The article explains the structure and purpose of a classified balance sheet, detailing how assets, liabilities, and stockholders’ equity are organized to assess a company’s financial position and liquidity, and how tools like working capital and the current ratio help evaluate financial health and creditworthiness.

The purpose of the balance sheet is to report the financial position of a company (its assets, liabilities, and stockholders’ equity) at a specific point in time. The relationship between the elements of the balance sheet is given by the fundamental accounting equation:

Assets = Liabilities – Stockholder’s Equity

Note that the balance sheet gets its name because the economic resources of a company (assets) must always equal, or be in balance with, the claims against those resources (liabilities and stockholders’ equity).

The balance sheet is organized, or classified, to help users identify the fundamental economic similarities and differences between the various items within the balance sheet. These classifications help users answer questions such as:

- how a company obtained its resources

- whether a company will be able to pay its obligations when they become due

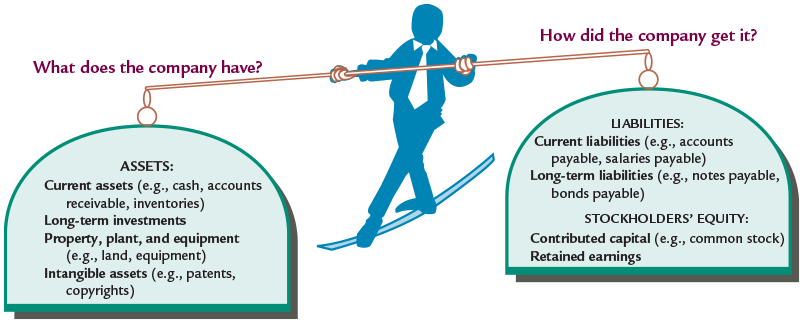

While companies often use different classifications and different levels of detail on their balance sheets, some common classifications are shown in Figure 1.

Figure 1. Common Balance Sheet Classification

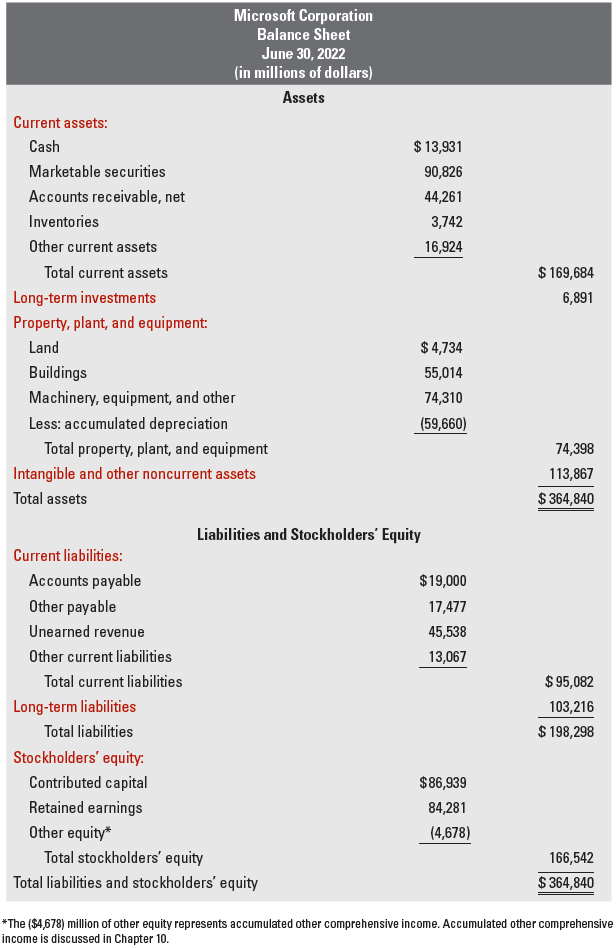

Let’s examine the balance sheet classifications in more detail by looking at Microsoft’s balance sheet shown in Figure 2.

Figure 2. Classified Balance Sheet Example

With regard to the heading of the financial statement, several items are of interest:

- Company name: The company for which the accounting information is collected and reported is clearly defined.

