General Journal

The general journal is a chronological, or date order, record of the transactions of a business. The general journal can be compared to an individual person’s diary.

Like a diary, the general journal is a place to record events that have affected the business. Recording a transaction in the general journal is referred to as journalizing the transaction. To record a journal entry:

1. Record the date.

2. Record the debit part of the entry by entering the account title and then entering the amount in the debit column.

3. Record the credit part of the entry on the next line by indenting the account title and then entering the amount in the credit column.

4. Write an explanation describing the entry.

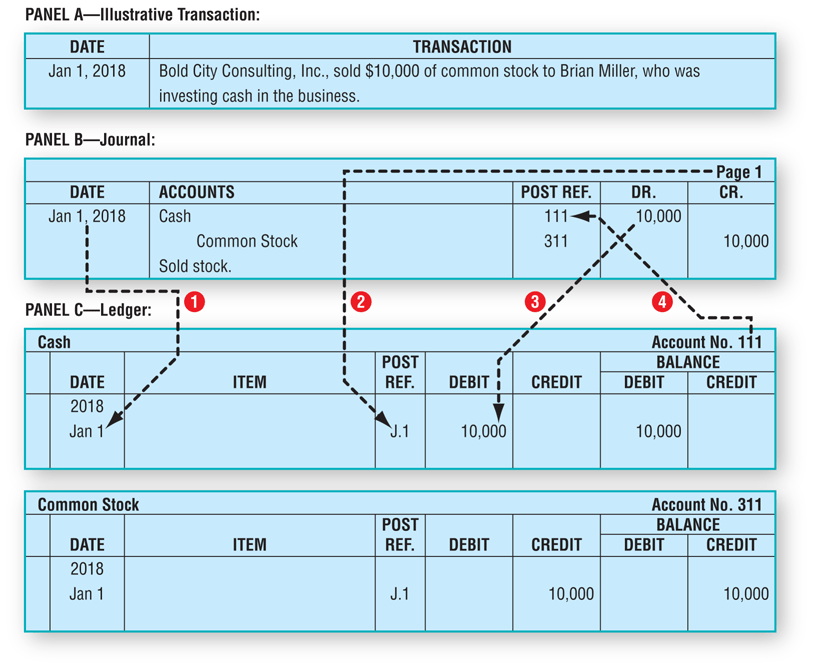

Figure 1, Panel A, describes a transaction, and Panel B shows how this transaction is entered in the journal. The page number of the journal appears in its upper-right corner.

Figure 1: How Transaction Is Entered In the Journal

General Ledger

Because the information in the general journal is organized by date and not by account, the information it provides is not very useful. To be more useful, information must be organized by account. Therefore, the general ledger was created.

The general ledger is a grouping of all the accounts of a business with their balances. It shows the amounts of Assets, Liabilities, and the Stockholders’ Equity accounts on a given date.

Once transactions have been entered in the general journal, the information is then transferred to the general ledger. The process of transferring information from the general journal to the general ledger is called posting.

Posting simply means copying the amounts from the journal to the ledger. Debits in the journal are posted as debits in the ledger, and credits in the journal are posted as credits in the ledger.

Figure 1, Panel C, demonstrates how an entry is posted from the journal to the ledger. The posting process demonstrated in Figure 1, Panel C includes four steps. The four steps required to post the first part of the journal entry are as follows:

- Arrow ❶ Copy the transaction date from the journal to the Cash account in the ledger.

- Arrow ❷ Copy the journal page number from the journal to the posting reference column in the Cash account in the ledger. “J.1” refers to Journal-page 1. This provides a reference that links the entry in the ledger back to the journal.

- Arrow ❸ Copy the dollar amount of the debit, $10,000, from the journal as a debit into the Cash account in the ledger.

- Arrow ❹ Copy the account number, 111, from the Cash account in the ledger back to the posting reference column in the journal. This step indicates that the $10,000 debit to Cash was posted to the Cash account in the ledger.

The journal entry is posted to Cash first because this is the first account listed in the entry. Once posting to Cash is complete, repeat the process to post the entry to Common Stock.

The account format used in Panel C of Figure 1 is called a four-column account. The first pair of debit and credit columns contains the individual transaction amounts that have been posted from journal entries, such as the $10,000 debit. The second pair of debit and credit columns is used to show the account’s balance after each entry.

Posting used to occur on a periodic basis, such as daily or weekly. However, most modern computerized accounting systems post transactions immediately after they have been entered.

Key Terms

General journal

The chronological accounting record of the transactions of a business.

Record

Entering a transaction in a journal; also called journalizing.

Transaction

An event that has a financial impact on a business entity.

General ledger

The accounting record summarizing, in accounts, the transactions of a business and showing the resulting ending account balances.

Posting

Copying information from the general journal to accounts in the general ledger.

Posting reference

A notation in the journal and ledger that links the two accounting records together.