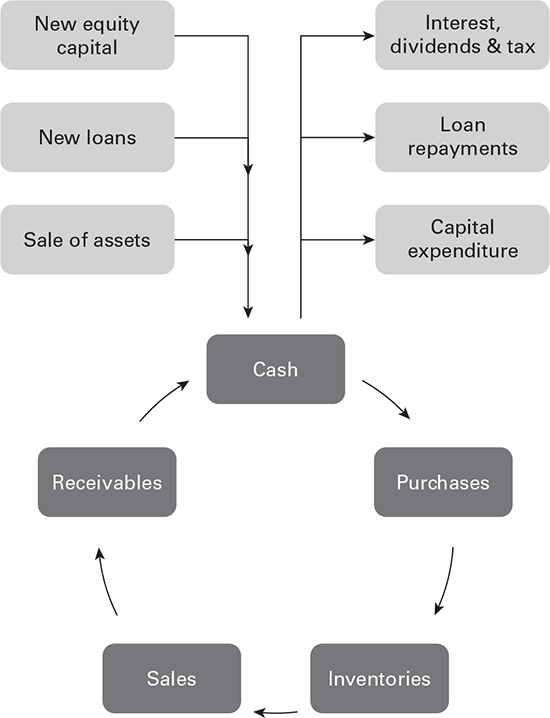

Cash flow refers to the ways in which cash moves in and out of a business through receipts and payments and also how it circulates within the business to be tied up in various assets such as an inventory of accounts receivable. This flow of cash is represented in Figure 1.

How quickly that cash flows and how much cash is tied up in assets will dictate the cash requirements of the business.

FIGURE 1 Cash flows in a typical business

Cash flow within a business is usually categorized into three different aspects:

Operating cash flow: cash flowing in and out of the business from normal day-to-day operations such as receipts from sales and payments for wages, purchases of inventory, utility bills, and rent.

Investment cash flow: the flow of cash in and out of the business relating to the purchase and sale of non-current assets.

Financing cash flow: cash inflows from new financing such as new equity or loans and cash outflows from the repayment of financing and payment of interest and dividends.

These three aspects of cash flow are all included in Figure 1.

The cash-flow cycle (sometimes known as the cash conversion cycle) refers to the circular flow of cash shown at the bottom of Figure 1.

During the normal operations of a business, cash gets tied up in working capital: cash is used to pay for purchases and becomes tied up in inventory. This inventory must be sold and the sales revenue collected from customers before it is converted back into cash.

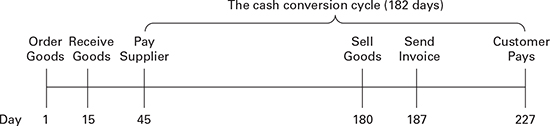

The cash-flow cycle measures the length of time in days that it takes for a business to convert purchases into cash. This is an important metric as it can provide the foundation for establishing how much cash the business needs. The faster cash flows around this cycle, the less is tied up in working capital and therefore the less cash the business needs. Figure 2 shows this cycle for a typical business.

FIGURE 2 The cash conversion cycle

Example

Figure 2 shows a timeline of what typically happens within the business from ordering goods in to eventually receiving payment for the sale of those goods to a customer. The goods are ordered in on day 1 but they are not received until day 15. This time lapse between ordering the goods (day 1) and receiving the goods (day 15) is known as lead time.

If the business has bought the goods on credit, there will be another time lag between receiving the goods and paying for the supply of them. In Figure 2 there is a time lag of 30 days (45 – 15) which is a typical credit period for a supplier. At this point, the clock starts ticking on the cash conversion cycle. The business has paid out money for goods which will not be converted back into cash until they are sold and the customer has paid.

The cash conversion cycle is, therefore, the time lapse between paying a supplier and receiving payment from the customer. In Figure 2 the supplier is paid on day 45 and the customer pays on day 227. The cash conversion cycle is therefore 182 days (227 – 45).

How much cash does a business need?

The amount of cash which a business chooses to hold will always be a trade-off between costs and benefits. Both holding too much cash and holding too little cash can have a cost to the business.

On the one hand, there is a cost to holding cash and so the more cash the business holds the greater the cost. This is usually measured as an opportunity cost, that is to say, the return that could have been earned by investing the cash in other assets.

On the other hand, there is also a cost to raising cash if it is not available when needed. So if a business holds too little cash, this will also create costs. This will be either the cost of converting assets into cash (by selling them) or the cost of arranging loans.

Cash, unless it is held in a high-interest investment account, represents shareholders’ capital that is not being put to work earning a return for the investors. There will, therefore, be a pressure to reduce the amount of cash the business holds.

The lower the cash balances, the lower the amount of capital the business uses to operate. Reducing cash will improve the return on capital employed (ROCE), as demonstrated in Worked Example 1.

Worked Example 1 Cash Balance And ROCE

Quint Co earns a profit before interest and tax of 280,000 dollars. The company has a total capital of 1,850,000 dollars. The current ROCE is, therefore:

![]()

Included within the capital of 1,850,000 dollars is a cash balance of 300,000 dollars. The finance director decides that the company does not need to hold this cash and therefore uses it to repay a loan.

This action will reduce the capital of the business to $1,550,000. This, in turn, increases the ROCE:

![]()

The company is, therefore, able to increase its financial performance (as indicated by ROCE) without any change in the level of profit simply by reducing its cash balance.

Although Worked Example 1 demonstrates that holding too much cash can have a negative impact on the business’s financial performance if the business does not hold sufficient cash it can experience trading problems (such as overtrading) which will also have a negative impact on profitability and shareholder returns. This means that a business is constantly seeking to hold just enough cash to meet its needs, but no more than is necessary. Managing cash is a constant balancing act between having too much cash and not enough.