By the end of this tutorial, you will be able to learn:

- What are the uses of accounting information?

- Who are internal users and what are their financial information requirements?

- Who are external users and what are their financial information requirements?

What are the uses of accounting information?

All accounting information is financial. Businesses also collect nonfinancial information. For example, a company maintains records on its employees including the number of people employed, their names, addresses, job titles and evaluations of their performance.

A business may also collect and analyze information about customers such as their buying preferences or past order histories.

A manufacturer may collect data on the amount of time a production machine is used and its output. However, this nonfinancial information is not maintained by accountants. The fact that we account for information that can be expressed in terms of money is referred to as the monetary unit assumption.

Internal Users and their Financial Information Requirements

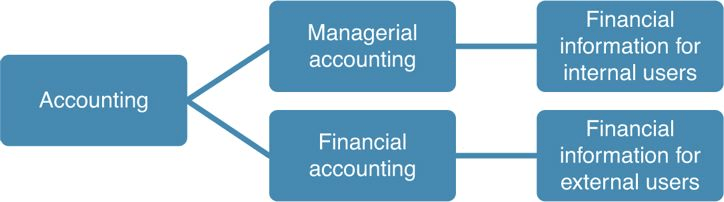

Accounting provides financial information to two groups of users: internal users and external users. Therefore, accounting is divided into two areas: managerial accounting and financial accounting.

• Managerial accounting accumulates and analyses financial information for internal users for planning, decision making, and control.

• Financial accounting accumulates and analyses financial information for external users who are interested in the performance and financial position of the business.

FIGURE 1 MANAGERIAL VERSUS FINANCIAL ACCOUNTING

Each area addresses a different set of needs for financial information, as shown in Figure 1.

In accounting, a user is someone who uses accounting information. Internal users include managers, other employees and members of the board of directors.

Normally, managerial accounting information is not provided to external users because it may reveal information that would put the company at a competitive disadvantage if it were known to outsiders. For example, a company may not want a competitor to know how much it pays for labor or materials used in production.

Exceptions are made when an outsider has a ‘need to know’ the information. For example, an outside consultant is hired by the company to improve its production efficiency and needs information to analyze the company’s operations. However, even this information is usually provided on the condition that the outsider will keep it confidential.

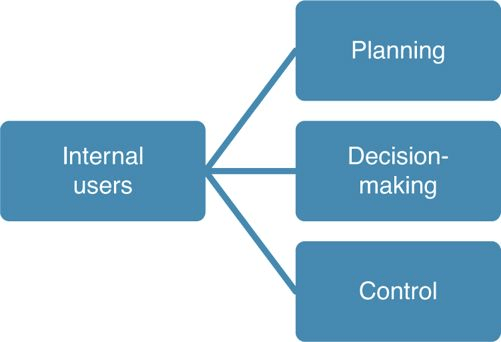

Managerial accounting information is used within the business for three main purposes:

• Planning – An example of planning is budgeting, which is the process of forecasting future financial needs based on what funds the company expects to collect as the result of sales and how much will be paid to purchase materials, for salaries and wages, and to acquire other resources.

• Decision making – Management may be considering whether to replace an older piece of equipment with a newer, more efficient model. Management accounting information would be needed to help evaluate the various alternatives available.

• Control – Management also uses accounting information to determine whether the business is operating according to its plans and identify situations when the business varies from those plans. For example, managerial accounting information might show that the business is spending more than predicted on wages and salaries for labor. After analyzing this information, management concludes that employees are working inefficiently because they have not been adequately trained.

Figure 2 summarizes the information requirements of internal users.

