This article explains the purpose and preparation of the retained earnings statement, highlighting how it tracks changes in a company’s retained earnings over a period. It also discusses the significance of dividend policies and how retained earnings impact business growth, investor returns, and financial stability.

The owners of a company contribute capital in one of two ways:

- directly, though purchases of common stock from the company

- indirectly, by the company retaining some or all of the net income earned each year rather than paying it out in dividends

The income earned by the company but not paid out in the form of dividends is called retained earnings. The retained earnings statement summarizes and explains the changes in retained earnings during the accounting period.

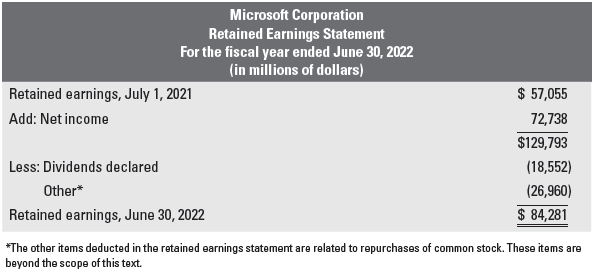

The beginning balance in retained earnings is increased by net income earned during the year and decreased by any dividends that were declared. Figure 1 shows the retained earnings statement for Microsoft.

Figure 1. Retained Earnings Statement Example

Notice the heading is similar to the heading for the income statement in that it covers a period of time instead of a specific date. In addition, Microsoft declared $18,552 million of dividends. While many companies provide their stockholders with a return on their investment in the form of dividends, many growing companies choose not to pay dividends in order to reinvest their earnings and support future growth.

Preparing a Retained Earnings Statement

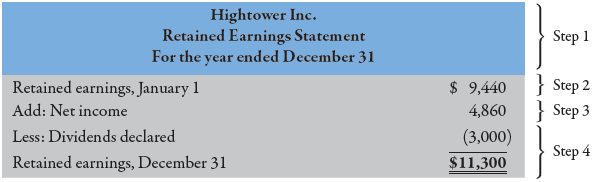

The preparation of the retained earnings statement involves four steps:

Step 1.

Prepare a heading that includes the name of the company, the title of the financial statement, and the time period covered.

Step 2.

List the retained earnings balance at the beginning of the period obtained from the balance sheet.

Step 3.

Add net income obtained from the income statement.

Step 4.

Subtract any dividends declared during the period. Double-underline the total, which should equal retained earnings at the end of the period as reported on the balance sheet.

Example 1: Preparing a Retained Earnings Statement

The retained earnings statement explains the changes in retained earnings during an accounting period.

Information:

Hightower Inc. reported the following account balances for the year ending December 31:

| Net income | $4,860 | Retained earnings, Jan. 1 | $ 9,440 |

| Dividends declared | 3,000 | Retained earnings, Dec. 31 | 11,300 |

Prepare Hightower’s retained earnings statement for the year ending December 31.

Solution:

Dividend Policy Decisions

You are the manager of a fast-growing software engineering firm. Over the last 5 years, your company has doubled the amount of its income every year. This tremendous growth has been financed through funds obtained from stockholders and cash generated from operations. The company has virtually no debt.

How would you respond to stockholders who have recently complained that the company’s policy not to pay dividends is preventing them from sharing in the company’s success?

Retained earnings can be an important source of financing for many companies. When companies feel that they have profitable growth opportunities, they should reinvest the earnings in the business instead of paying out the amount to stockholders as dividends. The reinvestment of these funds should result in higher stock prices (and increased wealth for the stockholders) as the company grows. If the company chose to pay a dividend, it would be forced to either abandon the growth opportunities or finance them through some other, more costly method (e.g., issuing debt).

When management feels that the company has growth opportunities that will increase the value of the company, the reinvestment of earnings is usually preferable.

Use of the Retained Earnings Statement

The retained earnings statement is used to monitor and evaluate a company’s dividend payouts to its shareholders. For example, some older investors seek out companies with high dividend payouts so that they will receive cash during the year. Other investors are more interested in companies that are reinvesting a sufficient amount of earnings that will enable them to pursue profitable growth opportunities. Finally, creditors are interested in a company’s dividend payouts. If a company pays out too much in dividends, the company may not have enough cash on hand to repay its debt when it becomes due.

Key Takeaways

The retained earnings statement plays a vital role in evaluating a company’s financial performance and strategic decision-making. It provides insights into how profits are utilized—whether reinvested for growth, reserved for stability, or distributed as dividends. This information is valuable for investors assessing potential returns, for management planning future expansion, and for creditors evaluating a company’s ability to meet its financial obligations. Overall, it serves as a key indicator of a company’s long-term sustainability and effective use of resources.