The article explains the concept of double-entry accounting, highlighting how transactions affect at least two accounts and maintain the balance of the accounting equation. It also discusses debits, credits, T-accounts, and normal account balances.

Double-Entry Accounting

The system used by companies to record the effects of transactions on the accounting equation. The effects of transactions are recorded in accounts. Under double-entry accounting, each transaction affects at least two accounts. In this article, we will explore accounts and the process by which transactions get reflected in specific accounts.

Accounts

To aid in the recording of transactions, an organizational system consisting of accounts has been developed. An account is a record of increases and decreases in each of the basic elements of the financial statements. Each financial statement element is composed of a variety of accounts. All changes in assets, liabilities, stockholders’ equity, revenues, or expenses are then recorded in the appropriate account. The list of accounts used by the company is termed a chart of accounts.

A typical list of accounts is shown in Figure 1.

| Assets | Liabilities | Stockholders’ Equity | Revenues and Gains | Expenses and Losses |

| Cash | Accounts Payable | Common Stock | Sales Revenue | Cost of Goods Sold |

| Investments | Salaries Payable | Retained Earnings | Service Revenue | Salaries Expense |

| Accounts Receivable | Unearned Sales Revenue | Interest Income | Rent Expense | |

| Inventory | Interest Payable | Rent Revenue | Insurance Expense | |

| Land | Income Taxes Payable | Gain on Disposal of Property, Plant, & Equipment | Depreciation Expense | |

| Buildings | Notes Payable | Advertising Expense | ||

| Equipment | Bonds Payable | Gain on Sale of Intangibles | Utilities Expense | |

| Patent | Repairs & Maintenance Expense | |||

| Copyright | Property Taxes Expense | |||

| Loss from Disposal of Property, Plant, & Equipment | ||||

Figure 1. Typical Accounts

Every company will have a different chart of accounts depending on the nature of its business activities. However, once a company selects which accounts will be used, all transactions must be recorded into these accounts. As the company engages in transactions, the transaction will either increase or decrease an account.

The amount in an account at any time is called the balance of the account. For example, the purchase of equipment will increase the balance in the equipment account, whereas the disposal of equipment will decrease the balance of the equipment account. For financial reporting purposes, the balances of related accounts typically are combined and reported as a single amount, with amounts of individual accounts such as land, buildings, and machinery disclosed in the footnotes.

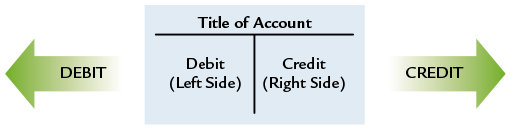

Although an account can be shown in a variety of ways, transactions are frequently analyzed using a T-account. The T-account gets its name because it resembles the capital letter T (see Figure 2). A T-account is a two-column record that consists of an account title and two sides divided by a vertical line—the left and the right side. The left side is referred to as the debit side and the right side is referred to as the credit side

Figure 2. Form of a T-Account

The terms debit and credit simply refer to the left and the right side of an account. The left is always the debit side and the right is always the credit side. Debit and credit do not represent increases or decreases. Instead, debit and credit simply refer to where an entry is made in an account. The terms debit and credit will also be used to refer to the act of entering dollar amounts into an account. For example, entering an amount on the left side of an account will be called debiting the account. Entering an amount on the right side of an account is called crediting the account.

On a bank statement, a credit to a person’s account means the account has increased. Similarly, a debit means the account has decreased. Why don’t credit and debit always mean “add” and “subtract”?

From the bank’s perspective, a person’s account is a liability since the bank must pay cash on demand. Because liabilities have normal credit balances, a credit will increase the account and a debit will decrease the account. However, from an individual’s perspective, cash is an asset which has a normal debit balance. Therefore, debits increase cash and credits decrease cash. It is critical to always look at the normal balance of an account before determining if a transaction increases or decreases an account.

You may be tempted to associate the terms credit and debit with positive or negative events. For example, assume you returned an item that you purchased with a credit card to the local store and the store credited your card. This is generally viewed as a positive event since you now owe less money to the store. Or, if you receive a notice that your bank had debited your account to pay for service charges that you owe, this is viewed negatively because you now have less money in your account. Resist this temptation. In accounting, debit means the left side of an account and credit means the right side of an account.

Debit and Credit Procedures

Using the accounting equation, we can incorporate debits and credits in order to determine how balance sheet accounts increase or decrease. There are three steps in determining increases or decreases to a balance sheet account:

Step 1.

Draw a T-account and label each side of the T-account as either debit (left side) or credit (right side).

Step 2.

Determine the normal balance of an account. All accounts have a normal balance. While individual transactions will increase and decrease an account, it would be unusual for an account to have a non normal balance.

Step 3.

Increases or decreases to an account are based on the normal balance of the account.

