The article explains the process of journalizing transactions in accounting, highlighting how debits and credits are used to record financial activities accurately. It also emphasizes the importance of journals in detecting errors, maintaining balanced records, and upholding ethical standards in financial reporting.

Journal

A chronological record showing the debit and credit effects of transactions on a company. Each transaction is represented by a journal entry so that the entire effect of a transaction is contained in one place. The process of making a journal entry is often referred to as journalizing a transaction. Because a transaction first enters the accounting records through journal entries, the journal is often referred to as the book of original entry.

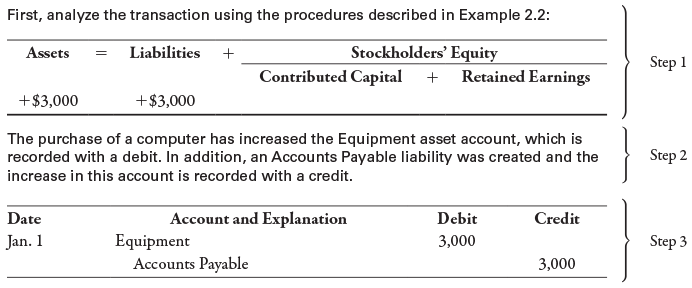

Example 1. Making a Journal Entry

A journal entry records the effects of a transaction on accounts using debits and credits.

On January 1, Luigi Inc. purchases a $3,000 computer from Worst Buy Electronics on credit, with payment due in 60 days.

Prepare a journal entry to record this transaction.

Solution:

From the journal entry in Example 1, notice several items:

- The date of the transaction is entered in the Date column.

- For each entry in the journal, the debit (the account and amount) is entered first and flush to the left. If there were more than one debit, it would be entered directly underneath the first debit on the next line. The credit (the account and the amount) is written below the debits and indented to the right. The purpose of this standard format is to make it possible for anyone using the journal to identify debits and credits quickly and correctly.

- Total debits must equal total credits.

In some instances, more than two accounts may be affected by an economic event. When this occurs, a compound journal entry is created as illustrated in Example 2.

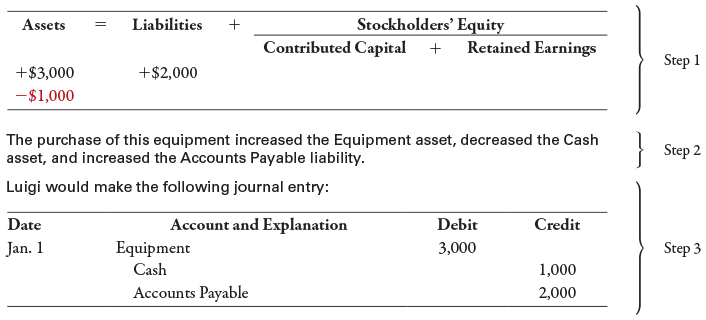

Example 2. Making a Compound Journal Entry

A compound journal entry records the effects of a transaction on more than two accounts; however, the total debits will still equal the total credits.

Luigi Inc. purchases a $3,000 computer from Worst Buy Electronics by paying $1,000 cash with the remainder due in 60 days.

Prepare a compound journal entry to record this transaction.

Solution:

First, analyze the transaction as follows:

The use of a journal helps prevent the introduction of errors in the recording of business activities. Because all parts of the transaction appear together, it is easy to see whether equal debits and credits have been entered. If debits equal credits for each journal entry, then debits equal credits for all journal entries.

At the end of the period, this fact leads to a useful check on the accuracy of journal entries. However, if the wrong amounts or the wrong accounts are used, debits can still equal credits, yet the journal entries will be incorrect. Additionally, each entry can be examined to see if the accounts that appear together are logically appropriate.

If all journal entries have equal debits and credits, how can mistakes or errors occur?

Mistakes or errors could still occur when entire transactions are not recorded, transactions are recorded for the wrong amounts or in the wrong accounts, or transactions are not recorded in the proper accounting period. While journal entries provide a safeguard against errors and mistakes, it will not prevent them all.

Ethical Decisions

When an error is discovered in a journal entry, the accountant has an ethical responsibility to correct the error (subject to materiality), even if others would never be able to tell that the error had occurred. For example, if an accountant accidentally records a sale of merchandise by crediting Interest Income instead of Sales Revenue, total revenue would be unaffected.

However, this error could significantly affect summary performance measures such as gross margin (sales minus cost of goods sold) that are important to many investors. When material errors are discovered, they should be corrected, even if this means embarrassment to the accountant.

To provide a further illustration of recording transactions using journal entries, consider the case of HiTech Communications Inc. We will analyze each transaction and report its effects on the financial statements in the margin next to the journal entry. Note that revenues and expenses appear on the income statement but also effect retained earnings on the balance sheet.

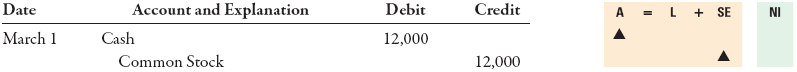

Transaction 1. Issuing Common Stock

On March 1, HiTech sold 1,000 shares of common stock to several investors for cash of $12,000.

