The article explains the accounting cycle and its role in accurately recording and reporting business activities, emphasizing how economic events are recognized and measured in financial statements. It also discusses the importance of the accounting equation and faithful representation in ensuring reliable and balanced financial reporting.

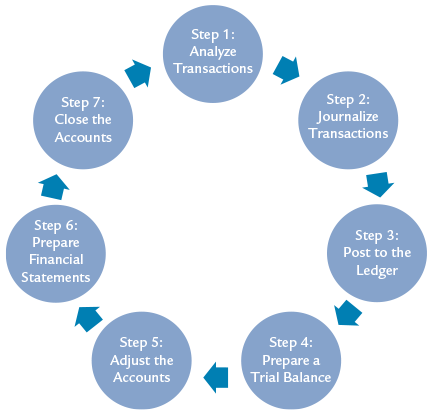

The sequence of procedures companies uses to capture and transform the effects of their business activities into financial statements is called the accounting cycle. If the financial statements are to present fairly the effects of the company’s activities, proper operation of the accounting cycle is essential. For example, if Disney failed to properly apply accounting procedures, it is likely that many of its business activities would be improperly recorded (if they were even recorded at all) and its financial statements would be misstated. The accounting cycle is shown in Figure 1.

Figure 1. Accounting Cycle Steps

Economic Events

A company engages in numerous activities that can be categorized as financing, investing, or operating activities. Each of these activities consists of different events that affect the company. Some of these events are external and result from exchanges between the company and another entity outside of the company. For example, when Disney issues common stock to investors, or sells a theme park ticket to a customer, it is engaging in an exchange with another entity. Other events are internal and result from the company’s own actions. When Disney uses equipment in its operations, no other entity is involved; however, the event still has an impact on the company.

Accounting measures the effects of events that influence a company and incorporates these events into the accounting system which, ultimately, produces the financial statements. However, not every event that affects a company is recorded in the accounting records. In order for an event to be recorded, or recognized, in the accounting system, the items making up the event must:

- impact a financial statement element (asset, liability, stockholders’ equity, revenue, expense, gain, or loss)

- faithfully represent the event

The first requirement usually is met when at least one party to a contract performs its responsibility according to the contract. For example, assume a buyer and seller agree upon the delivery of an asset and sign a contract. The signing of the contract usually is not recorded in the accounting system because neither party has performed its responsibility. Instead, recognition typically will occur once the buyer receives the asset or pays the seller, whichever comes first.

Even if the event impacts a financial statement element, a faithful representation of the event must be possible if it is to be recorded. An increase in travel or energy costs may adversely affect Disney’s future business. However, the effects of this cost increase cannot be faithfully represented, and the event will not be immediately recognized in the financial statements. Providing a measurement that is complete, unbiased, and free from error is important in accounting to avoid misleading users of financial statements.

A decision-maker would find it extremely difficult, if not impossible, to use financial statements that include amounts that failed to faithfully represent what has actually occurred. It is very important to pay attention to the recognition criteria as you consider an event for inclusion in the accounting system.

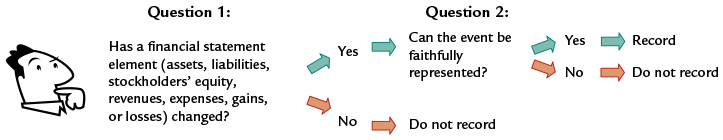

An accounting transaction results from an economic event that causes one of the elements of the financial statements (assets, liabilities, stockholders’ equity, revenues, or expenses) to change and that can be faithfully represented. A transaction refers to any event, external or internal, that is recognized in the financial statements. The process of identifying events to be recorded in the financial statements is illustrated in Figure 2.

Figure 2. Transaction Identification in the Financial Statement

Expanded Accounting Equation

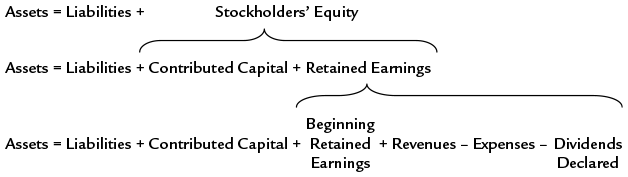

Because accounting is concerned with the measurement of transactions and their effect on the financial statements, a starting point in the measurement and recording process is the fundamental accounting equation:

Assets = Liabilities + Stockholder’s Equity

- The two sides of the accounting equation must always be equal or “in balance” as a company conducts its business. Accounting systems record these business activities in a way that maintains this equality. As a consequence, every transaction has a two-part, or double-entry, effect on the equation.

- The balance sheet and the income statement are related through retained earnings. Specifically, net income (revenues minus expenses) increases retained earnings. Given this relationship, the fundamental accounting equation can be rewritten to show the elements that make up stockholders’ equity.

With the expanded accounting equation shown in Figure 3, we are now ready to analyze how transactions affect a company’s financial statements.

Figure 3. Expanded Accounting Equation Formula and Format

Recognition of Economic Events

As you are analyzing the most recent financial statements of Big Oil (B&O) Company, you question if the company properly recorded an economic event. You know that B&O owns and operates several off-shore oil drilling platforms in the Gulf of Mexico. You also recall from news reports that a hurricane severely damaged two of the platforms, leading to a significant loss in revenue while the platforms were inactive. While you see evidence in the financial statements of the damage and repair to the platforms, you cannot find any evidence of the lost revenue in the financial statements.

Does the loss in revenue from the damaged oil platforms qualify for recognition in the financial statements?

To be recognized in the financial statements, the event must impact a financial statement element and be faithfully represented. While B&O may have been able to measure the loss in revenue, no financial statement element has been affected. While you may argue that this event affected revenue, revenue is an increase in assets resulting from the sale of products. Because the lost sales did not result in an inflow of assets, it is not considered revenue. In addition, expenses are defined as the cost of resources used to earn revenues. The lost revenue does not represent the use of resources and is therefore not an expense. Therefore, the lost revenue cannot be recognized in the financial statements.

Recognition of events in the financial statements requires analysis of whether the event impacted a financial statement element and can be faithfully represented.

Key Takeaways

Understanding and properly applying the accounting cycle is crucial for ensuring accurate financial reporting and effective decision-making. By recognizing and faithfully representing economic events, businesses can maintain reliable financial records that reflect their true financial position. These concepts not only help prevent errors and misstatements but also support transparency and consistency in financial statements, which are essential for investors, managers, and other stakeholders in evaluating a company’s performance and stability.