In finance we make comparison between primary and secondary capital markets.

The primary market is the market for the first issuance of a security. The secondary market trades securities after their issuance.

Primary Markets

Primary markets are for securities offered for sale for the first time. A primary market transaction is one in which there is an initial sale of a security by a firm or government and the issuer receives the funds raised by the sale.

The primary market is intermediated by investment banks. The banks (alone or in groups) buy the new securities from the issuer and sell them to individual investors and funds. The banks profit from the spread between the buy and sell prices.

Example

In June of 2014, GoPro Inc. sold over $425 million in stock in an initial public offering (IPO). This was a primary market transaction because GoPro received the proceeds of the sale. A secondary market transaction occurs if those same shares are resold today because GoPro would not receive any of the funds from this sale.

Secondary Markets: Auction and Dealer

Secondary markets are further divided into two groups: (1) auction and (2) dealer markets.

Auction markets trade in one physical or virtual location. A dealer market is characterized by multiple dealers who each hold an inventory of the security and who are each willing to buy or sell.

Auction Market

The key feature of an auction market is that all trading funnels through one location (real or virtual), so there is only one best price at any given time. On the NYSE floor, there are specific places (called trading posts) where particular stocks trade and the exchange assigns an auctioneer (specialist) to supervise the trading.

Worldwide, auction markets are moving away from physical trading floors and are more commonly organized as electronic limit order books. The book is open to all traders. Traders either submit limit orders that offer to trade a specific quantity at a specific price or submit market orders that are matched with posted limit orders.

Limit orders are recorded in the limit order book. Market orders are matched against the best buy or sell limit order based on priority rules (i.e., price and time).

Example

The New York Stock Exchange (NYSE) is an example of a physical auction market for stocks. The Chicago Mercantile Exchange (CME) has an online market for futures and options that is also categorized as an auction market.

Important

In a limit order book market there are bid and ask prices, but they are set differently from those in dealer markets. The bid price is the price of the best offer to buy (the limit order to buy with the highest price), and the ask price is the price of the best offer to sell (the limit order to sell with the lowest price).

Dealer Market

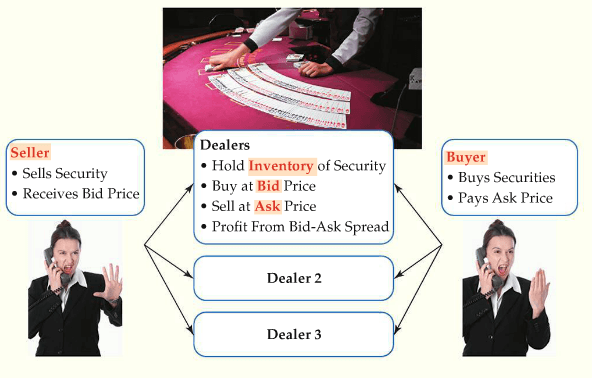

In dealer (over-the-counter (OTC)) markets, trading takes place in a variety of places. Figure 1 shows a dealer market. Trading usually occurs over the telephone or by computer.

In a dealer market multiple dealers simultaneously make a market in an individual security. Each dealer holds an inventory of the security, posts buy (bid) and sell (ask) prices, and stands ready to trade.

Traders can transact with any dealer, and it is up to traders to compare prices before selecting their dealer to ensure the best price.

Example

The NASDAQ (National Association of Securities Dealers Automated Quotation) computer system is an example of a computerized dealer market for stocks. The money market is a dealer market, as are the markets for foreign currencies and bonds.

Figure 1: Dealer Markets

Seller

A trader who wants to sell a security.

Inventory

To ensure an active market, dealers own an inventory of the security. The inventory is important, because buy and sell orders do not arrive at the dealer at the same time. For example, it is unlikely that one customer will call the dealer wanting to buy a security just as another customer is selling it. The dealer adds and subtracts stock from this inventory as demand warrants. Dealers want to begin and end each day with approximately the same inventory level.

Bid

Dealers buy at the bid price. If you call a dealer to sell a stock, you will be quoted a bid price. The bid price is the price dealers will pay for the stock.

Ask

Dealers sell at the ask price. If you want to buy a security, the dealer will quote the ask price. The ask price is the price at which the dealer sells the stock.

Buyer

A trader who wants to buy a security

The following table keys out the main differences between primary and secondary capital markets on the basis of several factors such as geographical location, entry process, intermediaries, types of companies involved, price determination, salability, transfer process, beneficiaries, financing, and securities issuance.

| Basis | Primary Market | Secondary Market |

| Issue of securities | Securities are issued for the first time | Securities issued earlier are traded in the secondary market. |

| Geographical location | There is no fixed geographical location. The issuing companies may have offices at different locations. | Location is usually financial capital of the country. |

| Entry | Almost every company can participate in a primary market. | Entering into secondary market or listing a company on stock exchange is quite difficult as company has to pass through various terms and conditions. |

| Intermediaries | Major intermediaries in primary market are merchant bankers, collection banks, portfolio managers, underwriters etc. | Major intermediaries in secondary market are brokers, sub-brokers etc. |

| Type of company | All types of companies can issue new shares whether listed or non-listed. | In secondary market, shares of only listed companies are bought and sold. |

| Price determination | Price of securities is fixed. | Price of securities keep fluctuating owing to demand/supply variations. |

| Transfer | Securities are transferred from institutions such as banks, corporations or government to investors. | Securities are transferred from one investor to another. |

| Salability | Securities once sold here, cannot be resold. | Securities can be sold unlimited times. |

| Beneficiary | Primary beneficiary is the issuing company. | Primary beneficiary is the investor/ shareholder. |

| Involvement of Companies | Companies are directly involved as shares are shares are sold by company directly to public. | There is no involvement of companies. |

| Financing | Through primary companies, funds are raised for financing companies for their expansion and diversification. | No funds are raised. Only buying/selling of securities is done among investors. |

Test Yourself

Which price will be higher, the bid or the ask?

A. Bid.

B. Ask.

C. Bid equals Ask.

Which type of order is likely to be filled more quickly: a market order or a limit order?

A. Limit.

B. Market.

C. Both are filled equally quickly.