The article explains the process of transaction analysis and how business activities affect the accounting equation, illustrating through examples how various transactions influence assets, liabilities, and stockholders’ equity while ensuring the equation remains balanced. It also highlights the classification of transactions into operating, investing, and financing activities.

Transaction Analysis

The process of determining the economic effects of a transaction on the elements of the accounting equation. Transaction analysis usually begins with the gathering of source documents that describe business activities. Source documents can be internally or externally prepared and include items such as purchase orders, cash register tapes, and invoices that describe the transaction and monetary amounts involved. These documents are the beginning of a “trail” of evidence that a transaction was processed by the accounting system.

After gathering the source documents, accountants must analyze these business activities to determine which transactions meet the criteria for recognition in the accounting records. Once it is determined that a transaction should be recorded in the accounting system, the transaction must be analyzed to determine how it will affect the accounting equation. Transaction analysis involves the following three steps:

Step 1.

Write down the accounting equation (use either the basic or an expanded accounting equation).

Step 2.

Identify the financial statement elements that are affected by the transaction.

Step 3.

Determine whether the elements increased or decreased.

Example 1 Performing Transaction Analysis

The economic effect of a transaction will have a two-part, or dual, effect on the accounting equation that results in the equation remaining in balance.

Information:

Luigi Inc. purchases a $3,000 computer from Worst Buy Electronics on credit, with payment due in 60 days.

Determine the effect of the transaction on the elements on the accounting equation.

Solution:

A computer is an economic resource, or asset, that will be used by Luigi in its business. The purchase of the computer increased assets and also created an obligation, or liability, for Luigi. Therefore, the effect of the transaction on the accounting equation is as follows:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$3,000 | +$3,000 | |||||

Note that the transaction analysis in Example 1 conformed to the two underlying principles of transaction analysis:

- There was a dual effect on the accounting equation.

- The accounting equation remained in balance after the transaction.

All transactions can be analyzed using a similar process.

To provide a further illustration of the effect of transactions on the accounting equation, consider the case of HiTech Communications Inc. HiTech is a newly formed corporation that operates an advertising agency that specializes in promoting computer-related products in the Cincinnati area. We show the effects of 13 transactions on HiTech’s financial position during March, its first month of operations.

Transaction 1. Issuing Common Stock

On March 1, HiTech sold 1,000 shares of common stock to several investors for cash of $12,000. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$12,000 | +$12,000 | |||||

Why must the accounting equation always remain in balance?

The accounting equation captures the business activities of a company. The left side of the accounting equation describes the economic resources, or assets, that the company has acquired. The right side of the equation describes the claims on these assets—either from creditors (liabilities) or from stockholders (stockholders’ equity). Because all resources belong to either the creditors or the stockholders, the equation must balance.

The sale of stock increases assets, specifically cash, and also increases stockholders’ equity (contributed capital or common stock). Obtaining funds by issuing stock is a financing activity.

Transaction 2. Borrowing Cash

On March 2, HiTech raised additional funds by borrowing $3,000 from First Third Bank of Cincinnati. HiTech promised to pay the amount borrowed plus 8% interest to First Third Bank in 1 year. The financial effect of this transaction is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$3,000 | +$3,000 | |||||

This borrowing has two effects: the asset cash is increased and a liability is created. HiTech has an obligation to repay the cash borrowed according to the terms of the borrowing. Such a liability is called a note payable. Because this transaction is concerned with obtaining funds to begin and operate a business, it is classified as a financing activity.

Transaction 3. Purchase of Equipment for Cash

On March 3, HiTech purchased office equipment (such as computer equipment) from Micro Center Inc. for $4,500 in cash. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$4,500 | ||||||

| −$4,500 | ||||||

There is a reduction in cash (an asset) as it is spent and a corresponding increase in another asset, equipment. The purchased equipment is an asset because HiTech will use it to generate future revenue. Notice that this transaction merely converts one asset (cash) into another (equipment). Because Transaction 3 is concerned with buying long-term assets that enable HiTech to operate, it is considered an investing activity.

