Much of the work of financial accountants consists of summarizing financial information in accordance with generally accepted accounting principles (GAAP). This information is largely derived from a transaction processing system which is based on the relationship between the three key components: assets, liabilities, and equity.

Assets

A definition of assets is ‘a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity’.

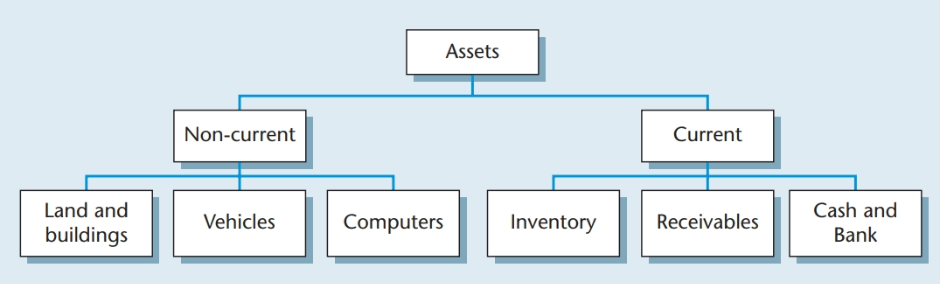

Typical business assets are divided between non-current assets, which are expected to be retained by the business for at least a year and are of significant value, and current assets, which might change frequently during the course of the business’s activities.

Typical examples of non-current assets are:

● Land

● Buildings

● Motor vehicles

● Machinery

● Computers.

Nearly all non-current assets will be subject to depreciation (a loss in value due to factors such as usage or aging).

Figure 1a Classifications and examples of assets

Typical examples of current assets (see Figure 1a) are:

● Inventory of unsold goods

● Trade receivables (the amounts owed to the business by customers)

● Prepayments (amounts paid in advance for items such as rent)

● Bank balances (cash in the bank – also called ‘cash-equivalents’)

● Cash balances (cash held by the business, but not in the bank).

Liabilities

The definition of liabilities is ‘present obligations of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits’.

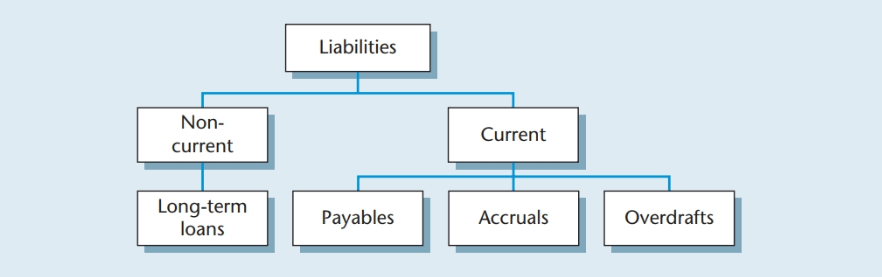

Typical business liabilities are divided between current liabilities, which are expected to be paid within one year, and non-current liabilities, which are expected to be paid after more than one year.

Figure 1b Classifications and examples of liabilities

Typical examples of current liabilities (see Figure 1b) are:

● Trade payables (the amounts owed by the business to suppliers of goods)

● Accruals (estimated amounts due for expenses such as electricity, where the bills have not yet been received)

● Bank overdrafts. A typical example of a non-current liability is:

● A loan is due for repayment in more than one year’s time.

Equity

Equity is also sometimes referred to as ‘capital’ or ‘ownership interest’, that is, the value which the owner or owners have invested in their business. The Framework defines equity as ‘the residual interest in the assets of the entity after deducting all its liabilities’.

Equity is the residual interest in the entity, calculated by subtracting liabilities from assets. The amount of equity, therefore, depends on the measurement of assets and liabilities. However, equity can be classified into different components. The most common categories are contributed capital, retained earnings and other reserves.