A T-account isn’t a type of account in your books, but rather a device you use for visualizing how to record an accounting transaction.

Accounting primarily centers around two amount columns, debits on the left and credits on the right, and the sum of both columns has to match. If you’re trying to figure out how to record a transaction, T accounts can help.

T-Account Example & Template

To explain T accounts, let’s first take a look at a simple example of how they work.

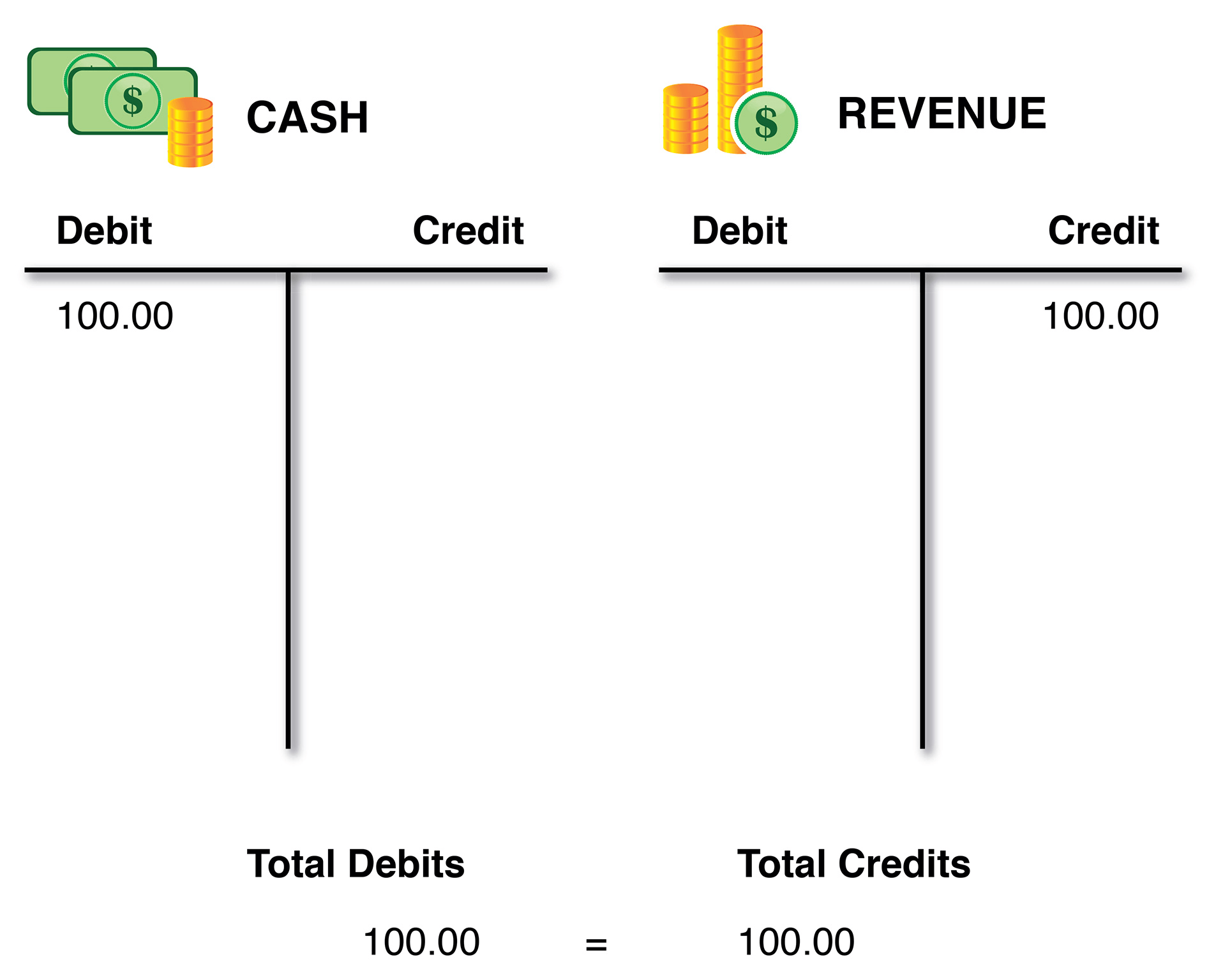

Say you receive 100 dollars as a payment from a customer. You increase Cash (it’s a debit, by the way) by 100 dollars, and Increase Revenue (a credit) by 100 dollars. Your T account for Cash shows 100 dollars on the left in the debit column. (Cash is an asset, and increases to asset accounts are debits.)

Now you need a T-account that balances this debit with a credit (right column). The T-account for your Revenue shows 100 dollars on the right. (Revenue accounts are increased with credits.) You’ve got 100 dollars on the left and 100 dollars on the right in your two T accounts, so they’re in balance.

