Fraud Triangle

The combination of perceived pressure, rationalization, and perceived opportunity necessary to commit fraud.

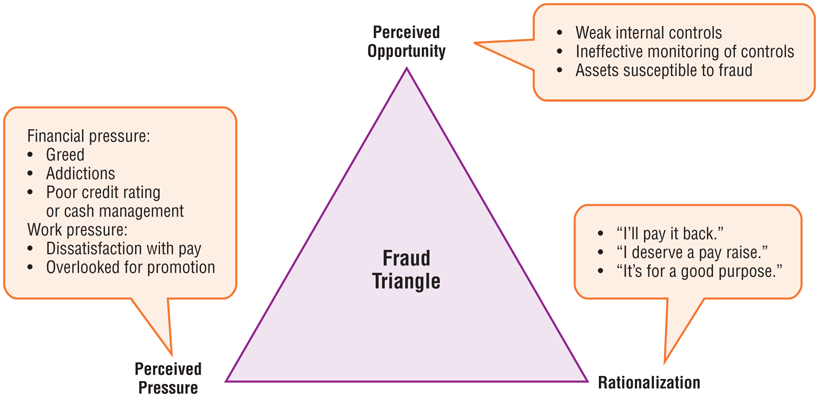

For fraud to occur, three components must also exist: perceived pressure, rationalization, and perceived opportunity. Figure 1, on the following page, presents the fraud triangle, which shows the connection of the three components necessary to commit fraud.

Figure 1: Fraud Triangle Components

Let us take a closer look at the three components of the fraud triangle.

Perceived Pressure

An element of the fraud triangle in which an employee feels a need to obtain cash or other assets.

Numerous reasons exist that could cause an individual to feel pressured to commit fraud. However, the most likely source of perceived pressure is usually financial pressure or work-related pressure. Financial pressure can be caused by, but is not limited to, the following:

- Unexpected financial needs, such as medical bills

- A drug or alcohol habit

- Living beyond one’s means

- A gambling addiction

- Unanticipated financial losses

- Excessive bills or personal debt

Work-related pressure also has several possible causes. An employee might feel dissatisfied with his or her job because of a sense of being underpaid or underappreciated. Or an employee might have recently been overlooked for a promotion. Either of these things can motivate an employee to “get even” with the company by committing fraud.

Also, if a company is performing poorly, it is possible for people within management to feel they are personally responsible. The perceived pressure caused by this feeling of personal responsibility can lead them to commit management fraud by falsifying the financial statements.

Rationalization

An element of the fraud triangle in which an employee justifies his or her actions and convinces himself or herself that fraud is not wrong.

The next component of the fraud triangle that must be present in order for fraud to occur is rationalization. Rationalization is simply finding good reasons for doing things that we know are wrong.

Rationalization is human nature and few people, if any, do not rationalize their behavior at some time or another. Employees who commit fraud attempt to justify their actions and convince themselves that fraud is not wrong by rationalizing their behavior.

Common rationalizations used by individuals involved in fraud include the following:

- “I didn’t steal the money; I only borrowed it, and I will pay it back.”

- “I deserve a pay raise. The company owes me.”

- “It won’t hurt anyone.”

- “Once the company gets over its financial difficulties, I will correct the books.”

Perceived Opportunity

An element of the fraud triangle in which an employee believes a chance exists to commit fraud, conceal it, and avoid punishment.

The third and final component of the fraud triangle is perceived opportunity. An individual who commits fraud must perceive that an opportunity exists to commit the fraud, conceal it, and avoid punishment.

An opportunity to commit fraud is often perceived when assets are easy to access or when assets are poorly accounted for by an organization.

Removing any one of the three components of the fraud triangle makes it much less likely that fraud will occur. Consider the following examples:

No Perceived Pressure: An employee may see an opportunity to steal a company computer. He or she may even be able to justify taking the computer by telling himself or herself that the computer is an older one the company no longer uses. However, if he or she can afford to purchase a new computer, the employee will have a low incentive to commit fraud.

No Rationalization: An employee may desperately need cash to pay overdue bills and may see a way to steal money without being detected. However, the employee’s moral beliefs may make it impossible for him or her to justify taking the money.

No Perceived Opportunity: An employee may feel pressured to steal money to cover a gambling debt. He or she may rationalize the theft by convincing himself or herself that he or she will repay the company next month. However, if it is not possible for the employee to steal money without being detected, it is unlikely that he or she will commit fraud. This situation arises because the employee sees no opportunity to engage in fraudulent activity without being discovered.

Of the three components of the fraud triangle, a business can have the most influence over the component of perceived opportunity. A business generally has limited control over perceived pressure felt by an employee or an employee’s ability to rationalize unethical behavior.

So, the most effective way for a business to prevent fraud is to reduce, or eliminate, the perceived opportunity for an employee to misappropriate company assets or for a manager to falsify financial information. Perceived opportunity can be reduced through a good system of internal control.