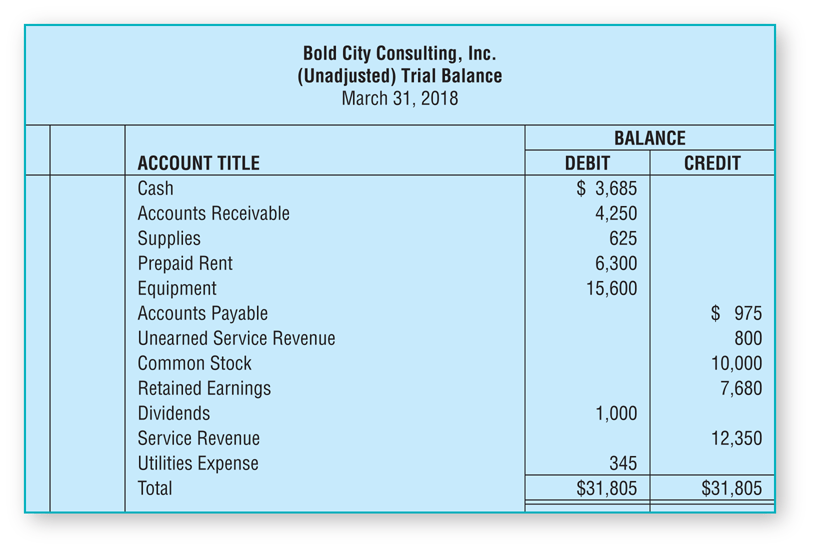

Definition: A trial balance prepared at the end of the accounting period, before the adjusting entries are made.

A Trial Balance is a list of all the accounts of a business and their balances; its purpose is to verify that total debits equal total credits.

At the end of the accounting period, the accountant prepares a trial balance from the account information contained in the general ledger. This trial balance lists most of the assets, liabilities, revenues, and expenses of the business, but these amounts are incomplete because adjusting entries have not yet been prepared. Therefore, this trial balance is called an unadjusted trial balance.

Example

Figure 1 shows the unadjusted trial balance for Bold City Consulting, Inc., at March 31, 2018, after its third month of operations.

Figure 1 Unadjusted Trial Balance for Bold City Consulting, Inc.

Remember that transactions are recorded in the journal and posted to accounts in the general ledger.