The 100 dollars debit in the Cash T-account balances the 100 dollars credit in the Revenue T-account.

T-Account Example 2

Let’s look at some more typical examples of how T accounts help you determine how to record a transaction, particularly when more than two accounts are involved. For purposes of these transactions, let’s assume you’re using accounting software and not writing down each transaction in a traditional ledger book.

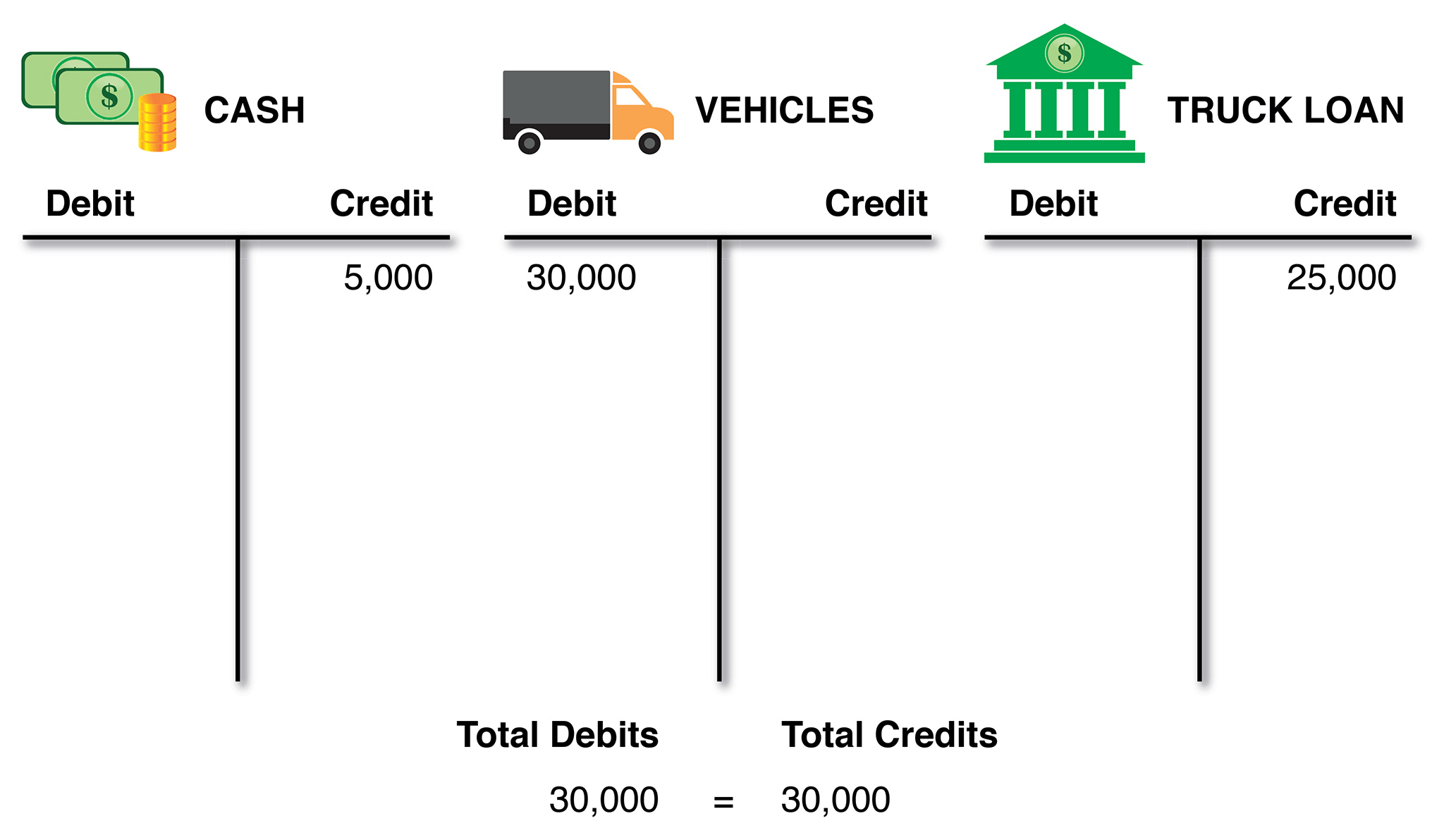

Say you finance the purchase of a delivery truck for your business. This seemingly simple transaction touches multiple accounts on your books.

Your truck costs 30,000 dollars and you make a 5,000 dollars down payment. When updating your books, you need to record that you used some of your cash, that you now own a truck, and that you also owe 25,000 dollars on it. But what do you debit, and what do you credit? That’s where T accounts cut through the confusion.

You need to record changes to three accounts:

- Your Cash account (in accounting vernacular, an asset account because we own the cash)

- A Vehicles account (another asset account because your business owns the truck)

- A Loan account (a liability account because your business owes the loan amount)

So you need three T accounts, Cash, Vehicles, and Truck Loan. On a blank piece of paper, draw your three T accounts, making them large enough you can write numbers on either side of the T.

