Adjusted trial balance is a list of all the accounts of a business with their adjusted balances.

Before preparing the financial statements, an adjusted trial balance is prepared to make sure total debits still equal total credits after adjusting entries have been recorded and posted.

Example

The adjusted trial balance for Bold City Consulting is presented in Figure 1.

Figure 1: Adjusted Trial Balance

Preparing the Financial Statements

The March financial statements of Bold City Consulting, Inc., are prepared from the adjusted trial balance in Figure 1. The financial statement is prepared as follows:

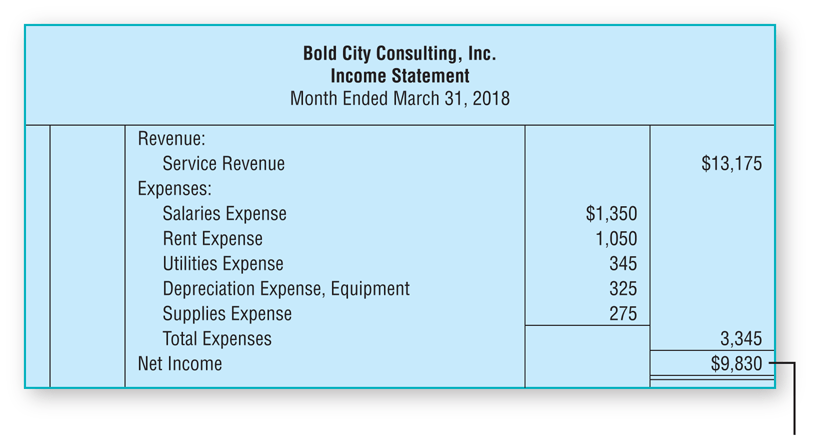

- The income statement (Figure 2) reports the revenues and the expenses to determine net income or net loss over a period of time.

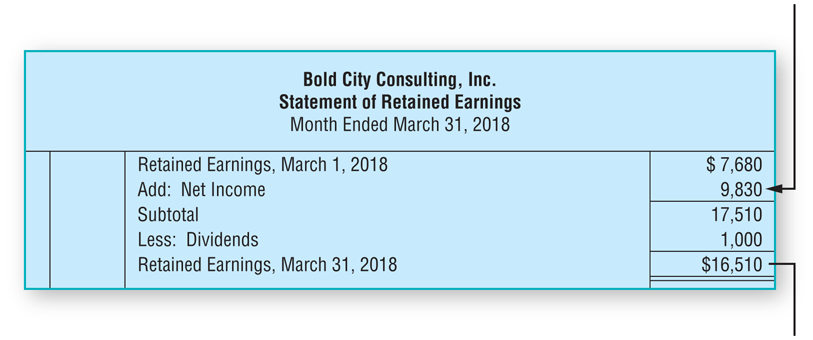

- The statement of retained earnings (Figure 3) shows changes in retained earnings during the period and computes the ending balance of retained earnings. Notice that the Retained Earnings balance of $7,680 on the adjusted trial balance does not represent the ending Retained Earnings balance because the account has not yet been updated for the current period’s earnings or dividends. It represents the balance at the beginning of March.

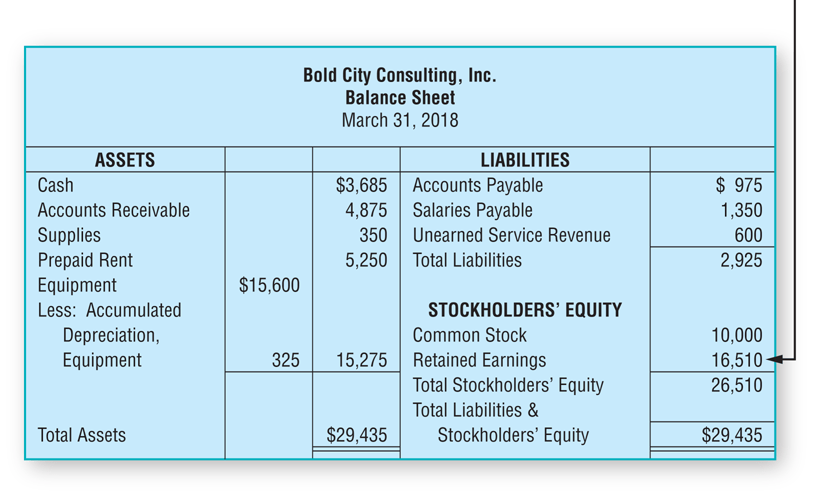

- The balance sheet (Figure 4) reports the assets, liabilities, and stockholders’ equity to determine the financial position of the business at a specific point in time.

Figure 2: Income Statement

Figure 3: Statement of Retained Earnings

Figure 4: Balance Sheet

Format

All financial statements include these elements:

Heading

- Name of the entity, such as Bold City Consulting, Inc.

- Title of the statement: Income Statement, Statement of Retained Earnings, or Balance Sheet

- Date, or period, covered by the statement: Month ended March 31, 2018, or March 31, 2018

Body of the Statement

On the income statement, expenses may be listed in descending order from the largest amount to the smallest amount, as Bold City Consulting did, or they may be listed in some other order, such as alphabetical order.

Decision Guidelines

| Decision | Guideline | Analyze |

|---|---|---|

| How can I tell how well a business is performing? | A company’s financial statements provide information regarding its performance. | The income statement reflects how profitable a business has been for a specified period of time. The statement of retained earnings shows how much of a company’s earnings have been distributed to the stockholders during the period. And the balance sheet reflects the business’s financial position on a given date. In other words, it shows what assets the business has and who has rights to those assets. |