Transaction 4. Purchasing Insurance

On March 4, HiTech purchased a 6-month insurance policy for $1,200 cash. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$1,200 | ||||||

| −$1,200 | ||||||

There is a reduction in cash (an asset) as it is spent and a corresponding increase in another asset, prepaid insurance. The purchased insurance is an asset because the insurance will benefit future accounting periods. This type of asset is often referred to as a prepaid asset. Notice that, like Transaction 3, this transaction converts one asset (cash) into another (prepaid insurance). Because Transaction 4 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 5. Purchase of Supplies on Credit

On March 6, HiTech purchased office supplies from Hamilton Office Supply for $6,500. Hamilton Office Supply agreed to accept full payment in 30 days. The financial effect of this transaction is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$6,500 | +$6,500 | |||||

HiTech received an asset (supplies) but also incurred a liability to pay for these supplies. A transaction where goods are purchased on credit is often referred to as a purchase “on account” and the liability that is created is referred to as an account payable. Because Transaction 5 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 6. Providing Services for Cash

On March 10, HiTech provided advertising services to Miami Valley Products in exchange for $8,800 in cash.

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$8,800 | +$8,800 | |||||

Revenue is recognized when a company satisfies its performance obligation to its customers. As an advertising company, providing advertising services is HiTech’s primary obligation to its customer. Therefore, this transaction results in an increase in assets (cash) and an increase in revenue. Because Transaction 6 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 7. Providing Services on Credit

On March 15, HiTech provided advertising services to the Cincinnati Times for $3,300. HiTech agreed to accept full payment in 30 days. The financial effect of this transaction is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$3,300 | +$3,300 | |||||

When a company performs services for which they will be paid at a later date, this is often referred to as a sale ‘‘on account.’’ Instead of receiving cash, HiTech received a promise to pay from the Cincinnati Times. This right to collect amounts due from customers creates an asset called an account receivable. The credit sale represents revenue for HiTech because it has satisfied its performance obligation to its customer by providing the advertising service. Note that the revenue is recognized when the service is provided, not when the cash is actually received. Because Transaction 7 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 8. Receipt of Cash in Advance

On March 19, HiTech received $9,000 from the Metropolis News for advertising services to be completed in the next 3 months. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$9,000 | +$9,000 | |||||

HiTech received cash for services. However, due to the revenue recognition principle, HiTech cannot recognize revenue until it has performed the advertising service. Therefore, the receipt of cash creates a liability for HiTech for the work that is due in the future. The liability that is created by the receipt of cash in advance of performing the revenue generating activities is called an unearned revenue. Because Transaction 8 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 9. Payment of a Liability

On March 23, HiTech pays $6,000 cash for the supplies previously purchased from Hamilton Office Supply on credit (Transaction 5). The financial effect of this transaction is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| −$6,000 | −$6,000 | |||||

The cash payment reduces an asset (cash) and partially settles HiTech’s obligation (liability). The liability “Accounts Payable” is reduced to $500 ($6,500 − $6,000). This means that HiTech still owes Hamilton Office Supply $500. Notice that the payment of cash did not result in an expense. The expense related to supplies will be recorded as supplies are used. Because Transaction 9 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 10. Collection of a Receivable

On March 25, HiTech collected $3,000 cash from the Cincinnati Times for services sold earlier on credit (Transaction 7). The financial effect of this transaction is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| +$3,000 | ||||||

| −$3,000 | ||||||

The collection of cash increases assets. In addition, the accounts receivable (an asset) is reduced. As a result of this cash payment, the Cincinnati Times still owes HiTech $300. Notice that the cash collection did not result in the recognition of a revenue. The revenue was previously recognized in Transaction 7 as the service was performed. Because Transaction 10 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 11. Payment of Salaries

On March 26 (a Friday), HiTech paid weekly employee salaries of $1,800. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| −$1,800 | −$1,800 | |||||

An expense is the cost of an asset consumed in the operation of the business. Consistent with the expense recognition principle, expenses are recorded in the same period as the revenue that it helped generate. Because an asset (cash) is consumed as part of HiTech’s normal operations, salaries are an expense. Transaction 11 is concerned with the operations of the company; it is classified as an operating activity.