T accounts provide a framework you can use to break down an accounting transaction into its elements and ensure your debits and credits balance.

Bottom Line

Taking the time to write out T accounts helps ensure you enter the transaction correctly in your accounting software. Remember that the sum of all amounts written on the left side of a T must balance with the amounts written on the right side of another T. Each T represents a separate account in your books or accounting software.

Now that you have your framework, you can begin to record the purchase. Debits (left-side entries) always increase asset accounts and reduce liability accounts, while credits (right-side entries) reduce asset accounts and increase liability accounts.

Here’s how to record your transaction:

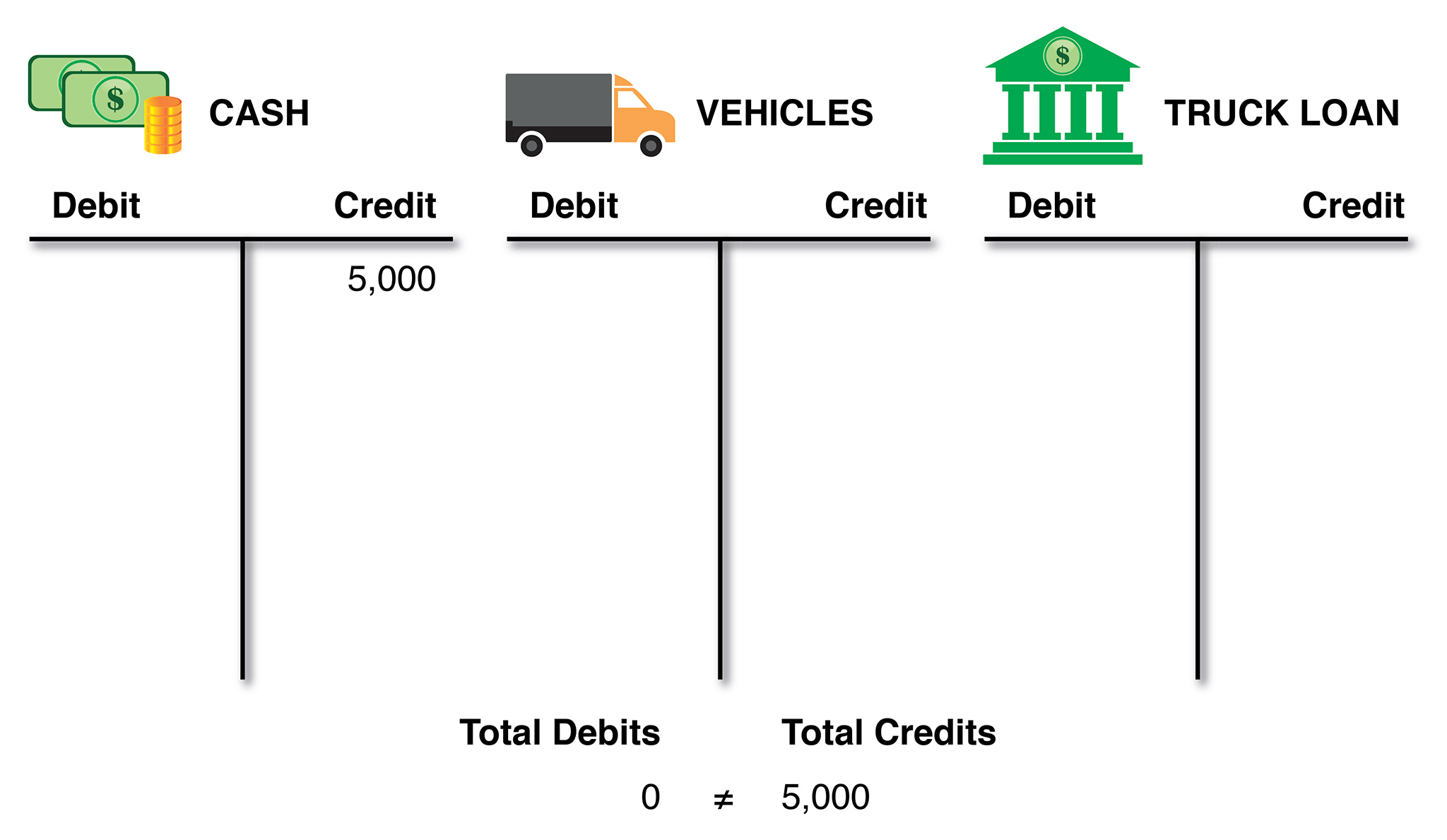

1. You wrote a check for 5,000 dollars which reduced your Cash account. Write 5,000 in the right Credit column of the Cash T-account.

Increases to the Cash account go on the left side of the T; decreases go on the right.

