Conservatism

Accounting principle stating that a business must report all items in financial statements at amounts that lead to the most cautious immediate results.

A conservative approach means that, when two reasonable options are present, the option should be chosen that causes assets and income to be understated, rather than overstated.

A conservative approach also means that liabilities and expenses are overstated, rather than understated. The goal is for financial statements to report figures that minimize the risk of overstating the company’s assets and of understating liabilities.

Lower-of-cost-or-market (LCM) Rule

The rule that a business must report inventory in financial statements at whichever is lower: the historical cost or the market value of each inventory item.

Merchandisers often face a situation in which the cost of replacing an inventory item is lower than the amount originally paid for the item. To take a conservative approach when these situations arise, businesses apply the lower-of-cost-or-market (LCM) rule.

The LCM rule requires businesses to report inventory in financial statements at whichever is lower for each item: the amount originally paid (the historical cost) or the replacement cost (the current market value).

If the replacement cost of inventory is less than its historical cost, a company writes down the inventory value by decreasing Inventory and increasing Cost of Goods Sold. In this way, net income is decreased during the period in which the decrease in the market value of the inventory occurred.

Process of Valuing Inventory

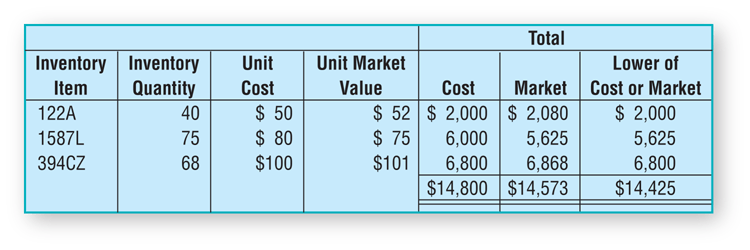

Let’s examine the process of valuing inventory according to the LCM rule for the inventory in Figure 1.

- Prepare a table listing each inventory item and its quantity, unit cost, and unit market value.

- Calculate the total cost and total market value for each item. Inventory Item 122A, for example, has a total cost of 2,000 dollars (40 units × 50 dollars cost per unit) and a total market value of 2,080 dollars (40 units × 52 dollars market value per unit).

- Place the LCM value for each item in the “Lower of Cost or Market” column. Item 122A would have a value of 2,000 dollars.

- Add the amounts in each column to obtain the total cost, total market value, and total LCM amounts.

- Adjust the inventory balance to reflect the LCM amount. The total cost is 14,800 dollars and the total LCM amount is 14,425 dollars, so a journal entry is made to reduce the inventory amount by the difference of 375 dollars(14,800 dollars−14,425 dollars).

Figure 1:LCM rule for the Inventory

The LCM rule may be applied to inventory on an item-by-item basis, as in Figure 1; to broad categories of items; or to all inventory taken as a whole. Application of the LCM rule is a continuation of the process of valuing inventory.

Businesses record inventory transactions, assigning a cost to each inventory item sold using the specific identification, FIFO, LIFO, or average cost method. Then, at the end of the accounting period, they apply the LCM rule to the ending inventory. In this way, businesses report conservative values for inventory and net income.