A liability is an obligation of the business that will have to be settled in the future. The definition is shown in the GAAP box.

| GAAP | A liability is ‘a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits’. |

Many liabilities arise from legal obligations such as a binding contract or statutory requirements (for example tax laws). However, an obligation could also be created by normal business practice. For example, a business may decide to repair goods that it sold if a defect became apparent after the warranty period expired. Thus while not legally required to make the repairs, the intention to make them creates an obligation.

However, liabilities do not arise based on future events like the intention to acquire an asset such as equipment, unless the company has entered into an irrevocable agreement to purchase the equipment.

The settlement of liability can occur in several different ways. It can be settled by paying cash, transferring other assets, providing services, replacing one obligation with another, or converting the obligation to equity.

Liabilities are created by past transactions or events. Even when payment will be made in the future, the obligation to do so is created by a past event. For example, a company may have promised rebates on products it sold to customers who will be paid in the future, but the obligation to pay the rebate was created by the sale of the product to the customer, a past transaction.

What Are Current Liabilities?

Liabilities are also classified as either current or noncurrent. The definitions of current liability and noncurrent liability are shown in the GAAP box.

| GAAP | ‘An entity shall classify a liability as current when: |

| (a) It expects to settle the liability in the normal operating cycle;

(b) It holds the liability primarily for the purpose of trading; (c) The liability is due to be settled within twelve months after the reporting period; or (d) The entity does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting period. |

|

| An entity shall classify all other liabilities as non-current.’ |

Figure 1 illustrates the statement of financial position, with liabilities categorized into current liabilities and noncurrent liabilities.

