Financial accounting involves two related functions – the recording of transactions and the preparation of financial statements.

A transaction is any activity involving money. Running, dancing and taking a bath are all activities. Such activities become a transaction in accounting terms only if there is a payment involved.

Recording of Transactions

A business engages in numerous transactions, such as when it buys and sells goods and pays rent and salaries. The transactions are recorded in books of account and this recording is referred to as bookkeeping. The name came from the fact that, before the use of computerized accounting packages, the records were kept manually in books. Nowadays, even the smallest business might be using a computerized accounting package, but the accounting principles and procedures will apply to all recording of transactions – whether the recording is done manually in a book or using a computerized package.

Preparation of Financial Statements

At regular intervals, the information recorded in books of account is summarized and presented in reports, referred to as financial statements. One of the financial statements is a Statement of financial position which is also known as a balance sheet – this shows the resources that a business controls, how it obtained those resources and how it has used them. Another financial statement is the Statement of income which shows how much has been earned – in accounting we refer to earnings as income or revenue, and the costs incurred to earn this income as expenses.

Statement of Financial Position

A Statement of financial position consists of two separate parts.

■ The first identifies the resources controlled by the business, for example, the business premises, office equipment, goods for sale and cash – these are known as assets.

■ The second identifies the source of the funds that were used to acquire the assets – these would normally have been provided by the owner of the business and others such as the bank and suppliers. Funds provided by the owner are known as capital and those provided by others are known as liabilities.

Impact of Transactions on the Statement of Financial Position

We will prepare a succession of Statements of financial position tracing the effect on it of each of six transactions.

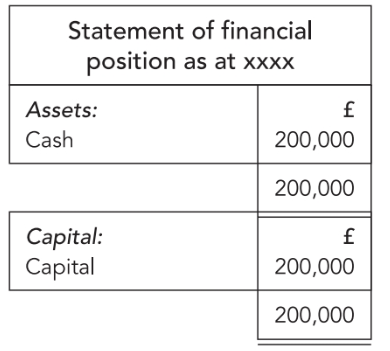

| Transaction one: Noel commences in business introducing £200,000 as his capital. A Statement of financial position drawn at this point (see on the right) reports on its first section as asset cash amounting to £200,000 and reports on its second section the source of that asset as Capital. Observe that the total of the first part (£200,000) is the same as the total of the second. |  |

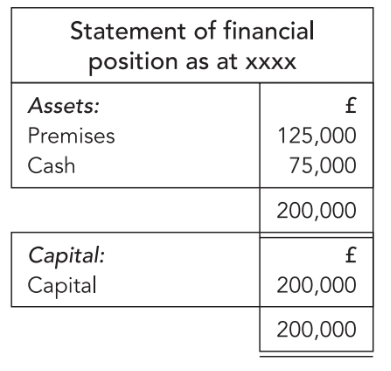

| Transaction two: the business pays £125,000 to acquire shop premises. This transaction reduces one asset (cash) and replaces it by another (premises). There are now two assets listed on the first part but its total remains the same as that of the second. |  |

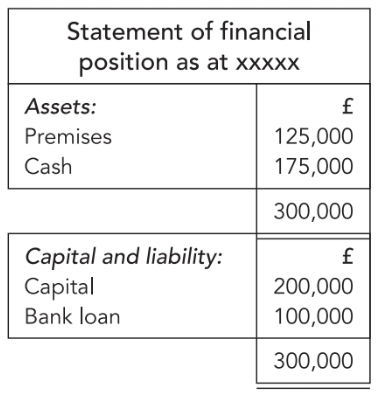

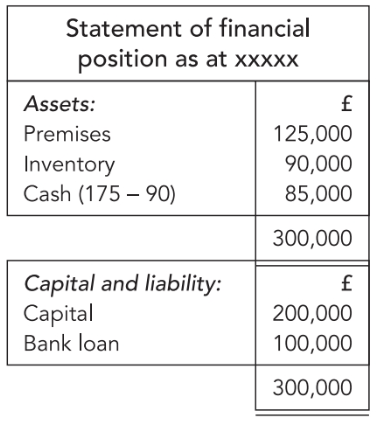

| Transaction three: the business obtains a bank loan of £100,000. The loan increases the cash held by the business so that the total of its assets increases to £300,000. These resources held by the business have come from two sources – one is capital provided by the owner and the other an amount obtained from the bank as a loan which we refer to as liability. The total of the resources held by the business (£300,000) remains the same as the total of the items listed in the second part as capital and liability. |  |

| Transaction four: the business pays £90,000 to buy goods for sale. These goods are referred to as inventory and they are listed on the first part as another asset. But the cash held by the business is reduced, by the amount paid, so that the total of the resources available to the business (assets) remains £300,000. The sources of these assets listed on the second part also add up to the same amount. |  |

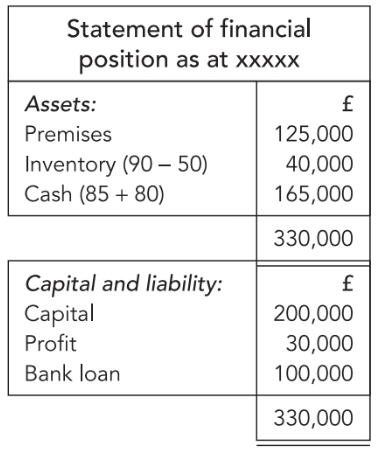

| Transaction five: the business sells for £80,000 some of the goods for which it had paid £50,000. The sale increases cash by £80,000, but the inventory decreases by only £50,000. As a result, the total of the assets increases to £330,000 i.e. an improvement of £30,000. Such improvement is referred to as profit. A sale is a way a business earns and such earning is referred to as income. The earning has been at a cost (i.e. giving away inventory which cost £50). Costs suffered in the earning process are referred to as an expense. The amount by which income (£80,000) exceeds expense (£50,000) is the profit.

