An asset is something that a business owns that has an economic benefit in the future (see GAAP box).

| GAAP | An asset is ‘a resource: (a) controlled by an entity as a result of past events; and (b) from which future economic benefits are expected to flow to the entity.’ |

Example

Gulf Research LLC is based in Dubai. This international firm provides a broad range of services for the petroleum industry, including project management, drilling, reservoir testing, and well analysis. Some of these services require large investments in equipment.

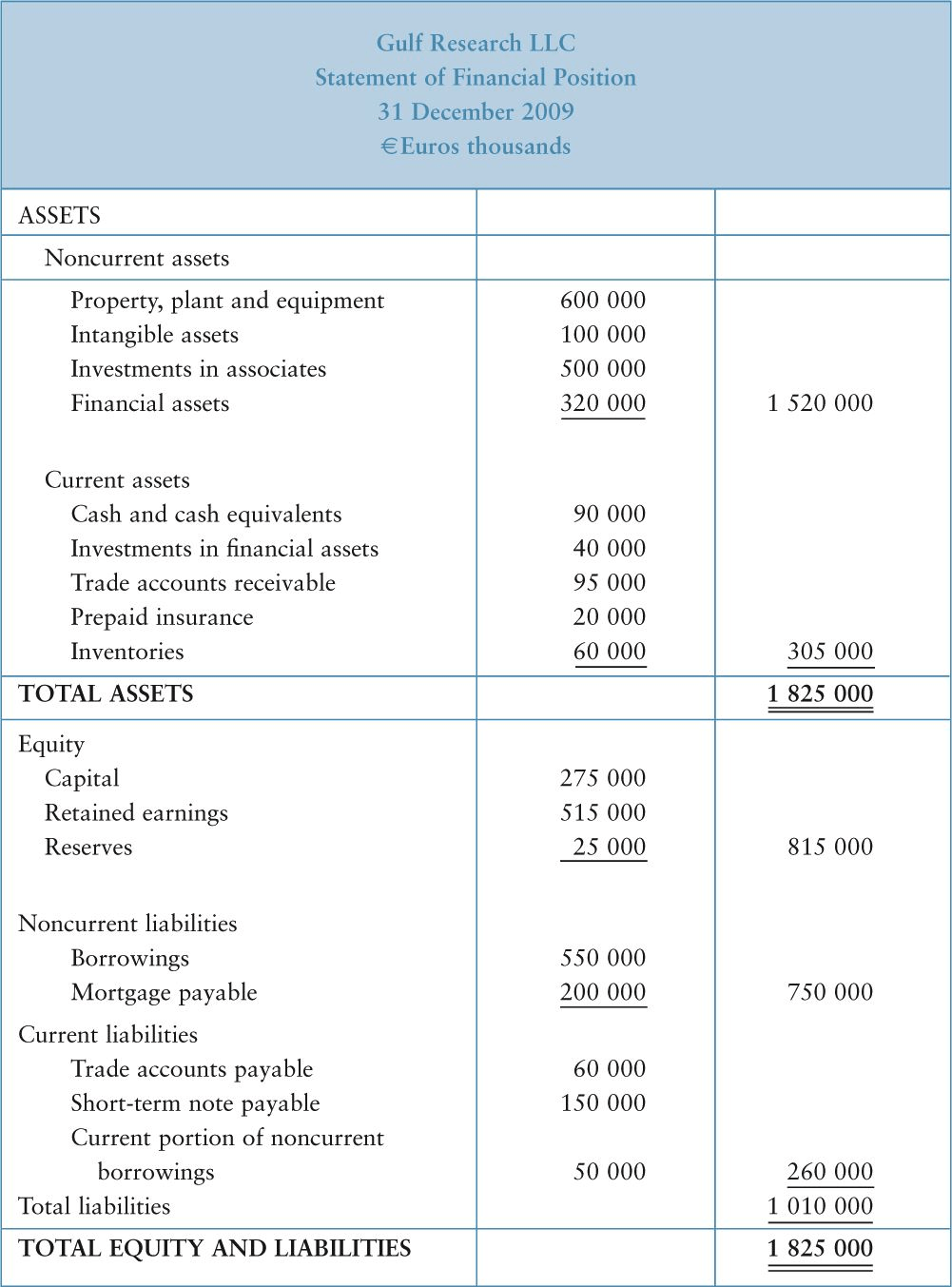

Figure 1 shows the statement of financial position of Gulf Research LLC on 31 December 2009.

Things to Look Out For

Accountants sometimes use a double underline to indicate the total for a column of figures. In Figure 1, Total Assets is double underlined, as is Total Equity and Liabilities. Subtotals (for example Total Equityand Total Liabilities) are indicated by a single underline of the amount. Also, notice that the currency symbol in Figure 1 is in the heading. The currency symbol is sometimes shown with the first number at the head of a column, and with subtotals and totals.

