Assets such as patents and copyrights that have no physical form; they are valuable because of the special rights they carry.

Intangible assets have no physical form. Instead, in most cases, these assets convey special rights to their owner. Intangible assets include patents, copyrights, trademarks, and other creative works.

When an intangible asset is acquired, the acquisition cost is debited to an asset account. The process of allocating the cost of an intangible asset to expense is called amortization. Amortization applies to intangible assets exactly as depreciation applies to fixed assets and depletion to natural resources.

Amortization

Systematic reduction of an intangible asset’s carrying value on the books; an expense that applies to intangible assets in the same way depreciation applies to fixed assets and depletion to natural resources.

Specific Intangible Assets

Below you will find most common intangible assets:

Patents

A federal government grant conveying an exclusive 20-year right to produce and sell a process, product, or technology; considered an intangible asset.

The useful life of a patent is often much less than 20 years because newer, better products and processes are invented, rendering the patent obsolete.

Copyrights

Exclusive right to reproduce and sell a book, musical composition, film, other work of art, or computer program; issued by the federal government, copyrights extend 70 years beyond the author’s life and are considered to be an intangible asset.

Copyrights also protect computer software programs such as Microsoft Windows 10. Copyrights are issued by the federal government and extend 70 years beyond the author’s life, although the useful life of most copyrights is relatively short. A copyright is accounted for in the same manner as a patent.

Trademarks and Brand Names

Trademarks convey the exclusive right to use a symbol, slogan, or brand name (also known as trade name) that represents a distinctive product or service such as Sony’s® Blu-ray Disc™ and Intel’s® Core™.

One of the most widely recognized legally protected slogans is Verizon Wireless’s “Can you hear me now?” The cost of a trademark or trade name is amortized over its useful life.

Franchises and Licenses

Franchises and licenses are privileges granted by a private business or a government to sell goods or services under specified conditions.

With a franchise, the franchisee uses another entity’s business model and brand name to operate, in effect, an independent branch of the business. The franchiser usually maintains a significant degree of control over the operations of the franchisee.

Under a license agreement, the licenser grants the licensee the right to sell goods or services, use a trademark, or use patented technology. The licenser usually has very little control over the operations of the licensee. The cost to acquire a franchise or license is amortized over its useful life.

Goodwill

In accounting, goodwill refers to the excess of the cost to purchase another company over the market value of its net assets (assets minus liabilities).

Example

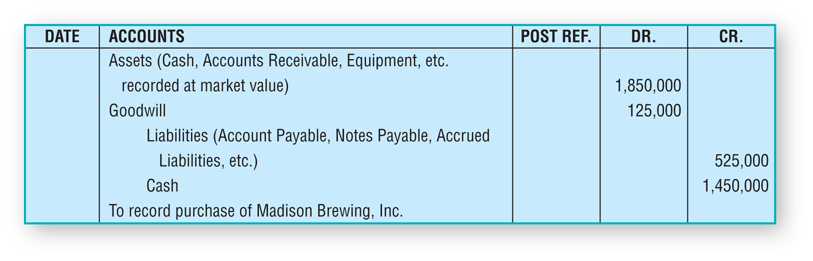

Suppose Bold City acquires Madison Brewing, Inc., for $\$1,450,000$ . At the time of the purchase, the total market value of Madison Brewing, Inc.’s assets is 1,850,000 dollars and the total market value of its liabilities is $\$525,000$. In this case, Bold City pays $\$125,000$ above the market value of Madison Brewing’s net assets of $\$1,325,000~\left(\$1,850,000-\$525,000\right)$. The extra $\$125,000$ is considered to be goodwill and is recorded as:

Goodwill has some unique features that differentiate it from other intangible assets.

- Goodwill is recorded only by an acquiring company when it purchases another company. An outstanding reputation may create goodwill, but that company never records goodwill for its own business.

- According to GAAP, goodwill is not amortized. Instead, the acquiring company measures the fair value of its goodwill each year. If the goodwill has increased in fair value, there is nothing to record. But if goodwill’s fair value has decreased, then the company records an impairment loss and writes the goodwill down. For example, suppose Bold City’s goodwill—which it acquired in the purchase of Madison Brewing, Inc.—has a fair value of 105,000.