Functional budgets are day-to-day operational budgets which focus on specific functions or aspects of the process or service.

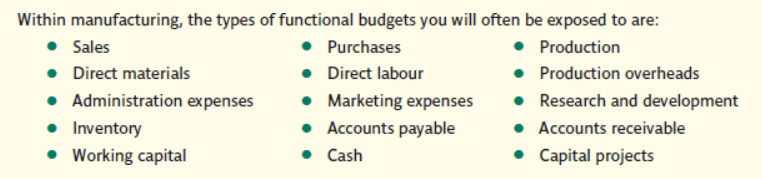

Within manufacturing, the functional budgets are often based around processes and operations such as research and development, sales, materials and marketing (see Figure 1).

However, in the public sector, they would create budgets based upon specific policies and programs. Government bodies create budgets based upon targets they need to achieve, driven by government policies and programs.

Figure 1: Typical functional budgets (within a manufacturing setting)

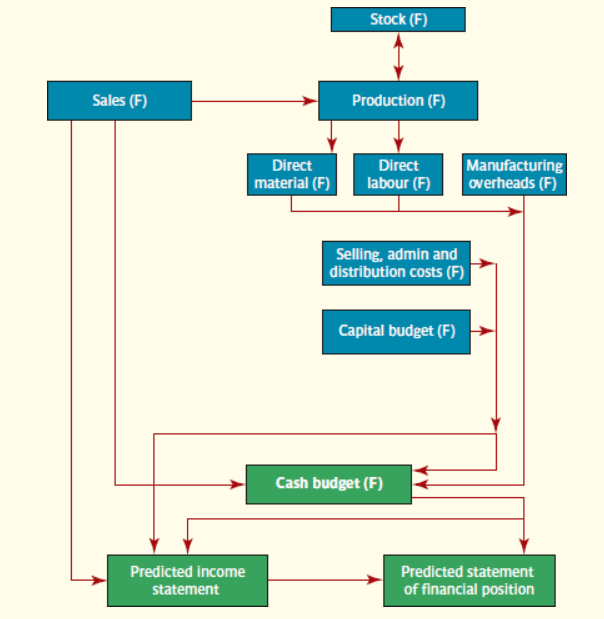

As stated previously, the functional budgets form the master budget. Figure 2, diagrammatically represents the relationship of the predicted financial statements and functional budgets.

Figure 2: Relationship of the functional budgets and predicted financial statements

Figure 2 depicts the relationship of the functional budgets with the cash budget being central to this process.

Functional Budget Types

Functional budgets provide an opportunity for companies to scrutinize individual aspects of the organization. Below we will examine three key functional budgets; sales, production and cash budgets to consider how they can improve planning and control within a business.

Sales Budget

The sales budget is very important because it can help you plan your production patterns and is often linked to key targets within an organization.

The sales budget will look different in every organization due to the range of products being sold, size of the company and the company’s organizational structure.

The way sales are reported will be determined by the purpose of the budget. If the budget is related to sales targets, then the sales are normally recorded as they are invoiced because the budget can be analyzed against these targets.

If the sales budget is used to feed directly into the cash budget, the sales may be recorded when the sales transactions convert into cash received.

Production Budget

The production budget, or operating budget as it will be known in a service-sector organization, considers the ‘units’ of production rather than the cost. Therefore, the budget value is normally units not currency.

This budget is linked to your inventory accounts and your sales account. It will also include any normal loss that is anticipated during the production and include contingency policies.

This budget is useful in two ways: to manage the production rate and to help maintain the company policy on stock levels.

If a company uses philosophies such as just in time (JIT) then they will want to maintain very low stock levels, and this will mean their control on the production budget will be essential, ensuring correct items are purchased at precisely the right time.

Cash Budget

Cash is the heart of every organization. Regardless of the millions of pounds presented on the Income Statement and the Statement of Financial Position, if they cannot pay their debts they will go bankrupt.

The management of cash is fundamental in any business or public organization; it is in terms of spending too much money and not spending enough. Managerial accounting uses cash budgets as a technique to manage this process.

Budgets can be incredibly useful in providing detail which can be used for planning purposes. Whether it is a sales budgets or a carbon budget, it provides the users with a target.