An invoice is defined as:

An itemized bill for goods sold or services provided, containing individual prices, the total charge, and the terms. (Webster’s dictionary)

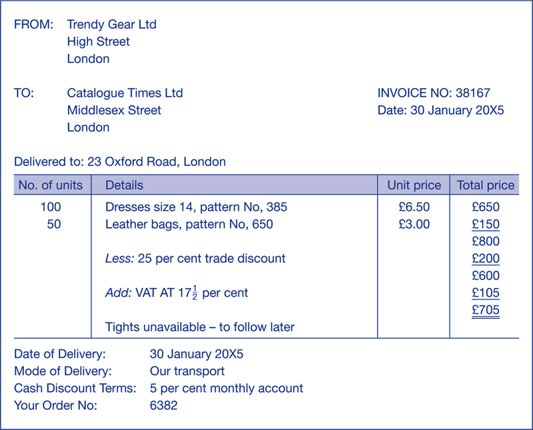

The purpose of the invoice, which is sent by the seller, is primarily to inform the buyer how much is owed for the goods supplied. It is not a demand for payment. A specimen invoice is shown in Figure 1.

FIGURE 1 An invoice Specimen

The information shown on an invoice consists of the following items:

- the name and address of the seller

- the name and address of the buyer

- the invoice and delivery note number of the seller (usually the same)

- the date of the invoice

- the address to which the goods were delivered

- the buyer’s order number

- the number of goods supplied

- details of the goods supplied

- the price per unit of each of the goods

- the total value of the invoice before value added tax (VAT)

- the trade and cash discount

- VAT payable and the total value of the invoice including VAT

- when payment should be made

- the seller’s terms of trade.

The buyer checks the invoice against his or her order and the delivery note (or usually with goods received note prepared by his or her receiving department). If correct, the invoice is then entered in the buyer’s books. Similarly, a copy of the invoice would have been entered in the seller’s books.