The article explains how accounting information is communicated through financial statements, outlining their purpose, types, and governing principles under GAAP, and introduces the fundamental accounting equation as the basis for understanding a company’s financial position.

A company’s business activities are summarized and reported in a set of standardized reports called financial statements. The role of financial statements is to provide information that helps investors, creditors, and others make judgments that serve as the basis for the various decisions they make. Financial statements help answer questions such as those shown in Figure 1.

Figure 1. Questions Answered by Financial Statements

Four Basic Financial Statements

Companies prepare four basic financial statements:

- The balance sheet reports the resources (assets) owned by a company and the claims against those resources (liabilities and stockholders’ equity) at a specific point in time.

- The income statement reports how well a company has performed (revenues, expenses, and income) over a period of time.

- The retained earnings statement reports how much of the company’s income was retained in the business and how much was distributed to owners over a period of time.

- The statement of cash flows reports the sources and uses of a company’s cash over a period of time.

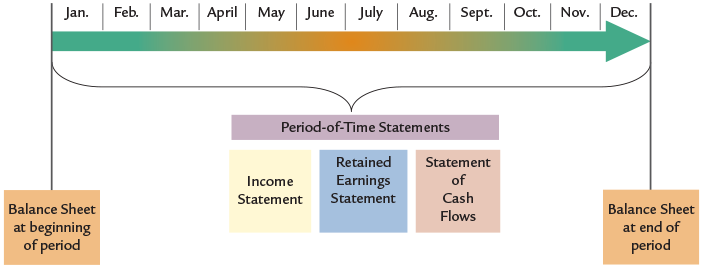

These four financial statements are prepared and issued at the end of an accounting period. While the accounting period can be a year, companies may prepare financial statements for any point or period of time. Most companies prepare financial statements at the end of each month, quarter, and year to satisfy the users’ needs for timely information. Note that the balance sheet is a point-in-time description, whereas the other financial statements are period-of-time descriptions that explain the business activities between balance sheet dates as shown in Figure 2.

Figure 2. Financial Statement Time Periods

A timeline depicts the financial statement time period that ranges from January to December, in increments of 1 month. Balance Sheet at the beginning of the period is prepared in January. Period-of-Time Statements range from January to December and include the following: Income Statement, Retained Earnings Statement, and Statement of Cash Flows. Balance Sheet at the end of the period is prepared in December.

In order to make it easier to use financial statements over time and across companies, a common set of rules and conventions have been developed to guide the preparation of financial statements. These rules and conventions, called generally accepted accounting principles (GAAP) were developed by several different organizations over a number of years.

In the United States, the Securities and Exchange Commission (SEC) has the power to set accounting rules for publicly traded companies. However, the SEC has delegated this authority to the Financial Accounting Standards Board (FASB). While the FASB is the primary accounting standard setter in the United States, the FASB has been working closely with the International Accounting Standards Board (IASB) in its development of international financial reporting standards (IFRS).

While financial statements prepared under GAAP provide the kind of information users want and need, the financial statements do not interpret this information. The financial statement user must use their general knowledge of business and accounting to interpret the financial statements as a basis for decision-making.

Fundamental Accounting Equation

To understand financial statements, it is necessary that you understand how the accounting system records, classifies, and reports information about business activities. The fundamental accounting equation illustrates the foundation of the accounting system and captures all of the economic activities of a business.

The fundamental accounting equation captures two basic features of any company. The left side of the accounting equation shows the assets, or economic resources of a company. The right side of the accounting equation indicates the claims on the company’s assets. These claims may be the claims of creditors (liabilities) or they may be the claims of owners (stockholders’ equity). The implication of the fundamental accounting equation is that a company’s resources (its assets) must always be equal to the claims on those resources (its liabilities and stockholders’ equity). Example 1illustrates this key relationship.

Example 1 Using the Fundamental Accounting Equation

A company’s resources (its assets) must always equal the claims on those resources (its liabilities and stockholders’ equity).

Information:

On January 1, Gundrum Company reported assets of $125,000 and liabilities of $75,000. During the year, assets increased by $44,000 and stockholders’ equity increased by $15,000.

Required:

- What is the amount reported for stockholders’ equity on January 1?

- What is the amount reported for liabilities on December 31?

Solution:

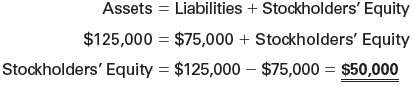

- Stockholders’ equity on January 1 is $50,000. This amount is calculated by rearranging the fundamental accounting equation as follows:

Three equations depict the calculation of Stockholders’ Equity. The equations read: Assets equals Liabilities plus Stockholders’ Equity; $125,000 equals $75,000 plus Stockholders’ Equity; Stockholders’ Equity equals $125,000 minus $75,000 equals $50,000.

- At December 31, liabilities are $104,000. This amount is computed by adding the change to the appropriate balance sheet elements and then rearranging the fundamental accounting equation as follows:

Four equations read as follows: Assets equals Liabilities plus Stockholders’ Equity; ($125,000 plus $44,000) equals Liabilities plus ($50,000 plus $15,000); Liabilities equals ($125,000 plus $44,000) minus ($50,000 plus $15,000) equals $169,000 minus $65,000 equals $104,000.

Key Takeaways

Understanding how accounting information is communicated through financial statements is essential for making informed business and investment decisions. These standardized reports, guided by principles such as GAAP and the fundamental accounting equation, provide a clear and consistent view of a company’s financial health. By accurately interpreting this information, users can evaluate performance, assess risks, and make strategic choices that contribute to effective financial management and organizational success.