Example 1 Determining Increases or Decreases to a Balance Sheet Account

Increases or decreases to an account are based on the normal balance of the account. Information:

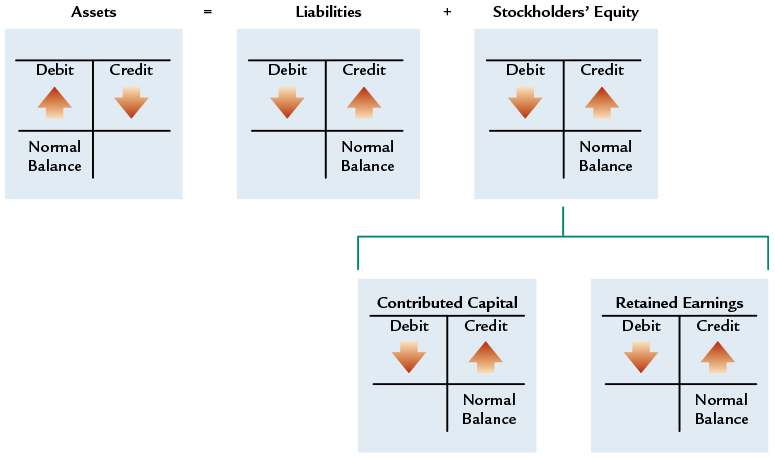

The balance sheet is comprised of three fundamental accounts—assets, liabilities, and stockholders’ equity. Stockholders’ equity consists of contributed capital and retained earnings.

Determine how each of the five balance sheet accounts increases or decreases.

Solution:

- Because assets are located on the left side of the accounting equation, their normal balance is a debit. Therefore, debits will increase assets and credits will decrease assets.

- Because liabilities and stockholders’ equity are on the right side of the accounting equation, their normal balance is a credit. Therefore, credits will increase liabilities and stockholders’ equity while debits will decrease these accounts.

- As stockholders’ equity accounts, both contributed capital and retained earnings have normal credit balances and are increased by credits and decreased by debits.

This is illustrated in the following T-accounts:

Every transaction will increase or decrease the elements of the accounting equation—assets, liabilities, and stockholders’ equity. The direction of these increases and decreases must be such that the accounting equation stays in balance—the left side must equal the right side. In other words, debits must equal credits. This equality of debits and credits provides the foundation of double-entry accounting in which the two-sided effect of a transaction is recorded in the accounting system.

The same three-step procedure can be followed to determine increases or decreases in revenues, expenses, gains, losses, and dividends declared. Example 2 demonstrates how increases and decreases in these accounts are recorded.

Example 2 Determining Increases or Decreases to Revenues, Expenses, Gains, Losses, and Dividends Declared

Increases or decreases to an account are based on the normal balance of the account.

Information:

The retained earnings account is affected by revenues, expenses, gains, losses, and dividends declared.

Determine how each of these five accounts increases or decreases.

Solution:

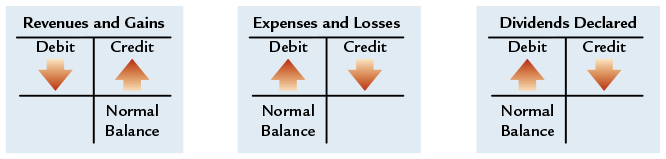

- Revenues and gains increase stockholders’ equity through retained earnings. Therefore, revenues and gains have a normal credit balance. That means that credits will increase revenues and gains, while debits will decrease revenues and gains.

- Expenses and losses decrease stockholders’ equity through retained earnings. Therefore, expenses and losses have a normal debit balance. That means that debits will increase expenses and losses, while credits will decrease expenses and losses.

- Dividends declared are defined as a distribution of retained earnings. Because dividends declared reduce retained earnings and stockholders’ equity, dividends declared have a normal debit balance. That means that debits will increase dividends declared, while credits will decrease dividends declared.

These procedures are summarized below.

From Example 2, you should notice several items. First, revenues and gains have opposite effects on retained earnings than expenses and losses; therefore, revenues and gains have opposite normal balances than expenses and losses. Second, any change (increase or decrease) in revenue, expense, gain, loss, or dividends declared affects the balance of stockholders’ equity. Specifically,

- an increase in a revenue or gain increases stockholders’ equity

- a decrease in a revenue or gain decreases stockholders’ equity

- an increase in an expense, loss, or dividends declared decreases stockholders’ equity

- a decrease in an expense, loss, or dividends declared increases stockholders’ equity

Finally, when revenues and gains exceed expenses and losses, a company has reported net income, which increases stockholders’ equity. When revenues and gains are less than expenses and losses, a company has reported a net loss, which reduces stockholders’ equity. These debit and credit procedures are summarized in Figure 3.

Figure 3. Summary of Debit and Credit Procedures

The important point from this analysis is that while debits are always on the left and credits are always on the right, the effect of a debit or credit on an account balance depends upon the normal balance of that account.

Inferring Activities from T-Accounts

As you examine the accounting records of Newton Inc., you notice that accounts receivable increased from $4,500 to $5,200 during the year and that credit sales were $65,800.

What was the amount of accounts receivable collected?

The primary activities that affect accounts receivable are the sale goods and services on credit (increases in accounts receivable) and the collection of cash related to these credit sales (decreases in accounts receivable). To help visualize the account activity, prepare a T-account as follows:

| Accounts Receivable | |||

| Beginning balance | 4,500 | ||

| Credit sales | 65,800 | ? | Cash collections |

| Ending balance | 5,200 | ||

Because you know the beginning and ending balances of accounts receivable and the amount of credit sales, you can determine the cash collections as:

$$\textrm{Cash collection}=$4,500+$65,800-$5,200=$65,100$$

An understanding of how business activities affect individual accounts can yield valuable insights into the economic events that occurred during a period.

Key Takeaways

Understanding double-entry accounting is essential for ensuring accuracy and reliability in financial recordkeeping. By applying the concepts of debits, credits, and T-accounts, businesses can maintain a balanced accounting equation and gain clear insights into their financial position. This system not only helps in detecting errors and preventing fraud but also provides a solid foundation for preparing financial statements, analyzing performance, and making informed business decisions—making it indispensable in real-world accounting applications.