The Statement of financial position lists the assets on the first part, amounting in all to £330,000, and lists the sources on the second part as capital, profit and the loan from the bank. |

|

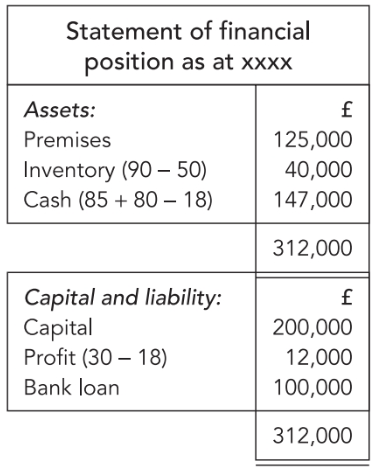

| Transaction six: the business pays £18,000 to its staff as a salary. The payment reduces the cash so that the total of the assets held by the business is now reduced to £312,000. Salary is another expense incurred in the earning process and needs to be offset from the income identifying the profit as £12,000 (i.e. £30,000 − £18,000). Thus the total of sources listed on the second part of the Statement of financial position remains the same as the total of its assets listed on the first part. |  |

With these six transactions, we have illustrated one of the key features of a Statement of financial position – that is that the total of the assets will always equal the total of the capital and liabilities.

In real life a business prepares a Statement of financial position only on the last day of an accounting period – this can be at the end of a month, quarter, half-year or, as is common, a year.

Statement of Income

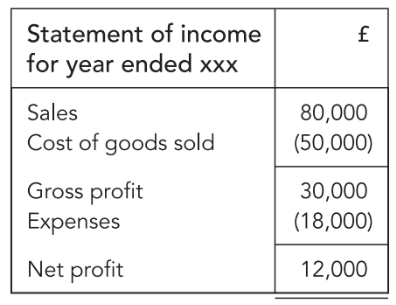

| The Statement of income is a report stating the earnings of business within an accounting period and comparing them with its expenses to identify whether it made a profit during the period (if income is more than the expenses) or a loss (if otherwise). Assuming that Noel’s business had only six transactions in the accounting period, its Statement of income would appear as shown on the right. The amount by which sales exceeds the cost of what was sold is referred to as gross profit. All other expenses are deducted from gross profit to identify the net profit in the period. |  |

Activity

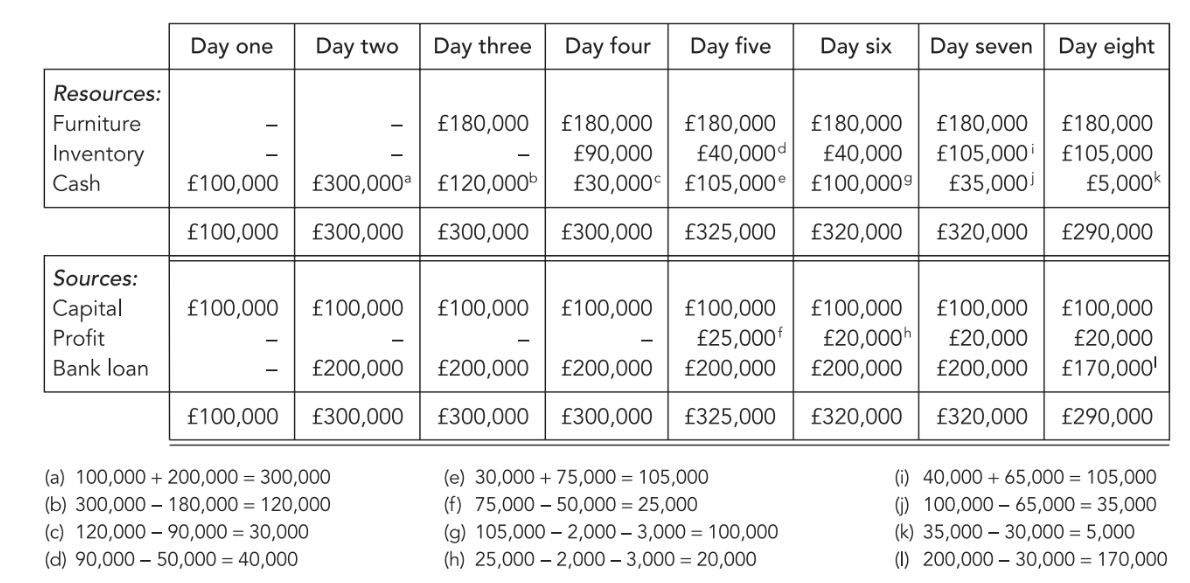

The resources of a business and their sources Let us assume that a business commenced by Albert had only a single transaction each day, as listed below:

Day one: Albert introduced £100,000 in cash as his capital

Day two: the business borrowed £200,000 from a bank

Day three: the business paid £180,000 for items of furniture

Day four: the business paid £90,000 to buy goods for sale

Day five: the business sold for £75,000 goods it had bought for £50,000

Day six: the business paid £2,000 as salary and £3,000 as other expenses

Day seven: the business paid £65,000 to buy more goods for sale

Day eight: the business repaid £30,000 of the bank loan

Required: identify the resources used and their sources on each of the eight days.

Solution

The resources of a business and their sources: