In addition to acquiring and depreciating fixed assets, businesses often dispose of them. The following are the most common ways that fixed assets are disposed.

- The asset is discarded (thrown out).

- The asset is sold.

- The asset is exchanged for another asset. This occurs most often when an asset is used as a trade-in toward the purchase of another asset.

Regardless of the method of disposal, it is important to ensure that depreciation expense on the asset is up to date before recording the disposal. Therefore, for any asset that has not been fully depreciated, a business must record the current period’s depreciation expense before recording the disposal of the asset.

Once depreciation is up to date, the disposal of an asset is recorded using the following procedure.

Step 1 Record “what you got.” In other words, if you received any cash as part of the disposal transaction, then you would debit Cash for the amount of cash received. If you received a piece of equipment, then you would debit the Equipment account for the fair value (cost) of the equipment you received.

Step 2 Record “what you gave up.” You need to remove the asset that was disposed of from your books by debiting Accumulated Depreciation and crediting the Asset account (e.g., Office Equipment) for the respective amounts associated with the disposed-of asset. Then, if you paid out any cash, you would credit Cash. If you gave a note payable, you would credit Notes Payable.

Step 3 Record any gain or loss recognized on the transaction. You will recognize (debit) a loss if the value of what you got in the transaction is less than what you gave up. You will recognize (credit) a gain if the value of what you got is more than the value of what you gave up in the transaction. In effect, the debit or credit needed in this part of the entry will equal the amount necessary to make the entire entry balance.

Example of Disposal of Fixed Assets

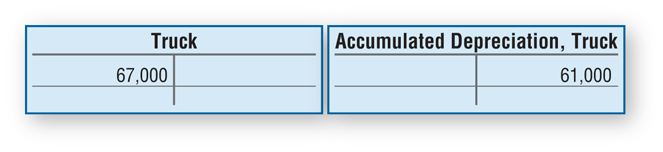

Let’s demonstrate asset disposals by once again using Bold City’s delivery truck as an example. At the end of its useful life, the delivery truck is represented in the books as:

Consider these three situations in which Bold City disposes of the delivery truck. All disposals are assumed to take place after the delivery truck has been fully depreciated.

| Situation A: | The truck is completely worthless and is scrapped for $0. |

| Situation B: | Bold City sells the truck for $8,000 cash. |

| Situation C: | Bold City trades the delivery truck in toward the purchase of a new truck that costs 9,500 and pays for the difference in cash. |

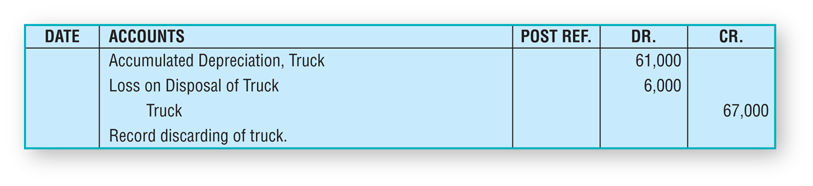

Situation A: The truck is completely worthless and is scrapped for $0. Let’s apply the three steps procedure for disposal outlined previously to demonstrate this:

Step 1 Record “what you got.” In this case, Bold City received nothing for the truck, so there is nothing to record.

Step 2 Record “what you gave up.” In this case, Bold City gave up the old delivery truck and should remove it from the books. To remove the asset, we must zero out both the Asset and Accumulated Depreciation accounts. To do this, we need to debit the Accumulated Depreciation, Truck account for 61,000 dollars and credit the Truck account for 67,000 dollars.

Step 3 Record any gain or loss on the transaction. This is a loss on disposal because Bold City received nothing for a truck that had a net book value (cost − accumulated depreciation) of $\$6,000$. Bold City debits Loss on disposal of Truck for $\$6,000$.

Bold City records the disposal as:

Notice that the debit to the loss account equals the amount needed to bring the entire entry into balance.

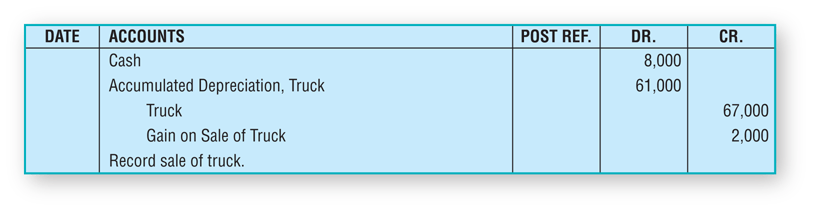

Situation B: Bold City sells the truck for $8,000 cash. The three steps procedure for disposal outlined previously can be applied to this situation as well:

Step 1 Record “what you got.” In this case Bold City received 8,000 dollars for the truck, so Cash is debited for 8,000 dollars.

Step 2 Record “what you gave up.” Once again, Bold City gave up the old delivery truck and should remove it from the books. Accumulated Depreciation, Truck is debited for $\$61,000$ and the Truck account is credited for $\$67,000$.

Step 3 Record any gain or loss on the transaction. This is a gain on sale because Bold City received $\$8,000$ for a truck that had a net book value (cost − accumulated depreciation) of $\$6,000$. Bold City credits Gain on Sale of Truck for $\$2,000$.

Bold City records the disposal as:

Observe that the credit to the gain account equals the amount needed to bring the entire entry into balance.

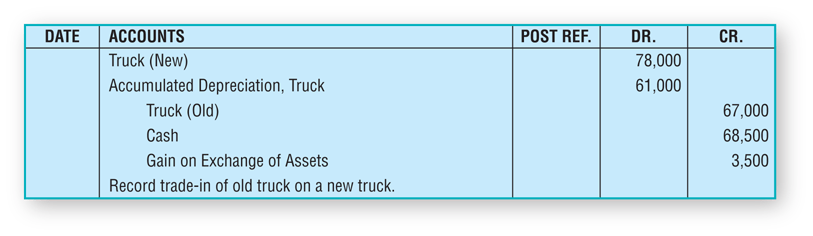

Situation C: Bold City trades the delivery truck in toward the purchase of a new truck that costs $\$78,000$. Bold City is granted a trade-in allowance of $\$9,500$ and pays for the difference in cash. Here again, let’s apply the three-step procedure to record the disposal.

Step 1 Record “what you got.” In this transaction, Bold City received a $\$78,000$ new truck. So, Truck (new) is debited for $\$78,000$.

Step 2 Record “what you gave up.” As in the previous situations, Bold City gave up the old delivery truck and should remove it from the books. Accumulated Depreciation, Truck is debited for $\$61,000$ and the Truck (old) account is credited for $\$67,000$. In addition to giving up the truck, Bold City paid cash in the amount of $\$68,500$, so Cash is also credited for $\$68,500$.

With a trade-in, the amount of cash paid is determined by subtracting the trade-in allowance from the purchase price of the new asset. So, the $\$78,000$ cost of the new truck less the $\$9,500$ trade-in allowance equals the $\$68,500$ cash paid.

Step 3 Record any gain or loss on the transaction. A gain on the exchange occurs because Bold City received a truck with a cost of $\$78,000$ for assets worth $\$74,500$ (a truck that had a net book value of $\$6,000$ plus cash of $\$68,500$). Bold City credits Gain on Exchange for $\$3,500$.

Bold City records the disposal as:

Once again, the gain equals the amount necessary to bring the entry into balance.

Example

A piece of equipment originally purchased for $\$42,000$ and with accumulated depreciation of $\$35,000$ was sold for $\$8,000$. How much gain or loss would be recognized on the sale?

Answer

The company received $\$8,000$ for a piece of equipment with a book value of $\$7,000\left(\$42,000-\$35,000\right)$, so a gain of $\$1,000$ should be recognized on the sale.