- Financial statement type: The title of the financial statement follows the name of the company.

- Date: The specific date of the statement is listed. Microsoft operates on a fiscal year that ends in June. A fiscal year is an accounting period that runs for 1 year. While many companies adopt a fiscal year that corresponds to the calendar year, others adopt a fiscal year that more closely corresponds with their business cycle.

- Amounts: Microsoft reports its financial results rounded to the nearest million dollars. Large companies often round the amounts presented for a more clear presentation. For Microsoft, the reported cash amount of $13,931 is actually $13,931,000,000.

Current Assets

The basic classification of a company’s assets is between current and noncurrent items. Current assets consist of cash and other assets that are reasonably expected to be converted into cash within 1 year or one operating cycle, whichever is longer. The operating cycle of a company is the average time it takes a company to purchase goods, resell the goods, and collect the cash from customers. Because most companies have operating cycles less than 1 year, companies typically designate 1 year as the dividing line between current and noncurrent items. Common types of current assets are:

- Cash

- Marketable securities—short-term investments in the debt and stock of other companies as well as government securities

- Accounts receivable—the right to collect an amount due from customers

- Inventories—goods or products held for resale to customers

- Other current assets—a “catch-all” category that includes items such as prepaid expenses (advance payments for rent, insurance, and other services) and supplies

Current assets are listed on the balance sheet in order of liquidity or nearness to cash. That is, the items are reported in the order in which the company expects to convert them into cash.

Many classifications on the balance sheet are essentially subtotals. Is it really important to place accounts within the right category or is it enough to simply understand if they are assets, liabilities, or stockholders’ equity?

It is critical that you be able to identify accounts as assets, liabilities, or stockholders’ equity accounts. However, the classifications are also important. Financial accounting is concerned with communicating useful information to decision-makers. These classifications provide decision-makers with information about the structure of assets, liabilities, and stockholders’ equity that assists them in understanding a company’s financial position.

Noncurrent Assets

Assets that are not classified as current are classified as long-term or noncurrent assets. These include long-term investments; property, plant, and equipment; intangible assets; and other noncurrent assets.

Long-Term Investments

Long-term investments are similar to short-term investments, except that the company expects to hold the investment for longer than 1 year. This category also includes land or buildings that a company is not currently using in operations.

Property, Plant, and Equipment

Property, plant, and equipment represent the tangible, long-lived, productive assets used by a company in its operations to produce revenue. This category includes land, buildings, machinery, manufacturing equipment, office equipment, and furniture. Property, plant, and equipment is originally recorded at the cost to obtain the asset. Because property, plant, and equipment help to produce revenue over a number of years, companies assign, or allocate, a portion of the asset’s cost as an expense in each period in which the asset is used. This process is called depreciation.

Accumulated depreciation represents the total amount of depreciation that the company has expensed over the life of its assets. Because accumulated depreciation is subtracted from the cost of an asset, it is called a contra-asset. The difference between the cost and the accumulated depreciation is the asset’s book value (or carrying value).

Intangible and Other Noncurrent Assets

Intangible assets are similar to property, plant, and equipment in that they provide a benefit to a company over a number of years; however, these assets lack physical substance. Examples of intangible assets include patents, copyrights, trademarks, and goodwill.

Other noncurrent assets is a catch-all category that includes items such as deferred charges (long-term prepaid expenses) and other long-term miscellaneous items.

Current Liabilities

Current liabilities are closely related to current assets. Current liabilities consist of obligations that will be satisfied within 1 year or the operating cycle, whichever is longer. These liabilities can be satisfied through the payment of cash or by providing goods or services. Current liabilities are typically listed in the order in which they will be paid and include:

- Accounts payable—an obligation to repay a vendor or supplier for merchandise supplied to the company

- Salaries payable—an obligation to pay an employee for services performed

- Unearned revenue—an obligation to deliver goods or perform a service for which a company has already been paid

- Interest payable—an obligation to pay interest on money that a company has borrowed