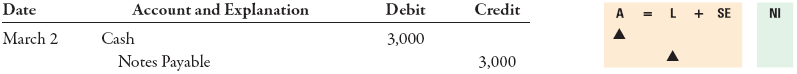

Transaction 2. Borrowing Cash

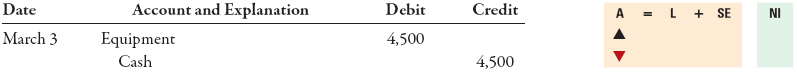

Transaction 3. Purchase of Equipment for Cash

On March 3, HiTech purchased office equipment (computer equipment) from Micro Center Inc. for $4,500 in cash.

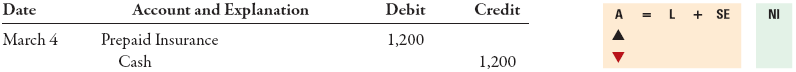

Transaction 4. Purchasing Insurance

On March 4, HiTech purchased a 6-month insurance policy for $1,200 in cash.

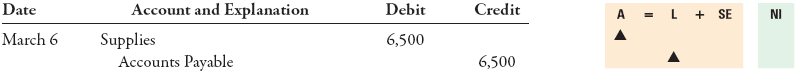

Transaction 5. Purchase of Supplies on Credit

On March 6, HiTech purchased office supplies from Hamilton Office Supply for $6,500. Hamilton Office Supply agreed to accept full payment in 30 days.

Transaction 6. Providing Services for Cash

On March 10, HiTech provided advertising services to Miami Valley Products in exchange for $8,800 in cash.

Transaction 7. Providing Services for Credit

On March 15, HiTech provided advertising services to the Cincinnati Times for $3,300. HiTech agreed to accept full payment in 30 days.

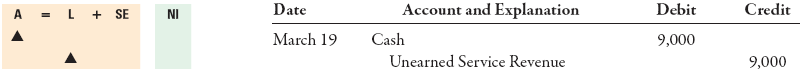

Transaction 8. Receipt of Cash in Advance

On March 19, HiTech received $9,000 in advance for advertising services to be completed in the next 3 months.

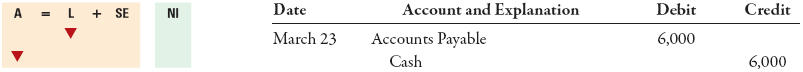

Transaction 9. Payment of a Liability

On March 23, HiTech pays $6,000 cash for the supplies previously purchased from Hamilton Office Supply (Transaction 5).

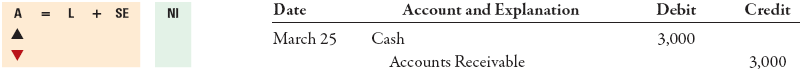

Transaction 10. Collection of a Receivable

On March 25, HiTech collected $3,000 cash from the Cincinnati Times for services sold earlier on credit (Transaction 7).

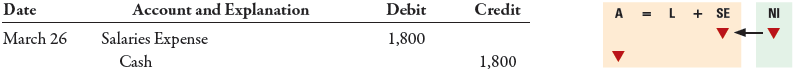

Transaction 11. Payment of Salaries

On March 26, HiTech paid employees their weekly salaries of $1,800 cash.

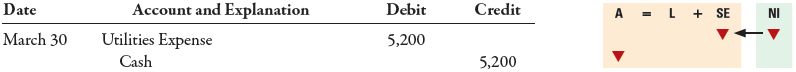

Transaction 12. Payment of Utilities

On March 30, HiTech paid its utility bill of $5,200 for March.

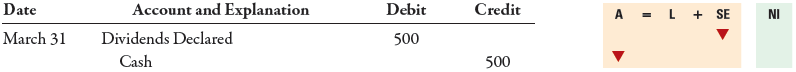

Transaction 13. Payment of a Dividend

On March 31, HiTech declared and paid a cash dividend of $500 to its stockholders.

Detecting Journal Entry Errors

You have been asked to inspect a delivery company’s journal. Upon doing so, you find the following entry related to the purchase of a truck:

Is this journal entry correct?

Because delivery trucks cannot be exchanged for prepaid rent, you conclude that an error was made in preparing this journal entry. It’s likely that the error was in the credit side of the entry. Instead of prepaid rent, the credit could be either to cash (if the purchase of the truck was for cash) or to note payable (if the purchase was on credit). Had the same data been entered directly into the accounts, this error would have been much more difficult to detect and correct.

The use of a journal helps prevent the introduction of errors in the recording of business activities.

Key Takeaways

Journalizing transactions is a fundamental step in the accounting process because it ensures that every financial activity is accurately recorded, organized, and verifiable. The use of journals helps maintain the balance between debits and credits, reducing the risk of errors and enabling clear tracking of a company’s financial performance. In practical applications, accurate journal entries support reliable financial statements, assist in decision-making, and uphold ethical and transparent business practices.