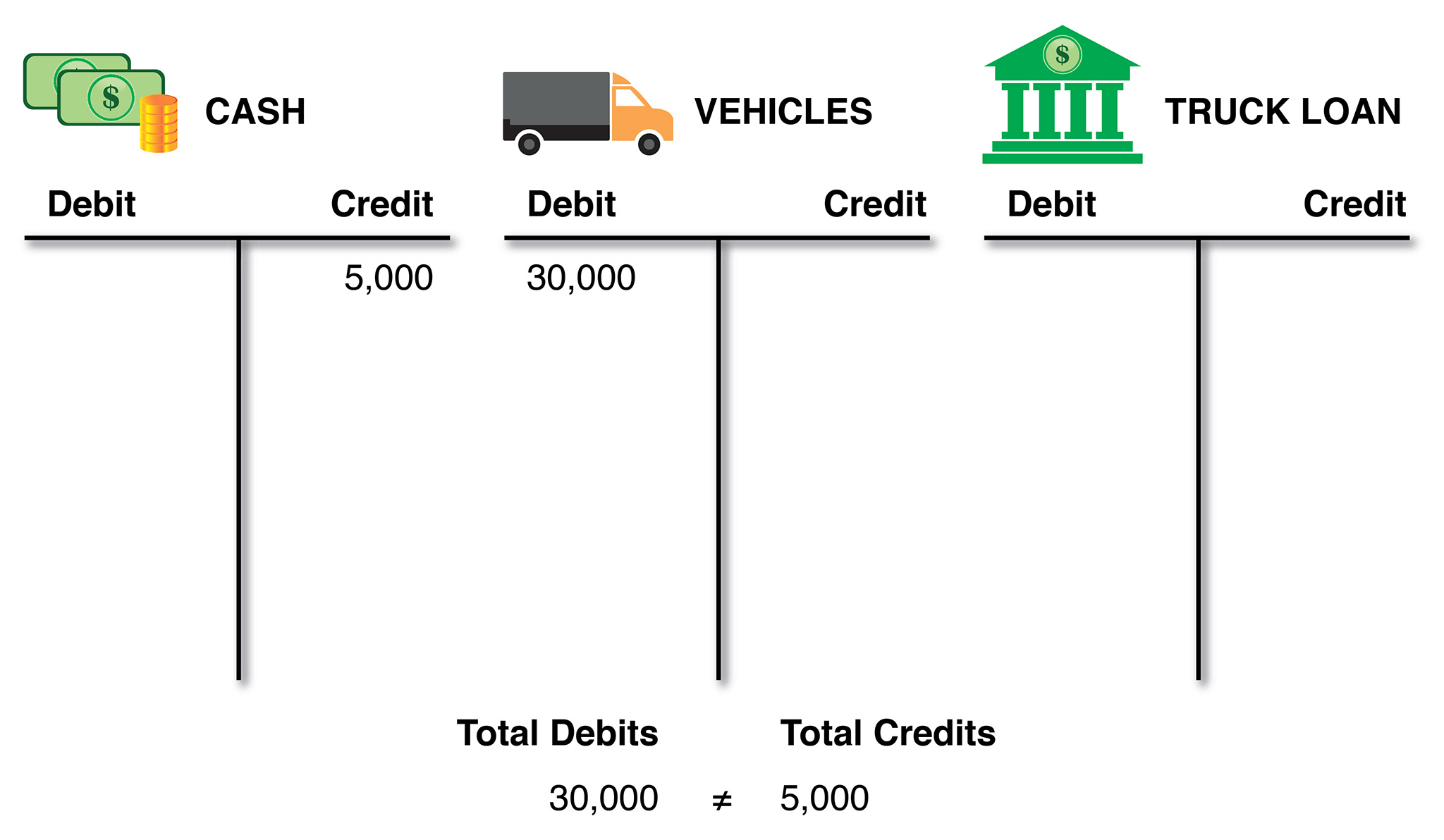

2. Your business now owns a 30,000 dollars delivery truck, which is an increase in assets. Write 30,000 in the left Debit column of the Vehicles T.

Increases to the Vehicles account to go on the left side of the T; decreases go on the right.

3. You know the sum of your debits and credits must match at the end, but so far, you have a 30,000 dollars debit and a 5,000 dollars credit. You still need to record a 25,000 dollars credit to get the transaction to balance. The last piece of your transaction is to record the 25,000 dollars your business borrowed to purchase the truck. Enter that amount on the right side of the Truck Loan T.

Increases to the Truck Loan account go on the right side of the T; decreases go on the left.

At this point, the sum of your debits and credits match. Remember, debits and credits aren’t one-for-one. In this case, we have two credits and one debit, but in total, the three amounts balance.

Using T accounts, you’ve figured out where everything goes, so you can record this transaction in your accounting software.