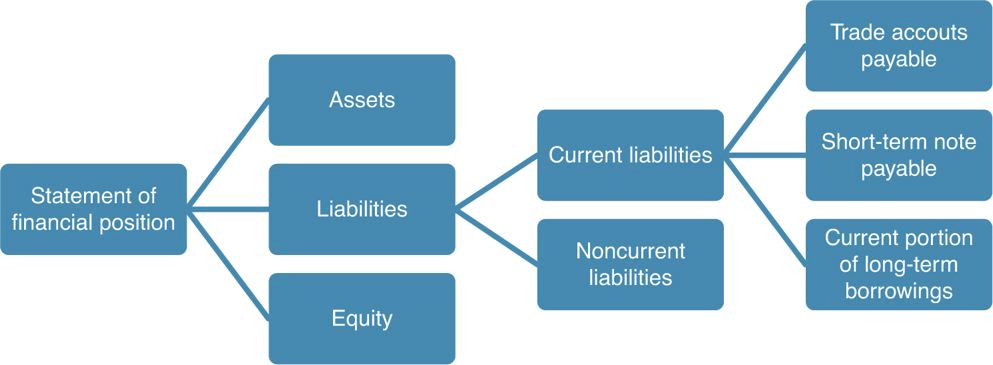

FIGURE 1 Current Liability Components

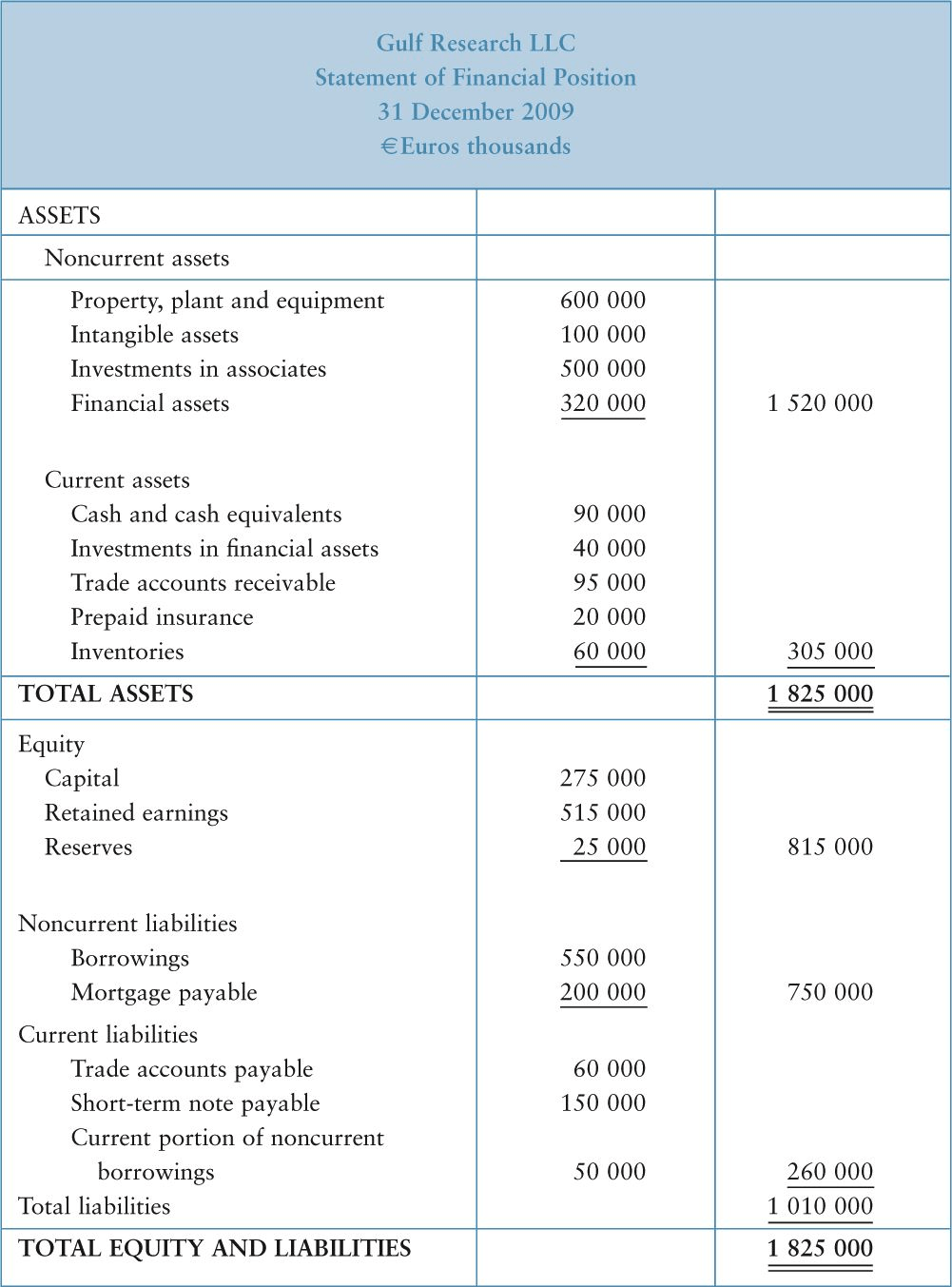

The statement of financial position in Figure 2 shows that Gulf Research has three current liabilities: the first is €60,000 for trade accounts payable, short-term note payable and current portion of noncurrent loans:

• A trade account payable is the amount the business owes to its suppliers. This liability was created when the business purchased goods or services on account and gave its promise to pay in the future.

• The short-term note payable for €150,000 represents an amount that the business owes on a note – money that it borrowed and that must be repaid in the short term.

• The current portion of noncurrent borrowings represents an amount that the business must pay within the next 12 months on long-term borrowings. In other words, in the past, the business borrowed an amount of money that it was obligated to repay over a period of more than 12 months. In each year, the business is required to repay some amount of this money in installments. The current installment due within 12 months would be reclassified as current. In Figure 2 you can see in noncurrent liabilities that Gulf Research has borrowings of €550,000. Total borrowings are €600,000 (€50,000 current + €550,000 noncurrent), of which €50,000 must be settled within 12 months.

FIGURE 2 Statement of Financial Position

When we then add €60,000 for trade accounts payable, €150,000 for the short-term note payable and €550,000 for the current portion of noncurrent borrowings, the total is €260,000 for current liabilities. Figure 3 graphically illustrates current liability line items based on the Gulf Research example.

