The primary goal of any accounting system is to capture, summarize, and report useful information to users so that they can make informed decisions. The key difference between financial accounting and managerial accounting is the intended user of the information.

Financial accounting information is aimed at external users, or those outside the organization such as investors, creditors, and regulators. Managerial accounting information is aimed at internal users, or those working inside the organization, such as business owners, managers, and employees.

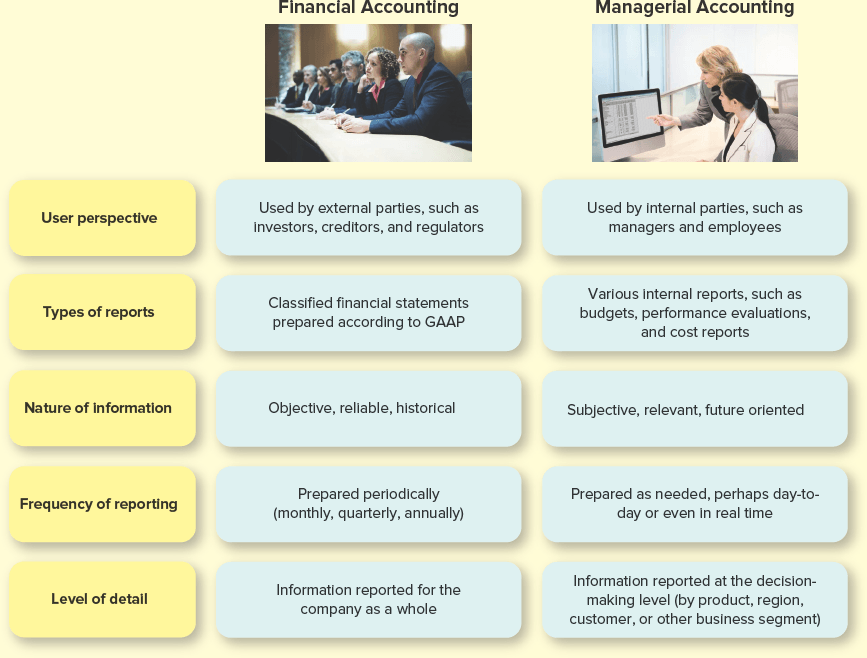

Because the intended users of the information are different, there are several other differences between financial and managerial accounting.

Accountants prepare external financial statements according to generally accepted accounting principles (GAAP), which provide external users with certain advantages in terms of their comparability and objectivity.

However, internal managers often need more detailed information than those financial reports can capture. Managers need information that is timely and relevant to the specific decision at hand. Rather than knowing what happened last year or last quarter, managers need to know what is happening today and be able to predict what will happen tomorrow.

See Figure 1 for a summary of the key differences between financial accounting and managerial accounting.

Important

Financial accounting is sometimes referred to as external reporting while managerial accounting is referred to as internal reporting. The difference is whether the intended users are inside or outside the company.