The article explains the conceptual framework of accounting, highlighting its role in guiding financial reporting through fundamental and enhancing qualitative characteristics, key assumptions, and core accounting principles. It also discusses how these concepts ensure consistency, reliability, and usefulness of financial information for decision-making.

Generally accepted accounting principles (GAAP) rest on a conceptual framework of accounting. This conceptual framework flows logically from the fundamental objective of financial reporting: to provide information that is useful in making investment and credit decisions. The conceptual framework is designed to support the development of a consistent set of accounting standards and provide a consistent body of thought for financial reporting.

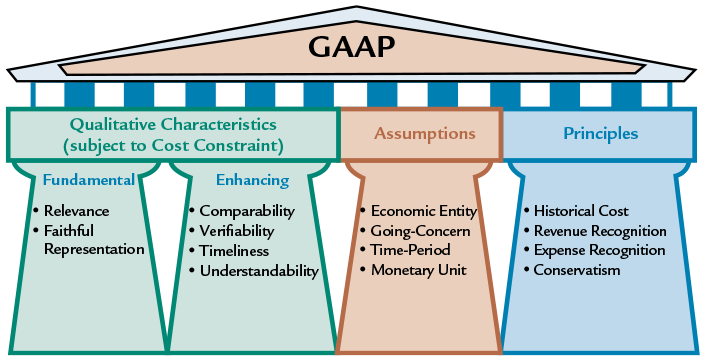

An understanding of the conceptual framework should help you in understanding complex accounting standards by providing a logical structure to financial accounting; in other words, the concepts help to explain “why” accountants adopt certain practices. Figure 1 summarizes the characteristics of useful information as well as the underlying assumptions and principles that make up the conceptual framework and serve as the foundation of GAAP.

Figure 1. Conceptual Framework of Accounting (Qualitative Characteristics, Assumptions, and Principles)

Qualitative Characteristics

The FASB has identified two fundamental characteristics that useful information should possess—relevance and faithful representation. The application of these criteria determines which economic events should be shown in the financial statements and how best to record these events.

- Relevance: Information is relevant if it is capable of making a difference in a business decision by helping users predict future events (predictive value) or providing feedback about prior expectations (confirmatory value). If the omission or misstatement of information could influence a decision, the information is said to be material. Therefore, materiality is also an aspect of relevance.

- Faithful representation: Accounting information should be a faithful representation of the real-world economic event that it is intending to portray. Faithfully represented information should be complete (includes all necessary information for the user to understand the economic event), neutral (unbiased), and free from error (as accurate as possible).

In applying these fundamental characteristics, the usual process is to identify the most relevant information and then determine if it can be faithfully represented.

In addition to the fundamental characteristics, four enhancing characteristics—comparability, verifiability, timeliness, and understandability—have been identified. These enhancing characteristics are considered complementary to the fundamental characteristics, and their presence should help determine the degree of the information’s usefulness.

- Comparability: Comparable information allows external users to identify similarities and differences between two or more items. Information is useful when it can be compared with similar information about other companies or with similar information about the same company for a different time period.

- Consistency can be achieved when a company applies the same accounting principles for the same items over time. Consistency can also be achieved when multiple companies use the same accounting principles in a single time period. Comparability should be viewed as the goal while consistency helps to achieve that goal.

- Verifiability: Information is verifiable when independent parties can agree on the measurement of the activity. When multiple independent observers can reach a general consensus, there is an implication that the information faithfully represents the economic event being measured.

- Timeliness: Information is timely if it is available to users before it loses its ability to influence decisions.

- Understandability: If users who have a reasonable knowledge of accounting and business can, with reasonable study effort, comprehend the meaning of the information, it is considered understandable.

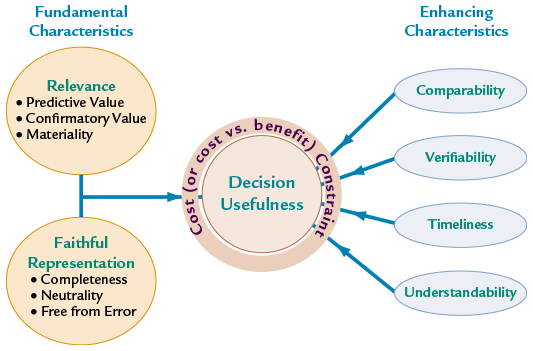

These qualitative characteristics are bound by one pervasive constraint—the cost constraint. The cost constraint states that the benefit received from accounting information should be greater than the cost of providing that information. If the cost exceeds the benefit, the information is not considered useful. Figure 2 illustrates the qualitative characteristics of useful financial information.

Figure 2. Qualitative Characteristics of Accounting Information

Trade-offs are often necessary in evaluating these criteria. For example, the most relevant information may not be able to be faithfully represented. Similarly, changing economic situations may require a change in the accounting principle used. Such a change may decrease the comparability of the information presented. In these situations, the accountant must exercise judgment in determining the accounting principles that would produce the most useful information for the decision-maker. In all situations, accountants should follow a full disclosure policy. That is, any information that would make a difference to financial statement users should be revealed.

Assumptions

The following four basic assumptions underlie accounting:

- Economic entity assumption: Under this assumption, each company is accounted for separately from its owners. For example, Disney does not record the personal transactions of its shareholders in its financial statements.