Transaction 12. Payment of Utilities

On March 30, HiTech paid its utility bill of $5,200 for March. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| −$5,200 | −$5,200 | |||||

Because an asset (cash) is consumed by HiTech as part of the operations of the business, the cost of utilities used during the month is an expense. Similar to the payment of salaries, utility expense is recorded as a decrease in retained earnings in the same period that it helped to generate revenue. Because Transaction 12 is concerned with the operations of the company, it is classified as an operating activity.

Transaction 13. Payment of a Dividend

On March 31, HiTech declared and paid a cash dividend of $500 to its stockholders. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Stockholders’ Equity | ||

| Contributed Capital | + | Retained Earnings | ||||

| −$500 | −$500 | |||||

Dividends are not an expense. Dividends are a distribution of net income and are recorded as a direct reduction of retained earnings when they are declared. The payment of a dividend is classified as a financing activity.

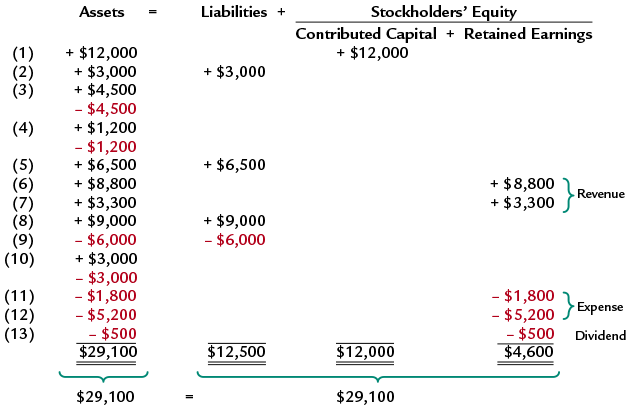

Overview of Transactions for HiTech Communications Inc.

Figure 1 summarizes HiTech’s transactions in order to show their cumulative effect on the accounting equation. The transaction number is shown in the first column on the left. Revenue and expense items are identified on the right. Notice that this summary reinforces the two key principles:

- Each transaction has a dual effect on the elements of the accounting equation.

- The accounting equation always remains in balance—the total change in assets ($29,100) equals the change in liabilities plus stockholders’ equity ($29,100).

Figure 1. Transaction Analysis for HiTec Communications Inc.

Transaction analysis can be used to answer many important questions about a company and its activities. Using the information in Figure 1, we can answer the following questions:

- What are the amounts of total assets, total liabilities, and total equity at the end of March? At the end of March, HiTech has total assets of $29,100, total liabilities of $12,500, and total equity of $16,600 ($12,000 of contributed capital plus $4,600 of retained earnings). These amounts for assets, liabilities, and stockholders’ equity at the end of March would be carried over as the beginning amounts for April.

- What is net income for the month? Net income is $5,100, which represents the excess of revenues of $12,100 ($8,800 + $3,300) over expenses of $7,000 ($5,200 + $1,800). Notice that dividends are not included in income; instead, they are included on the retained earnings statement.

- How much cash was received during the month? How much was spent? How much cash does HiTech have at the end of the month? During March, HiTech received a total of $35,800 in cash ($12,000 + $3,000 + $8,800 + $9,000 + $3,000) and spent a total of $19,200 ($4,500 + $1,200 + $6,000 + $1,800 + $5,200 + $500). At the end of the month, HiTech had cash on hand of $16,600 ($35,800 − $19,200).

The summary in Figure 1 can become quite cumbersome. For example, in order to determine the amount of cash that HiTech has at the end of the month, you may find it necessary to refer back to the actual transactions to determine which ones involved cash and which did not.

In addition, what if an investor or creditor wanted to know not only net income but also the types of expenses that HiTech incurred? (For example, what was the dollar amount spent for salaries?) To answer these questions, more information is needed than the transaction summary provides. For a company like Disney, a spreadsheet such as the preceding one would prove inadequate to convey its financial information to investors and creditors. A better way to record and track information is necessary. The solution is double-entry accounting.

Key Takeaways

Understanding transaction analysis and its impact on the accounting equation is essential for maintaining accurate financial records and ensuring a company’s financial statements reflect its true position. By properly analyzing and classifying transactions into operating, investing, and financing activities, businesses can make informed decisions, maintain balance in their accounts, and comply with accounting principles. This process not only supports transparency and accountability but also provides valuable insights for investors, managers, and creditors in evaluating a company’s performance and financial stability.