FIGURE 3 Current Liability Components

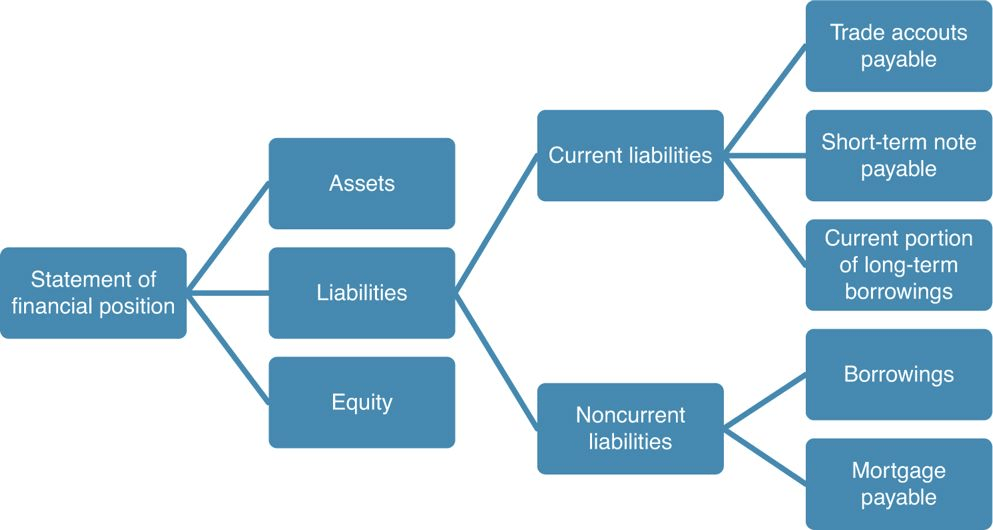

What Are Noncurrent Liabilities?

A noncurrent liability (or long-term liability) is a liability that does not meet the definition of a current liability.

Gulf Research has two noncurrent liabilities: borrowings of €550,000 and a mortgage payment of €200,000 (Figure 2).

A mortgage is a form of debt for the purchase of real estate; normally the real estate is pledged as security for the debt. If the debt is not paid, the creditor who lent the money may take possession of the property and sell it. The proceeds would be used to settle the debt. Presumably, in Gulf Research’s case, this mortgage payable was used to finance a building or other real estate in the property, plant and equipment asset category.

Together these two items total €750,000. Noncurrent and current liabilities are added together to equal total liabilities of €1,010,000. Figure 4 illustrates the statement of financial position with the line items for noncurrent liabilities included.

FIGURE 4 Noncurrent Liability Components

WORKING CAPITAL

Why are assets and liabilities classified as current and noncurrent? The answer is that it is important to know what resources are available to the business in the short term or within the next year. If those resources are insufficient, this is a more immediate threat to the business than, say, a shortage of financial resources that is expected to occur two or three years into the future.

Short-term resources are measured by working capital, which is the difference between current assets and current liabilities. The formula is:

Working Capital = Current Assets − Current Liabilities

For Gulf Research, working capital is €45,000, calculated:

WORKING CAPITAL = €305,000 − €260,000

€45,000 = €305,000 − €260,000

Key Terms of Liabilities

Liabilities

– Obligations of the business that are expected to be satisfied in the future.

Current liabilities

– A liability that the entity expects to settle in its normal operating cycle; holds primarily for the purpose of trading; is due to be settled within 12 months, or the entity does not have an unconditional right to defer settlement of the liability for at least 12 months.

Trade accounts payable

– The amount the business owes to suppliers.

Current portion of non-current borrowing

– The amount owed within the next 12 months on a non-current liability.

Noncurrent liabilities

– Liabilities that do not meet the definition of current liabilities.

Mortgage

– A form of debt for the purchase of real estate, whereby the real estate is pledged as security for the debt.