Definition

The system that transfers money between suppliers and users. It comprises financial intermediaries, markets, and instruments (securities).

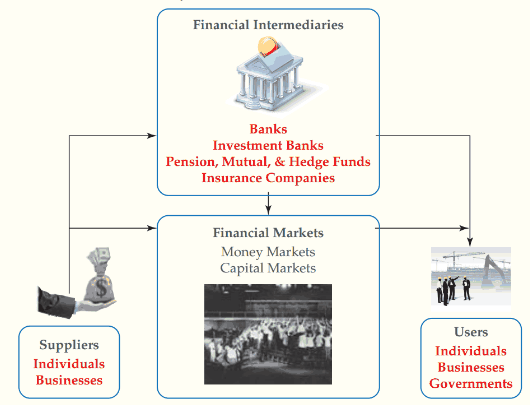

The financial system, as shown in Figure 1, transfers money from suppliers (such as individual households) to users, such as companies. Suppliers have savings that they want to invest to earn a return. Users need money to fund their activities.

Example

For example, individuals borrow to finance a home purchase, businesses expand their factories, and governments build roads.

The financial markets are the places in which suppliers and users transact. They usually transact through intermediaries and seldom transact directly with each other. The intermediaries include (commercial) banks, investment banks, funds, and insurance companies.

Figure 1 Financial System Components

Financial Intermediaries

Banks & Thrifts

Take deposits from savers and lend to individuals (i.e., mortgages) and businesses (i.e., lines of credit and commercial loans). Profit from the spread between the rate charged on loans and the rate paid on deposits.

Investment Banks

Help companies, municipalities, and states raise capital by selling securities to the public. Profit from the spread between the price paid to security issuer and price charged to the investor. Provide financial consulting to companies

Pension, Mutual and Hedge Funds

Invest in private businesses and financial securities on behalf of individual savers. Profit from management fees charged to savers

Insurance Companies

Collect premiums from individuals/businesses for life and property insurance. Invest premium income prior to paying out claims. Profit if premium plus investment income exceeds claims.

Suppliers

Individuals

The primary investors in the economy. Ultimately, they own every business asset. As individuals plan for retirement (or set aside money for other goals), they invest their savings in the financial system with the expectation of converting those savings into greater savings in the future.

Businesses

Supply funds in the form of retained earnings.

Users

Individuals

Borrow to finance homes, cars, and holidays.

Businesses

Use the money to start new projects. They borrow money and raise equity.

Governments

Borrow to pay for operating deficits and to fund real capital like new highways.

Test yourself

Who is the primary supplier of funds in the financial system?

A. Governments.

B. Businesses.

C. Individuals.

Which of the following is a user but not a supplier of funds in the financial system?

A. Individuals.

B. Governments.

C. Businesses.