- Income taxes payable—an obligation to pay taxes on a company’s income

Long-Term Liabilities and Stockholders’ Equity

Long-term liabilities are the obligations of the company that will require payment beyond 1 year or the operating cycle, whichever is longer. Common examples are:

- Notes payable—an obligation to repay cash borrowed at a future date

- Bonds payable—a form of an interest-bearing note payable issued by corporations in an effort to attract a large amount of investors

Stockholders’ equity is the last major classification on a company’s balance sheet. Stockholder’s equity arises primarily from two sources:

- Contributed capital—the owners’ contributions of cash and other assets to the company (includes the common stock of a company)

- Retained earnings—the accumulated net income of a company that has not been distributed to owners in the form of dividends

If a firm has been profitable for many years, and if its stockholders have been willing to forgo large dividends, retained earnings may be a large portion of equity.

Together, a company’s liabilities and equity make up the capital of a business. Microsoft has debt capital, capital raised from creditors, of $198,298 million (total liabilities). Of this, $95,082 million comes from current creditors, while $103,216 million comes from long-term creditors. Microsoft’s equity capital, which is the capital of the stockholders, is $166,542 million (total stockholders’ equity).

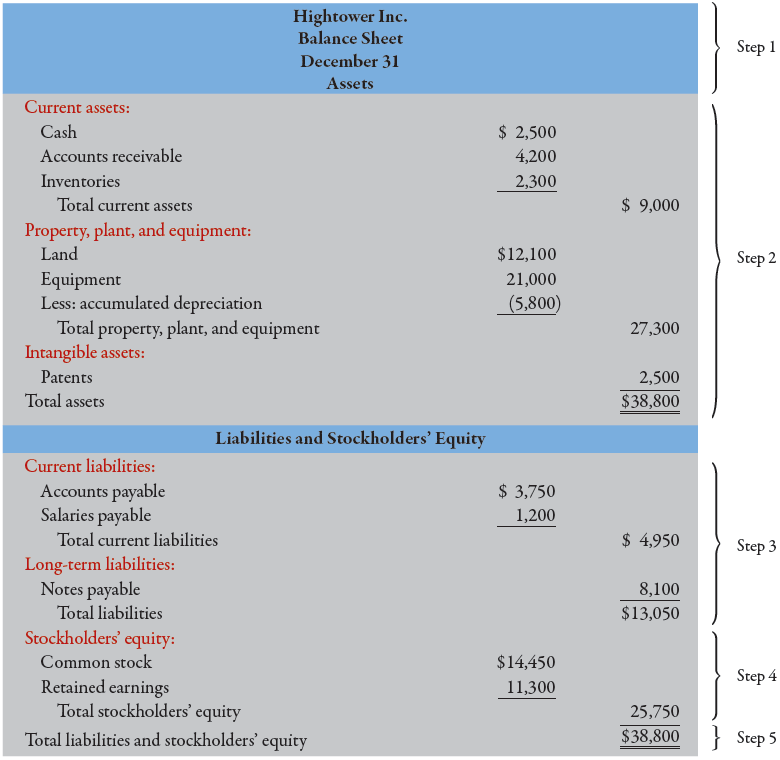

Preparing a Classified Balance Sheet

Using the fundamental accounting equation and the common classifications of balance sheet items, a company will prepare its balance sheet by following five steps:

Step 1.

Prepare a heading that includes the name of the company, the title of the financial statement, and the time period covered.

Step 2.

List the assets of the company in order of their liquidity or nearness to cash. Use appropriate classifications. Add the assets and double underline the total.

Step 3.

List the liabilities of the company in order of their time to maturity. Use appropriate classifications.

Step 4.

List the stockholders’ equity balances with appropriate classifications.

Step 5.

Add the liabilities and stockholders’ equity and double underline the total.

In general, only the first items in a column as well as any subtotals or totals have dollar signs. Also, when multiple items exist within a classification, these items are grouped together in a separate column (to the left of the main column) and their total is placed in the main column. Example 1 illustrates the steps in the preparation of a classified balance sheet.

Example 1 Preparing a Classified Balance Sheet

The balance sheet reports the financial position of a company (it’s assets, liabilities, and stockholders’ equity) at a specific point in time.

