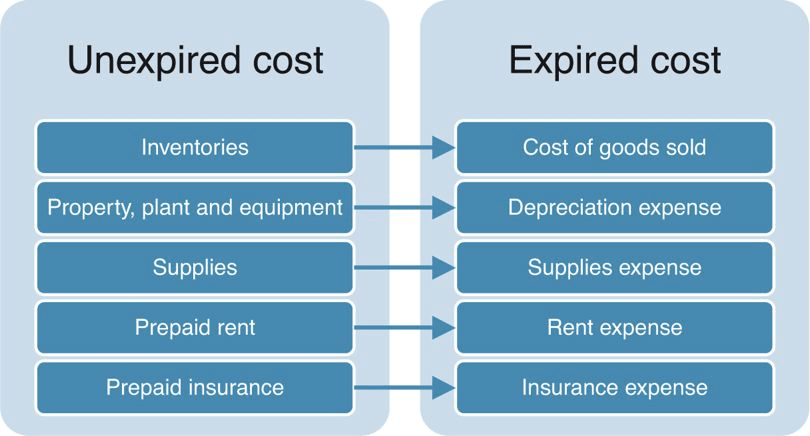

Examples of costs that are classified as assets on the statement of financial position and later reclassified as expenses on the statement of comprehensive income because they have expired are shown in Figure 2.

Figure 2 Unexpired and Expired Costs

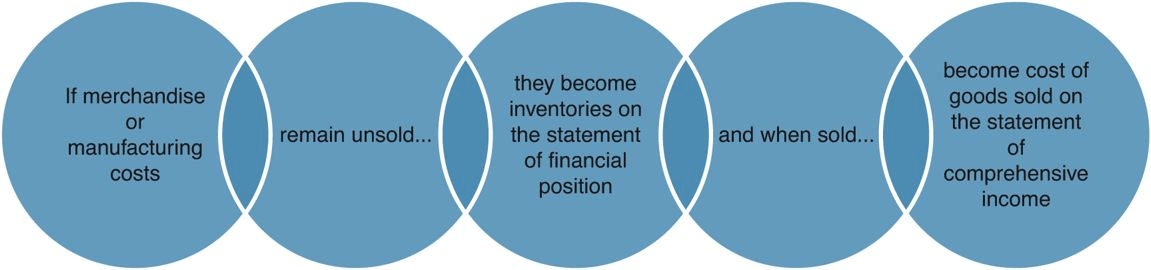

Notice in particular ‘inventories’ and ‘cost of goods sold’ in the first item in Figure 2. Let’s take an example of Carrefour’s cash purchase of consumer electronic devices from the Chinese supplier. This purchase is a cost. But in order to correctly classify this cost as an asset or an expense, we need to know whether it has expired. As long as the devices remain unsold, the cost appears on the statement of financial position as inventories (an asset). Once sold, the asset cost expires and becomes the cost of sales (an expense) on the statement of comprehensive income. The diagram in Figure 3 shows this relationship.

Figure 3 Inventories versus Cost of Sales

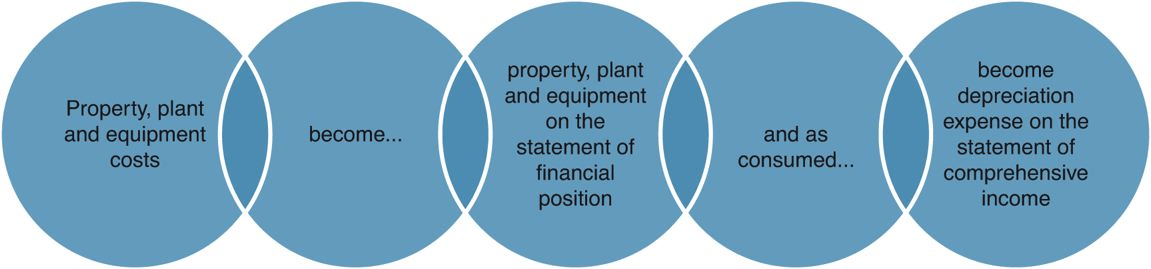

The second line of Figure 2 shows that property, plant, and equipment, which is an asset cost on the statement of financial position, expires to become depreciation expense on the statement of comprehensive income.

In other words, depreciation expense represents the amount of the cost for the property, plant, and equipment that was consumed during the period. This is shown in Figure 4.

Figure 4 Property, Plant And Equipment versus Depreciation Expense

The same logic applies to supplies, prepaid rent, prepaid insurance and other costs that expire and are therefore reclassified from the statement of financial position to the statement of comprehensive income.