- Going-concern assumption: This assumption states that a company will continue to operate long enough to carry out its existing commitments. Without this assumption, many of our accounting procedures could not be followed. This assumption is essential for valuing assets (future benefits) and liabilities (future obligations).

- Time-period assumption: This assumption allows the life of a company to be divided into artificial time periods so that net income can be measured for a specific period of time (e.g., monthly, quarterly, or annually). Without this assumption, a company’s income could only be reported at the end of its life.

- Monetary unit assumption: This assumption requires that a company account for and report its financial results in monetary terms (such as U.S. dollar, euro, or Japanese yen). This assumption implies that certain nonmonetary items (such as brand loyalty or customer satisfaction) are not reported in a company’s financial statements since they can’t be measured in monetary terms.

Principles

Principles are general approaches that are used in the measurement and recording of business activities. The four basic principles of accounting are: the historical cost principle, the revenue recognition principle, the expense recognition principle, and the conservatism principle.

- Historical cost principle: This principle requires that the activities of a company are initially measured at their cost—the exchange price at the time the activity occurs. For example, when Disney buys equipment used at one of its theme parks, it initially records the equipment at the cost paid to acquire it. Accountants use historical cost because it provides an objective and verifiable measure of the activity. However, the historical cost principle has been criticized because, after the date of acquisition, it does not reflect changes in market value. The Financial Accounting Standards Board (FASB), aware of this criticism, has been developing standards that use market values to measure certain assets and liabilities (such as investments in marketable securities) after the date of acquisition.

- Revenue recognition principle: This principle is used to determine when revenue is recorded and reported. Under this principle, revenue is to be recognized or recorded in the period in which a company satisfies its performance obligation or promise within a contract. Generally, this occurs when services are performed or goods are delivered to customers.

- Expense recognition principle: This principle requires that an expense be recorded and reported in the same period as the revenue that it helped generate. It is often referred to as the matching principle. This may or may not be in the same period that cash is paid. Together, the application of the revenue and expense recognition principles determines a company’s net income.

- Conservatism principle: This principle states that accountants should not overstate assets and income when they prepare financial statements. The idea behind this principle is that conservatism is a prudent reaction to uncertainty and offsets management’s natural optimism about the company’s future prospects. However, conservatism should not lead to biased financial information nor should it ever be used to justify the deliberate understatement of assets or income.

Companies assume they are going concerns. Wouldn’t the valuation of a company’s assets be more relevant if this assumption were relaxed and the net assets valued at their current selling costs?

Current selling costs are only relevant if the company intends to sell the assets in the near term. However, many assets (such as machinery or buildings) are used over long periods of time, and in these situations, the use of current selling prices would be of little value to financial statement users. In addition, the cost of obtaining current values for these assets would greatly outweigh the benefits received.

Example 1 Applying the Conceptual Framework

The conceptual framework provides a logical structure and direction to financial accounting and reporting and supports the development of a consistent set of accounting standards.

Information:

Mario is faced with the following questions as he prepares the financial statements of DK Company:

- Should the purchase of inventory be valued at what DK paid to acquire the inventory or at its estimated selling price?

- Should information be provided that financial statement users might find helpful in predicting DK’s future income?

- Faced with a choice between two equally acceptable estimates, should Mario choose the one that results in the higher or the lower amount for net income?

- Although DK is profitable, should the financial statements be prepared under the assumption that DK will go bankrupt?

- Should DK’s inventory be reported in terms of the number of units on hand or the dollar value of those units?

- Should equipment lease on a long-term basis be reported as an asset (the economic substance of the transaction) or should it be reported as a rental (the form of the transaction)?

- Should DK recognize revenue from the sale of its products when the sale is made or when the cash is received?

- Should DK record the purchase of a vacation home by one of its shareholders?

- Should DK report income annually to its shareholders or should it wait until all transactions are complete?

- Should DK report salary expense in the period that the employees actually worked or when the employees are paid?

Which qualitative characteristic, assumption, or principle should Mario use in resolving the situation?

Solution:

- Historical cost: The activities of a company (such as purchase of inventory) should be initially measured at the exchange price at the time the activity occurs.

- Relevance: Material information that has predictive or confirmatory value should be provided.

- Conservatism: When faced with a choice, accountants should avoid overstating assets or income.

- Going-concern: In the absence of information to the contrary, it should be assumed that a company will continue to operate indefinitely.

- Monetary unit: A company should account for and report its financial results in monetary terms.

- Faithful representation: Information should portray the economic event that it is intending to portray completely, accurately, and without bias.

- Revenue recognition: Revenue should be recognized when a company satisfies its performance obligation to a customer.

- Economic entity: A company’s transactions should be accounted for separately from its owners.

- Time-period: The life of a company can be divided into artificial time periods so that income can be measured and reported periodically to interested parties.

- Expense recognition: Expenses should be recorded and reported in the same period as the revenue it helped generate.

Key Takeaways

The conceptual framework is essential because it provides the foundation for developing consistent accounting standards and ensures that financial information is relevant, reliable, and useful for decision-making. By applying its principles and assumptions—such as relevance, faithful representation, and the going-concern concept—accountants can produce transparent and comparable financial statements that support investors, creditors, and management in making informed business decisions. This structured approach enhances the credibility and consistency of financial reporting across different organizations and time periods.