FIGURE 2 USES OF FINANCIAL INFORMATION BY INTERNAL USERS

External Users and their Financial Information Requirements

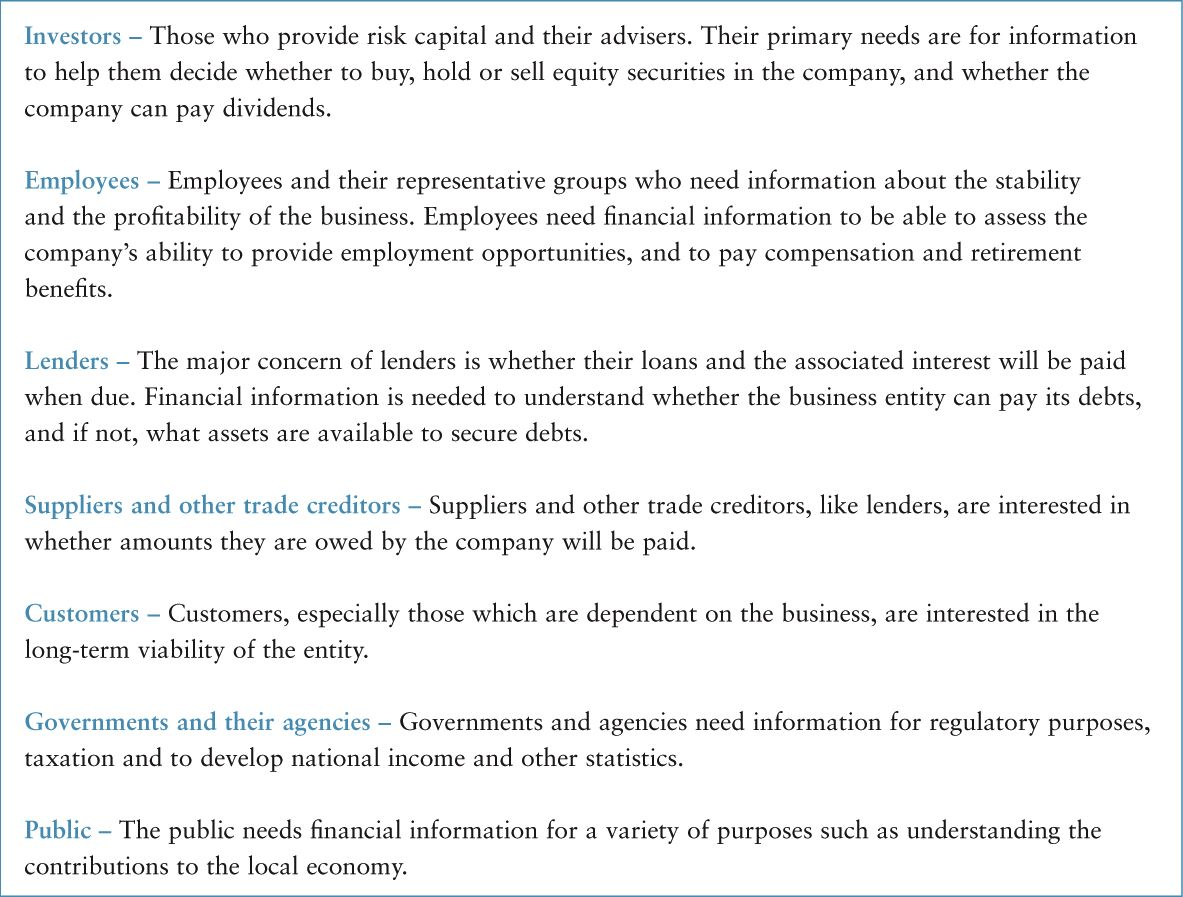

Financial accounting provides information to external users. External users are third parties who have a stake or other vested interest in the business ethics, and who are interested in the financial position of the business, its performance and changes in financial position.

Figure 3 presents a list of different external users with a brief description of the financial information requirements for each.

FIGURE 3 EXTERNAL USERS AND THEIR INFORMATION REQUIREMENTS

Managers do not use financial accounting information to make internal decisions. However, they are concerned about how external users evaluate the business; and external users are interested in the financial position, performance, and changes in financial position of the business. For that reason, managers and the board of directors pay particular attention to financial accounting reports. The reason is that they want to understand how an external user – especially investors and creditors like banks – view the company. Investors and creditors provide investment capital to the business, which is needed if the company is to prosper and grow.

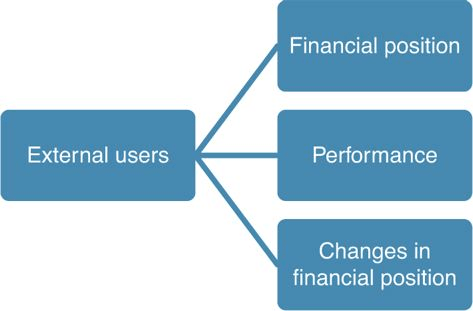

Figure 4 illustrates the financial information requirements of external users.

FIGURE 4 USES OF FINANCIAL INFORMATION BY EXTERNAL USERS