FIGURE 1 Statement of Financial Position

Assets are classified as either current or noncurrent, as illustrated in Figure 2.

FIGURE 2 Current and Noncurrent Assets

What Are Current Assets?

The definition of a current asset is shown in the GAAP box.

| GAAP | ‘An entity shall classify an asset as current when: |

| (a) it expects to realize the asset or intends to sell or consume it in its normal operating cycle;

(b) it holds the asset primarily for the purpose of trading; (c) it expects to realize the asset within twelve months after the reporting period; (d) that asset is cash or a cash equivalent… |

|

| An entity shall classify all other assets as non-current.’ |

Generally speaking, a current asset (also referred to as a short-term asset) is an asset like a trade accounts receivable or inventories that is expected to be converted to cash or a cash equivalent (realized) within the normal operating cycle (see GAAP box).

| GAAP | An operating cycle is ‘the time between the acquisition of assets for processing and their realization in cash or cash equivalents’. |

Most operating cycles are shorter than one year and businesses therefore typically use 12 months after the reporting period as their guideline for classifying an asset as current or noncurrent. Also, notice that cash or cash equivalents (see the GAAP box for definitions) are current assets.

| GAAP | ‘Cash is cash on hand and demand deposits.’ Cash equivalents are ‘short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value’. |

As you can see from the definition, cash is money that is either on hand or in the bank (demand deposit). When a business has cash with no immediate use for it, then it may invest the money for additional income, which usually takes the form of interest. These investments meet the definition of cash equivalents (see GAAP box) when they can be readily converted to a known amount of cash.

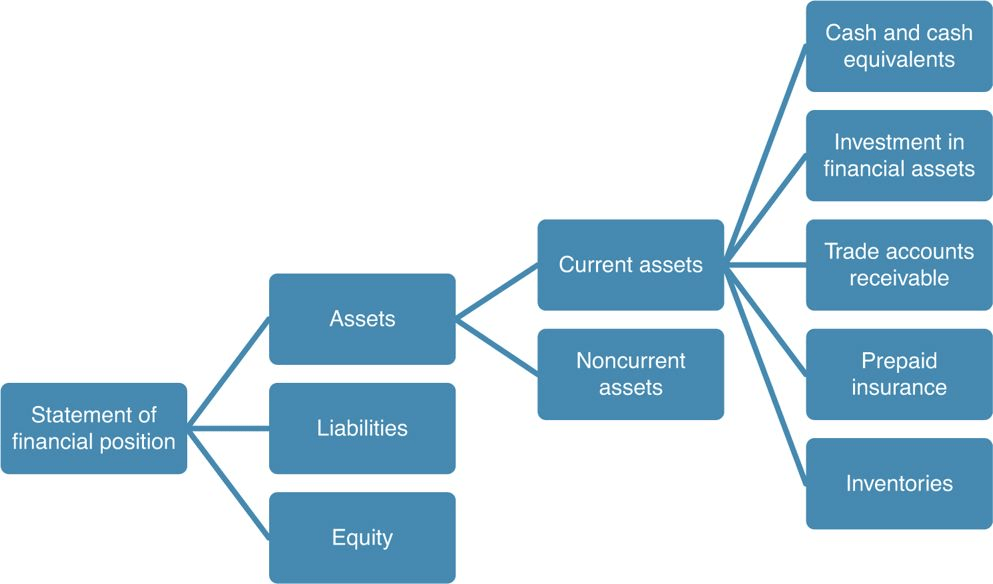

Figure 1 shows that Gulf Research has €305,000 in current assets. This total includes cash and cash equivalents, investments in financial assets, trade accounts receivable, prepaid insurance and inventories.

• Investment in financial assets refers to investments that Gulf Research has in shares of other companies, bonds and debt owed to Gulf Research by others. While these are being held for the short term (less than one year) and are thus classified as a current asset, they do not meet the definition for a cash equivalent and so are reported as a separate line item.

• Trade accounts receivable represent the business’s right to collect cash in the future based on the customer’s promises to pay for goods and services purchased before the reporting date.

• Prepaid insurance is one form of prepaid expense. Prepaid expenses are goods or services that are paid for before they are used. Thus they are an asset because the economic benefit will be used in the future. Most prepaid expenses are current assets, although it is possible to have a noncurrent prepaid expense.

• Inventories are ‘assets: (a) held for sale in the ordinary course of business; (b) in the process of production for such sales; or (c) in the form of materials or supplies to be consumed in the production process or in the rendering of services’.

Figure 3 illustrates current asset line items graphically, based on the Gulf Research example.

