The article explains the different forms of business organization—sole proprietorship, partnership, and corporation—and outlines the main types of business activities including financing, investing, and operating, that all businesses engage in to function and generate profit.

Accounting is an information system that identifies, measures, records, and communicates financial information about an accounting entity. An accounting entity is a business that has an identity separate from that of its owners and managers and for which accounting records are kept.

Forms of Business Organization

This article emphasizes accounting for entities which take one of three forms: sole proprietorship, partnership, or corporation.

Sole Proprietorship

A sole proprietorship is a business owned by one person. Sole proprietorships, which account for more than 70% of all businesses, are usually small, local businesses such as restaurants, photography studios, retail stores, or website developers. This organizational form is popular because it is simple to set up and gives the owner control over the business. While a sole proprietorship is an accounting entity separate from its owner, the owner is personally responsible for the debt of the business. Sole proprietorships can be formed or dissolved at the wishes of the owner.

Partnership

A partnership is a business owned jointly by two or more individuals. Small businesses and many professional practices of physicians, lawyers, and accountants are often organized as partnerships. Relative to sole proprietorships, partnerships provide increased access to financial resources as well as access to the individual skills of each of the partners. The partnership entity does not pay taxes. Instead, each partner pays taxes at their individual rate. Similar to sole proprietorships, partnerships are accounting entities separate from the partners; however, the partners are jointly responsible for all the debt of the partnership.

Corporation

A corporation is a business organized under the laws of a particular state. A corporation, such as Apple, is owned by one or more person’s called stockholders, whose ownership interests are represented by shares of stock. A primary advantage of the corporate form is the ability to raise large amounts of money (capital) by issuing shares of stock. Unlike a sole proprietorship or a partnership, a corporation is an “artificial person” and the stockholders’ legal responsibility for the debt of the business is limited to the amount they invested in the business.

In addition, shares of stock can be easily transferred from one owner to another through capital markets without affecting the corporation that originally issued the stock. The ability to raise capital by selling new shares, the limited legal liability of owners, and the transferability of the shares give the corporation an advantage over other forms of business organization. However, the requirements to form a corporation are more complex compared to the other forms of business organization.

In addition, owners of corporations generally pay more taxes than owners of sole proprietorships or partnerships. This occurs because corporate earnings are taxed at the corporate level and individual shareholders are taxed again at the individual level when earnings are distributed. This is known as double taxation.

Figure 1 illustrates the advantages and disadvantages of each form of organization. While the combined number of sole proprietorships and partnerships greatly exceeds that of corporations, the majority of business in the United States is conducted by corporations. Therefore, this book emphasizes the corporate form of organization.

Figure 1. Forms of Business Organization

An illustration depicts the forms of business organization with plus signs representing “advantages” and minus signs representing “disadvantages” as follows: Sole Proprietorship: Easily formed (plus sign), Tax advantages (plus sign), Controlled by owner (plus sign), Personal liability (minus sign), and Limited life (minus sign); Partnership: Access to the resources and skills of partners (plus sign), Tax advantages (plus sign), Shared control (minus sign), and Personal liability (minus sign); Corporation: Easier to raise money (plus sign), Easier to transfer ownership (plus sign), Limited liability (plus sign), More complex to organize (minus sign), and Higher taxes (minus sign).

You Decide Choice of Organization Form

You are an entrepreneur who has decided to start a campus-area bookstore. In order to start your business, you have to choose among three organizational forms—sole proprietorship, partnership, or corporation. You have enough personal wealth to finance 40% of the business, but you must get the remaining 60% from other sources.

How does the choice of organizational form impact your control of the business and ability to obtain the needed funds?

The choice of organizational form can greatly impact many aspects of a business’s operations. Each form has certain advantages and disadvantages that you should carefully consider.

- Sole proprietorship: A sole proprietorship would give you the most control of your business. However, you would be forced to obtain the additional 60% of funds needed from a bank or other creditor. It is often difficult to get banks to support a new business.

- Partnership: If you choose to form a partnership, you would still have access to bank loans. In addition, you would also have the ability to obtain the additional funds from your partner or partners. In this situation, the partners would then have a 60% interest in the business, which may be an unacceptable loss of control.

