The market for bonds with a maturity of less than 1 year. These bonds are all zero-coupon bonds and include bankers’ acceptances, commercial paper, and government T-bills.

The term money market is a misnomer. Money is not traded in the money markets. However, in a money market, the securities

- are fixed income securities (i.e., bonds),

- are short term,

- are highly liquid (easy to sell), and

- Mature in less than 1 year from their issue date.

Investors use the money market as an interim investment that provides a higher return than cash. Most investment funds and financial intermediaries (such as banks) hold money market securities to meet withdrawals.

Money market securities have large face values (i.e., $1 million), which precludes most individual investors from buying them. As a result, individuals participate in the money market when they buy units in money market mutual funds (MMMFs).

The sellers of money market securities find that the money market provides a low-cost source of temporary funds. Banks borrow in the money market to meet short-term reserve requirement shortages. The government funds a large portion of the U.S. debt by issuing Treasury bills (T-bills).

Money markets permit finance companies, such as General Motors Acceptance Corporation (GMAC), to raise the funds it uses to make car loans.

Figure 1 shows a diagram of the money market.

Figure 1 Money Market Components

Components

1. Issuers

U.S. Treasury

The U.S. Treasury is the largest of all money market borrowers. It issues T-bills to finance the national debt. Short-term issues enable the government to raise funds until tax revenues are received.

Companies

Corporations use commercial paper to finance the loans they extend to their customers. For example, GMAC Financial Services borrows money by issuing commercial paper and uses the money to make loans, for example, to consumers buying General Motors cars, with repayment to come from customers making their monthly payments.

Banks

Banks are the major issuer of negotiable certificates of deposit (NCDs) and the only issuer of federal funds.

2. Instruments

T-Bills

The most widely held money market security is the Treasury bill or T-bill. T-bills are sold at a discount to par value and have the lowest possibility of default of all money market securities. T-bills have 4-week, 13-week, 26-week, and 52-week maturities.

Bankers’ Acceptances

A negotiable certificate of deposit (NCD) is a security issued by a bank that documents a deposit and specifies the interest rate and maturity date. Because a maturity date is specified, an NCD is term security as opposed to demand security.

An NCD is also a bearer instrument, which means that whoever holds the instrument at maturity receives the principal and interest.

The denominations of NCDs range from $100,000 to $10 million. Few NCDs are denominated less than $1 million. NCDs typically have a maturity of 1-4 months.

Commercial Paper

Commercial paper securities are unsecured promissory notes issued by corporations. Because these securities are unsecured, only the largest and most creditworthy corporations issue commercial paper.

Commercial paper always has an original maturity less than 270 days, so as to avoid the need to register the security issue with the Securities and Exchange Commission (SEC). The most commercial paper actually matures in 20-45 days. Commercial paper is issued at a discount to its face value.

Dealers

The primary function of dealers is to make a market for money market securities by maintaining an inventory from which to buy or sell. These firms are very important to the liquidity of the market because they ensure that both buyers and sellers can readily market their securities.

Money market dealers are commercial banks, investment banks, and broker-dealers, such as Citibank, Bank of America, JP Morgan, Goldman Sachs, and Cantor Fitzgerald.

These same firms are also primary dealers at U.S. Treasury auctions. Primary dealers are the institutions allowed to bid at the auctions.

3. Buyers

Funds

Because many money market instruments are too large for the average investor to afford, investors instead buy units in money market mutual funds (MMMFs). The funds purchase money market securities.

Federal Reserves

The Federal Reserve (the Fed) is the Treasury’s agent for the distribution of all government securities. The Fed holds a large inventory of Treasury securities that it sells (buys) if it believes that the money supply should be reduced (expanded).

Insurance Cos

Property and casualty insurance companies must maintain liquidity because of their unpredictable need for funds.

For example, when Hurricane Katrina hit the Gulf Coast in 2005, insurance companies paid out billions of dollars in benefits to policyholders to help cover the $81 billion loss Katrina caused. To meet this demand for funds, the insurance companies had to sell a portion of their money market holdings.

Pensions

Pension funds maintain a portion of their funds in the money market so that they will be liquid enough to take advantage of investment opportunities. Additionally, pension funds must have sufficient liquidity to meet their obligations to beneficiaries.

Banks

Commercial banks hold a larger percentage of U.S. government securities than any other group of financial institutions (approximately 12%). This is partly because of regulations that limit the investment opportunities available to banks.

Money Market Instruments

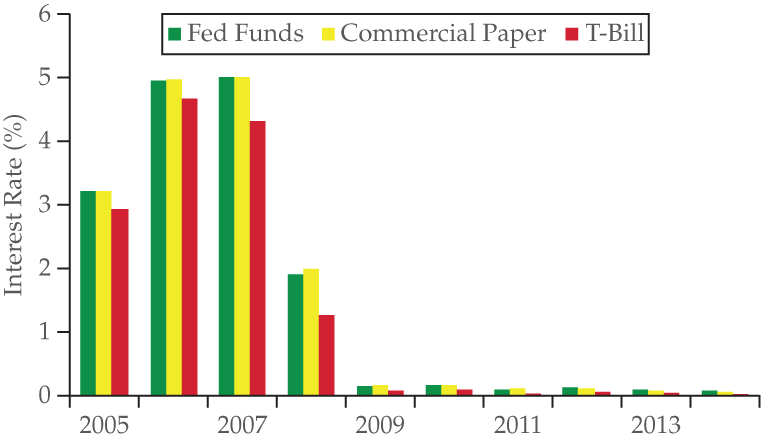

Figure 2 compares the interest rates on selected money market instruments. On this graph, you will notice that all of the money market instruments appear to move together over time. This is because all are very low risk and have short-term maturities, so they are close substitutes.

T-bills are issued by the U.S. government and have the lowest risk of default, so the rate of return on T-bills is consistently the lowest.

Figure 2 also demonstrates the large drop in interest rates after the financial crises of 2008. Before 2008, rates ranged between 3% and 5%. Since the crises, they have been below 1%.

Figure 2 Money Market Instruments

Test yourself

What is the maximum maturity of securities that trade on the money markets?

A. 2 years.

B. 30 years.

C. 3 years.

D. 1 year.