FIGURE 3 Current Asset Components

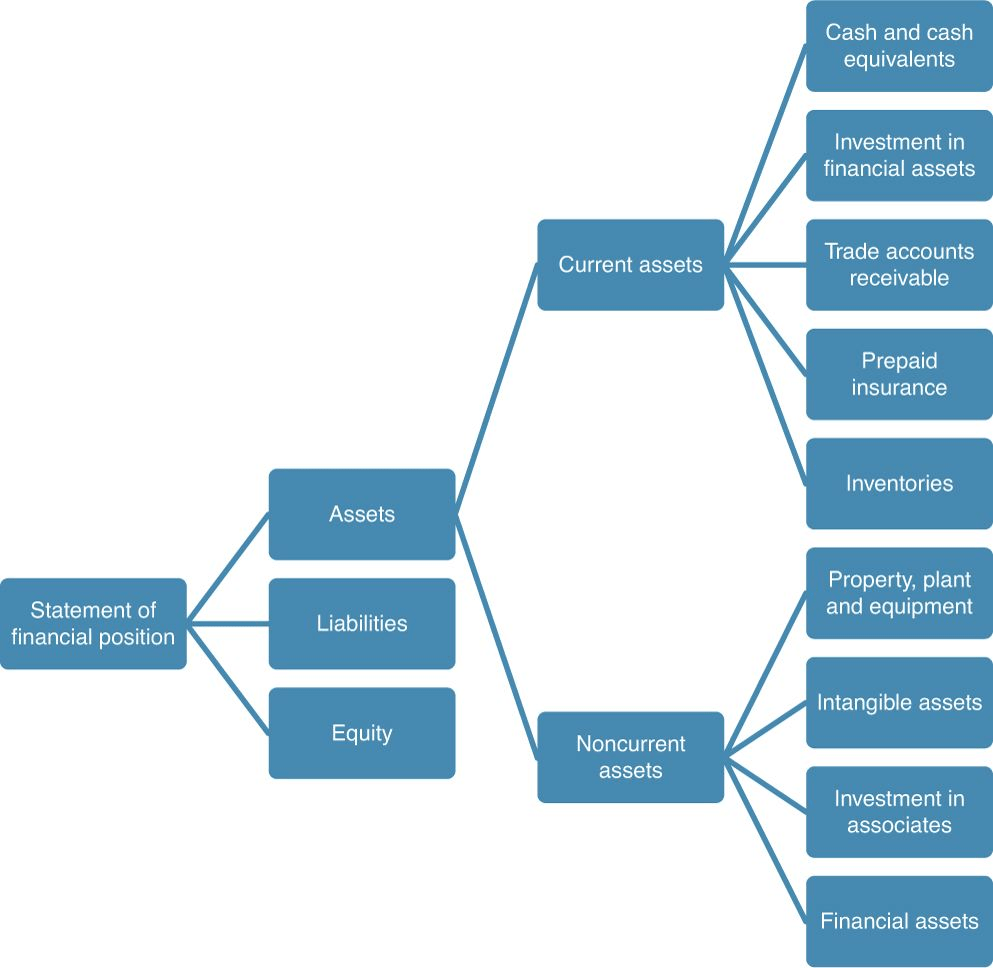

What Are Noncurrent Assets?

Noncurrent assets (or long-term assets) are assets that do not meet the definition of current assets. The statement of financial position for Gulf Research (Figure 1) includes property, plant and equipment, intangible assets, investments in associates, and financial assets.

• Property, plant, and equipment (also capital assets or fixed assets) refer to assets used in the production of goods and services, rental to others or for administrative purposes, and are expected to be used for more than one period. Office buildings, manufacturing facilities, and equipment are examples.

• Intangible assets are assets with no physical substance. Examples include copyrights, patents, brands, and customer lists.

• Gulf Research also has an investment in associates. This represents the company’s ownership of part of another business over which it has significant influence.

• Finally, Gulf Research reports financial assets of €320,000. These may be shares of other companies, bonds, debt owed to Gulf Research by others and any other financial instrument – except that these assets are long term.

Noncurrent assets total €1,520,000. When this amount is added to current assets of €305,000, total assets equal €1,825 000. Figure 4 adds noncurrent asset line items based on the Gulf Research example.

FIGURE 4 Noncurrent Asset Components

Key Terms of Assets

Assets

– Resources that are is expected to have an economic benefit to the business entity in the future.

Current assets

– Assets that the entity expects to realize, sell or consume within a normal operating cycle; holds for the primary purposes of trading; expects to realize within 12 months; or is cash (unless restricted from being exchanged or used to settle a liability within 12 months).

Cash

– Currency and demand deposits.

Cash Equivalents

– Financial investments that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value.

Trade accounts receivable

– The amount a customer owes to the business for goods or services purchased.

Prepaid expense

– An asset created when cash is paid in advance for a future expense.

Inventories

– Assets held for sale in the ordinary course of business; in the process of production for such sale; or in the form of materials or supplies to be consumed in the production process or in the rendering of services.

Noncurrent assets

– Assets that do not meet the definition of current assets.

Intangible assets

– An identifiable nonmonetary asset without physical substance.