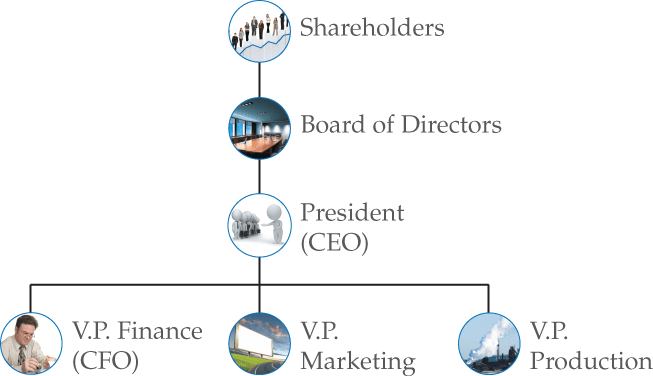

Figure 1 shows an organizational structure of a corporation. At the top are shareholders, who are the owners of the company. The owners’ control of the corporation is exercised through their right to vote for members of the board of directors.

The board of directors hires the senior management and sets their compensation. The board also reviews and votes on all major initiatives.

Figure 1 Organizational Structure of a Corporation

Goals of Financial Management

To recommend a best practice, we have to know the goal of the decision-maker (i.e., the board and the company’s managers). What objective function should managers maximize?

In a sole proprietorship, the manager maximizes the interests of the owner because the two individuals are one. In a corporation, ownership and control are separate, so the duty of the manager is less clear.

The common law requires board members to have a fiduciary duty to the corporation. A fiduciary duty is a duty of care, loyalty, and good faith. But a corporation is just a nexus of contracts between stakeholders (i.e., shareholders, bondholders, employees, and suppliers).

Recognizing this, the common law also stipulates that no one stakeholder group has legal primacy over any other (except in takeovers, in which the duty of the board is to shareholders). As you can imagine, this duty to the corporation is difficult to implement, since many decisions involve conflicts between stakeholder groups.

Despite the confusion introduced by the common law, the legal structure of the corporation provides an answer to the question. Recall that shareholders elect board members. To be reelected, board members must act in the best interests of shareholders. The best interest of shareholders is that the stock price be as high as possible.

Principal–Agent Problem

All individuals act in their own interest. However, when managers put their interests before the interests of the stockholders, problems arise.

When principals (stockholders) cannot monitor agents (managers) easily, then managers have the opportunity to use corporate resources in ways that benefit themselves but may not benefit shareholders (e.g., empire building, perquisite consumption). This conflict of interest is called a principal–agent problem.

To solve the principal–agent problem, shareholders need to spend resources to align managers’ interests with their own.

The loss of shareholder wealth associated with managerial waste and the cost of resources used to monitor agents’ behavior and align incentives are called agency costs.

Principal–Agent Problem: Contractual Remedies

One possible remedy is an executive compensation plan that aligns the goals of managers more closely with those of shareholders. Giving executives stocks and stock options is considered one way of reducing agency costs.

If executive compensation is tied to the stock price, then executives should make choices that maximize the stock price. Although this is true, it does not work perfectly. Executives who own stock can still make decisions in which they realize all of the benefits (e.g., executive jets) but incur only a fraction of the costs because the costs are spread across all the shareholders.

- You May Also Read: Types of Business Organizations