The major difference between international accounting standards (IFRS) and US accounting standards (GAAP) is the use of current or market values versus historical values for assets and liabilities.

Many users of financial statements, particularly of a balance sheet, ask, “What is something worth today?” They are asking for financial statements that reflect current or market values, not historical values.

Example

Let’s look at your land. Most users want to know your land is now worth 150,000 dollars. They want to know that you could sell it for 150,000 dollars and receive 150,000 dollars cash. They want to know the current or market value of your land, not what it cost you 10 years ago.

IFRS would recognize your land has increased in value, even though you have not sold it. Under IFRS, the land could increase in value from 100,000 dollars to 150,000 dollars. You would recognize a 50,000 dollars profit, and stockholders’ equity would increase by 50,000 dollars. Under US GAAP, the increase in value would not be recognized.

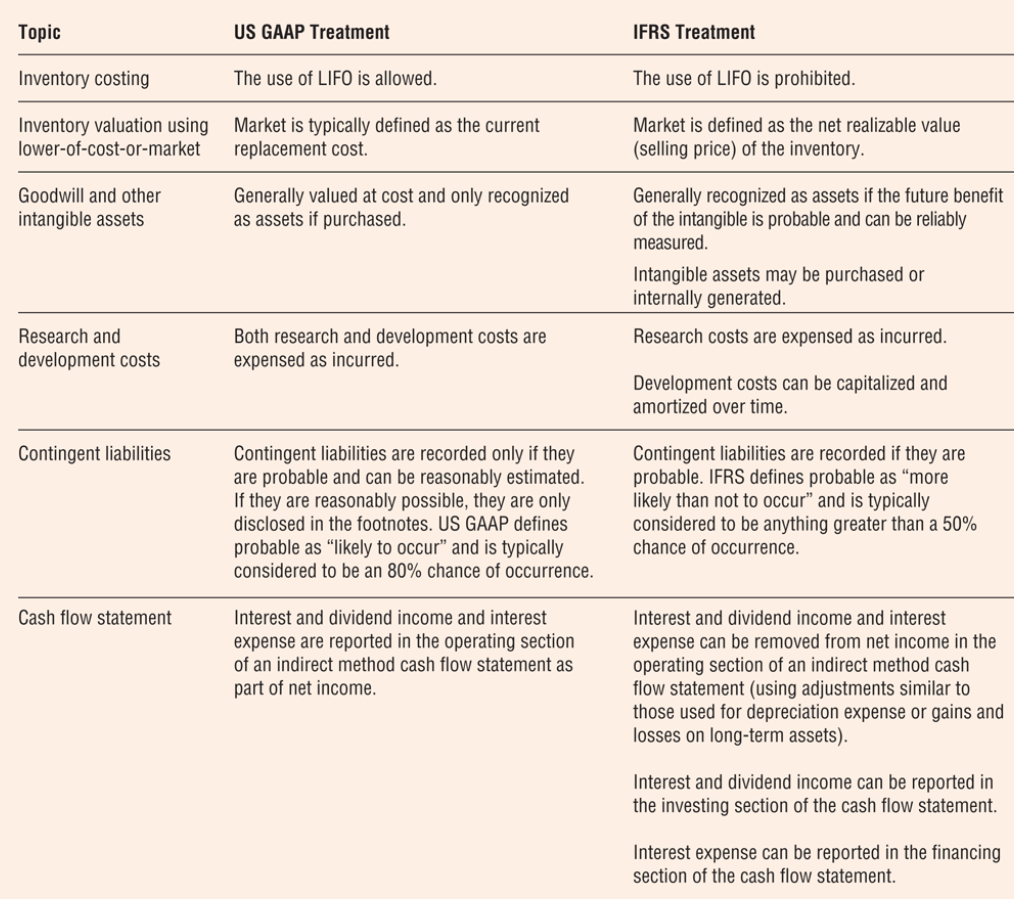

Figure 1 summarizes some of the more significant items that differ between US GAAP and IFRS.

Figure: Difference between US GAAP and IFRS