Information:

Hightower Inc. reported the following account balances at December 31:

| Inventories | $ 2,300 | Accounts receivable | $ 4,200 | Accounts payable | $ 3,750 |

| Land | 12,100 | Cash | 2,500 | Common stock | 14,450 |

| Salaries payable | 1,200 | Equipment | 21,000 | Patents | 2,500 |

| Retained earnings | 11,300 | Accumulated depreciation | 5,800 | Notes payable, long-term | 8,100 |

Prepare Hightower’s balance sheet at December 31.

Solution:

Using Balance Sheet Information

The balance sheet conveys important information about the structure of assets, liabilities, and stockholders’ equity, which is used to judge a company’s financial health. For example, the relationship between current assets and current liabilities gives investors and creditors insights into a company’s liquidity—the ability to pay obligations as they become due. Two useful measures of liquidity are working capital and the current ratio. Working capital and current ratios for a company are helpful when compared to other companies in the same industry. It is even more helpful to look at the trend of these measures over several years.

Working Capital

Working capital is a measure of liquidity, computed as:

Working Capital = Current Assets – Current Liabilities

Because current liabilities will be settled with current assets, Microsoft’s working capital of $74,602 million ($169,684 million – $95,082 million) signals that it has adequate funds with which to pay its current obligations. Because working capital is expressed in a dollar amount, the information it can convey is limited. For example, comparing Microsoft’s working capital to Intel’s working capital of $30,076 million would be misleading since Microsoft is $196,434 million larger (in terms of assets).

Current Ratio

The current ratio is an alternative measure of liquidity that allows comparisons to be made between different companies and is computed as:

$$\textrm{Current Ratio}=\frac{\textrm{Current Assets}}{\textrm{Current Liabilities}}$$

For example, Microsoft’s current ratio of 1.78 ($169,684 million ÷ $95,082 million) can be compared with its competitors (e.g., Intel’s current ratio is 2.10).

Apple’s current ratio tells us that for every dollar of current liabilities, Microsoft has $1.78 of current assets. When compared to Intel, Microsoft is less liquid.

Assessing the Creditworthiness of a Prospective Customer

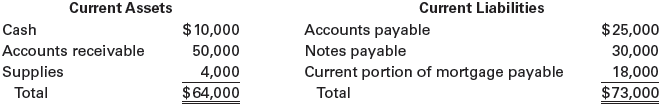

You are the regional credit manager for Nordic Equipment Company. Thin Inc., a newly organized health club, has offered to purchase $50,000 worth of exercise equipment by paying the full amount plus 9% interest in 6 months. At your request, Thin provides the following figures from its balance sheet:

Based on what you know about Thin’s current assets and liabilities, do you allow the company to purchase the equipment on credit?

In making your decision, it is important to consider the relationship between a company’s current assets and its current liabilities. Observe that Thin’s current liabilities exceed current assets by $9,000 ($64,000 − $73,000) resulting in negative working capital.

In addition, Thin’s current ratio is 0.88 ($64,000 ÷ $73,000). By all indications, Thin is suffering from liquidity issues. Finally, there is no evidence presented that Thin’s liquidity problem will improve. If Thin does fail to pay its liabilities, it is possible that the existing creditors could force Thin to sell its assets in order to pay off the debt. In such situations, it is possible that you will not receive the full amount promised. Unless Thin can demonstrate how it will pay its current short-term obligations, short-term credit should not be extended.

Allowing a company to purchase assets on credit requires evaluating the debtor’s ability to repay the loan out of current assets.

Key Takeaways

The classified balance sheet plays a vital role in understanding a company’s financial stability and operational efficiency. By organizing assets, liabilities, and stockholders’ equity into meaningful categories, it provides investors, creditors, and management with a clear picture of liquidity, solvency, and overall financial health. Tools such as working capital and the current ratio further enhance decision-making by revealing a company’s ability to meet short-term obligations. These applications make the classified balance sheet an essential tool for evaluating performance, guiding financial planning, and supporting informed business decisions.