Unlike money markets, capital markets are markets in which the securities have an original maturity greater than 1 year. The principal securities traded in the capital market are bonds and stocks.

Capital market participants have different motives from those of money market participants. The money markets are primarily for warehousing funds until a more important need arises.

The securities traded on the capital markets fund long-term investments by companies and governments in projects like factories and highways.

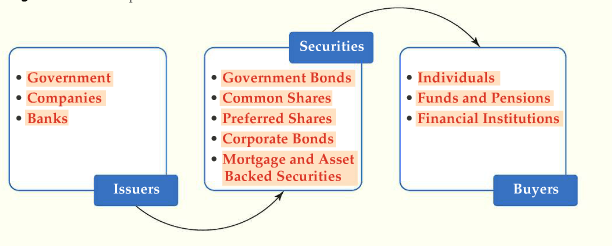

Figure 1 Capital Market Components

Components

1. Issuers

Government

The U.S. Treasury is the largest issuer of bonds and accounts for about 85% of the outstanding public debt. A number of federal agencies issue bonds, as do state and local governments.

The federal government issues bonds to fund the national debt. State and local governments issue bonds to finance projects like schools and prisons.

Companies

Corporations issue stocks and bonds to raise funds for projects and acquisitions. Bonds are an alternative to bank borrowing.

Banks

Banks will initiate mortgages and then sell off bundles (say, 100 mortgages) to an investment bank. The investment bank sells the bundle to an investor. The bundles are called mortgage (asset) backed securities.

2. Securities (Instruments)

Government Bonds

A bond is a security that requires the issuer to make a series of annual (or semiannual) interest payments followed by a final maturity payment. A bond is like an IOU.

Bondholders don’t have to wait for maturity to get their money back, they can sell their bonds to other investors in the bond market.

The U.S. Treasury issues T-Notes and T-Bonds (T-Bonds have a maturity greater than 10 years). The Federal Reserve auctions new T-Notes and T-Bonds on behalf of the Treasury.

Common Shares

Stock represents ownership in a corporation. A stockholder owns a percentage interest in a firm consistent with the percentage of outstanding stock held.

Stockholders are residual claimants in the sense that they get whatever is left-over after all of the company’s liabilities are paid off.

Common shareholders exercise their control of the corporation by voting for directors who sit on the board. (Typically one vote per share.) Common shareholders receive a dividend at the discretion of the board.

Preferred Share

The preferred stockholder receives a fixed dividend that does not change. Preferred stockholders have a more senior claim against assets than common shareholders and are entitled to their dividends before common shareholders. Preferred stockholders usually do not vote.

Corporate Bonds

Corporate bonds are similar to government bonds, but corporate bonds can be more exotic in the sense of having more features. For example, some corporate bonds give the bondholder the option to convert into being a stockholder.

Mortgage and Asset-Backed Securities

Mortgage-backed securities are bundles of mortgages. The owner of mortgage-backed security receives the stream of interest and principal payments from the original borrowers.

Asset-backed securities are similar to mortgage-backed, but they are bundles of car loans or credit card receivables instead of mortgages.

3. Buyers

Individuals

The largest purchasers of capital market claims are households. Individuals invest in stocks and bonds as a means of preparing for retirement.

Funds & Pensions

Mutual funds, hedge funds, and pensions are pools of money managed by professional portfolio managers. The funds can be invested in any type of security. Different funds have different investment objectives. Investors own units or shares in the fund.

Financial Institutions

Financial institutions are also large purchasers of capital market securities because individuals and households often deposit funds in financial institutions that use the funds to purchase capital market instruments.

For example, property and casualty insurance companies invest their premium income in capital market securities (mainly bonds) to earn income on the money before they must pay out on a claim.

Capital Market Instruments

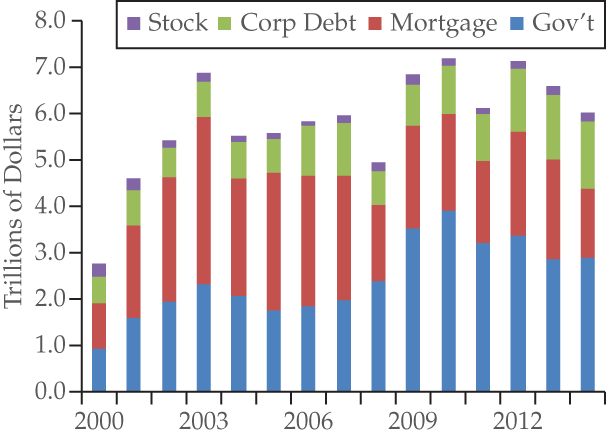

Figure 2 shows the value of equity (stock) and debt (bonds) issued per year since 2000. Note that the total value of stock issued is much less than the value of bonds issued by corporations (Corp. Debt). One reason for the preference for debt is that interest payments are tax deductible.

Prior to the 2008 sub-prime mortgage crisis, notice a large amount of mortgage-backed securities. Subsequent to 2008, the spike in government debt issuances is accounted for by the fiscal stimulus program.

Figure 2 Capital Market Instruments

Test Yourself

What is the difference between stocks and bonds?

A. More stocks are issued each year than bonds (by value).

B. Companies can issue both but governments cannot.

C. Stockholders are lenders. Bondholders are owners.

D. Bonds have short maturities. Stocks have long maturities