The article explains the concept of depreciation as a systematic method of allocating the cost of fixed assets over their useful lives and discusses the key factors involved in computing depreciation. It also highlights how depreciation estimates influence financial statements and decision-making for companies and external users such as lenders.

The cost of a fixed asset represents the cost of future benefits or service potential to a company. With the exception of land, this service potential declines over the life of each asset as the asset is used in the operations of the company. The expense recognition principle requires that the cost of a fixed asset be allocated as an expense among the accounting periods in which the asset is used and revenues are generated by its use. Depreciation is the process of allocating, in a systematic and rational manner, the cost of a tangible fixed asset (other than land) to expense over the asset’s useful life.

The amount of depreciation expense is recorded each period by making the following adjusting journal entry:

| Depreciation Expense | xxx | |

| Accumulated Depreciation | xxx |

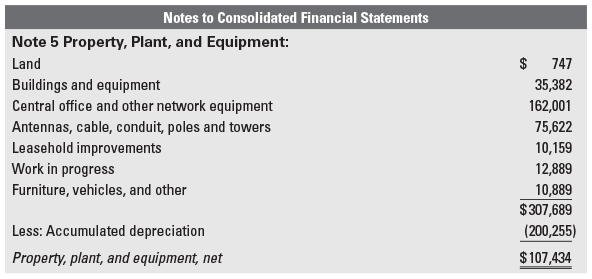

The amount of depreciation recorded each period, or depreciation expense, is reported on the income statement. Accumulated depreciation, which represents the total amount of depreciation expense that has been recorded for an asset since the asset was acquired, is reported on the balance sheet as a contra-asset. Accumulated depreciation is deducted from the cost of the asset to get the asset’s book value (or carrying value). Figure 1 shows the disclosures relating to property, plant, and equipment and depreciation made by Verizon in its 2022 annual report.

Figure 1. Excerpt from Verizon’s Annual Report

Before continuing, it is critical to understand the following points:

- Depreciation is a cost allocation process. It is not an attempt to measure the fair value of the asset or obtain some other measure of the asset’s value. In fact, the book value (cost minus accumulated depreciation) of an asset that is reported on a company’s balance sheet is often quite different from the market value of the asset.

- Depreciation is not an attempt to accumulate cash for the replacement of an asset. Depreciation is a cost allocation process that does not involve cash.

Information Required for Measuring Depreciation

The following information is necessary in order to measure depreciation:

- cost of the fixed asset

- useful life (or expected life) of the fixed asset

- residual value (salvage value) of the fixed asset

Cost

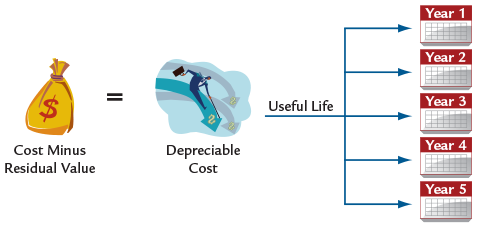

Cost of a fixed asset is any expenditure to acquire the asset and to prepare the asset for use. In addition to cost, we also need to examine two other items—useful life and estimates of residual value—to measure depreciation. Figure 2 shows the relationship among the factors used to compute depreciation expense.

Figure 2. Components of Depreciation Expense

Useful Life

The useful life of an asset is the period of time over which the company anticipates deriving benefit from the use of the asset.

The useful life of any fixed asset reflects both the physical capacities of the asset and the company’s plans for its use. Many companies plan to dispose of assets before their entire service potential is exhausted. For example, major automobile rental companies typically use an automobile for only a part of its entire economic life before disposing of it.

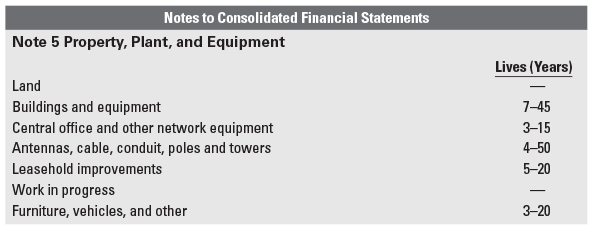

The useful life also is influenced by technological change. Many assets lose their service potential through obsolescence long before the assets are physically inoperable. As shown in Figure 3, Verizon uses an estimated useful life of 3 to 50 years for its fixed assets.

Figure 3. Excerpt from Verizon’s Annual Report

Residual Value

The residual value (also called salvage value) is the amount of cash or trade-in consideration that the company expects to receive when an asset is retired from service. Accordingly, the residual value reflects the company’s plans for the asset and its expectations about the value of the asset once its expected life with the company is over. A truck used for 3 years may have a substantial residual value, whereas the same truck used for 12 years may have minimal residual value. Residual value is based on projections of the same future events that are used to estimate an asset’s useful life. Since depreciation expense depends on estimates of both useful life and residual value, depreciation expense itself is an estimate.

The cost of the asset minus its residual value gives an asset’s depreciable cost. The depreciable cost of the asset is the amount that will be depreciated (expensed) over the asset’s useful life.

Impact of Depreciation Estimates

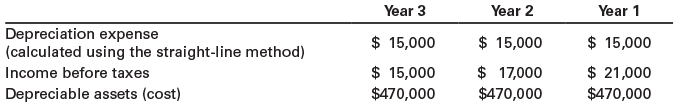

You are a loan officer of the Prairie State Bank. The president of a ready-mix concrete company, Concrete Transit Company, has applied for a 5-year, $150,000 loan to finance their company’s expansion. You have examined Concrete Transit’s financial statements for the past 3 years and found the following:

Based on other customers in the same business that use the same depreciation method as Concrete Transit, you expected depreciation expense to be approximately 15% of the cost of the depreciable assets.

Should you make the loan?

Since Concrete Transit has similar assets and is using a similar depreciation method to its competitors, the most obvious reason for reporting a lower percentage of depreciation expense is that Concrete Transit is using different estimates of residual value and/or useful life than its competitors.

If higher estimates of residual value or useful life are used, depreciation expense will be lower and income will be higher. If you adjust Concrete Transit’s depreciation expense to 15% of the cost of its depreciable assets, depreciation expense will increase from $15,000 to $70,500 ($470,000 × 0.15) for each year. This would cause a decrease in income before taxes of $55,500 each year. These adjusted amounts suggest that Concrete Transit has been increasingly unprofitable. Given the difficulties it would likely have in making the required loan payments, the loan should not be made.

While most companies establish policies for depreciable assets that specify the estimation of useful lives and residual values, the measurement of depreciation expense (and income) ultimately relies on judgment.

Key Takeaways

Understanding depreciation and the factors that influence it—such as cost, useful life, and residual value—is essential because these estimates directly affect a company’s reported income, asset values, and financial health. Accurate depreciation practices ensure that expenses are matched with revenues, provide a realistic picture of asset usage, and support better decision-making for managers, investors, and lenders. In practical applications, reliable depreciation estimates help companies plan asset replacements, evaluate profitability, and maintain transparency in financial reporting, making them a critical component of sound financial management.