- Corporation: If you choose to form a corporation, you could obtain the needed funds by issuing stock to investors. While a 60% interest may still be transferred to the stockholders, if the stock were widely dispersed among many investors, you might still retain effective control of the business with a 40% interest.

The choice of organizational form involves the consideration of many different factors.

Business Activities

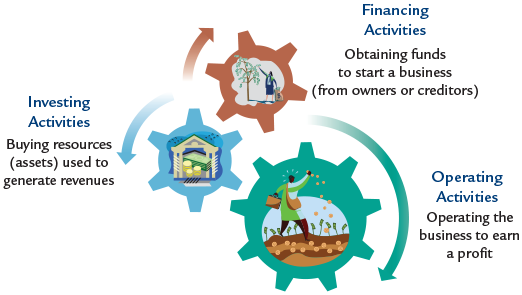

Regardless of the form of a business, all businesses engage in activities that can be categorized as financing, investing, or operating activities.

An illustration presents the business activities as follows: Financing Activities: Obtaining funds to start a business (from owners or creditors); Operating Activities: Operating the business to earn a profit; and Investing Activities: Buying resources (assets) used to generate revenues. These activities are illustrated in Figure 2.

Figure 2. Business Activities

Financing Activities

A corporation’s financing activities include obtaining the funds necessary to begin and operate a business. These funds come from either issuing stock or borrowing money. Most companies use both types of financing to obtain funds.

When a corporation borrows money from another entity such as a bank, it must repay the amount borrowed. The person to whom the corporation owes money is called a creditor. This obligation to repay a creditor is termed a liability and can take many forms. A common way for a corporation to obtain cash is to borrow money with the promise to repay the amount borrowed plus interest at a future date. Such borrowings are commonly referred to as notes payable. A special form of note payable that is used by corporations to obtain large amounts of money is called a bond payable.

In addition to borrowing money from creditors, a corporation may issue shares of stock to investors in exchange for cash. The dollar amount paid to a corporation for these shares is termed common stock and represents the basic ownership interest in a corporation. In a recent annual report, Apple reported it had issued 15,943,425,000 shares of common stock. The corporation is not obligated to repay the stockholder the amount invested; however, many corporations distribute a portion of their earnings to stockholders on a regular basis. These distributions are called dividends.

Creditors and stockholders have a claim on the assets, or economic resources, of a corporation. However, the claims on these resources differ. In the case of financial difficulty or distress, the claims of the creditors (liabilities) must be paid prior to the claims of the stockholders (called stockholders’ equity). Stockholders’ equity is considered a residual interest in the assets of a corporation that remain after deducting its liabilities.

Investing Activities

Once a corporation has obtained funds through its financing activities, it buys assets (resources) that enable it to operate. For example, Apple recently reported $42,117 million in land, buildings, machinery, and equipment that it uses in its operations. A corporation may also obtain intangible assets that lack physical substance, such as copyrights and patents. The purchase and sale of the assets that are used in operations (commonly referred to as operating assets) are a corporation’s investing activities.

Regardless of its form, assets are economic benefits that a corporation control. The assets purchased by a corporation vary depending on the type of business that the corporation engages in, and the composition of these assets is likely to vary across different companies and different industries. For example, in a recent annual report, property, plant, and equipment made up approximately 12% of Apple’s total assets. This is typical of many technology companies. In contrast, property, plant, and equipment made up almost 51% of the total assets of Delta Airlines, a company that relies heavily on airplanes to produce revenue.

Operating Activities

Once a corporation has acquired the assets that it needs, it can begin to operate. While different businesses have different purposes, they all want to generate revenue. Revenue is the increase in assets that results from the sale of products or services. For example, Apple recently reported sales revenue of $394,328 million. In addition to revenue, assets such as cash, accounts receivable (the right to collect an amount due from customers), supplies, and inventory (products held for resale) often result from operating activities.

To earn revenue, a corporation will incur various costs or expenses. Expenses are the cost of assets used, or the liabilities created, in the operation of the business. Apple reported expenses of $223,546 million related to the cost of iPhones, iPads, Apple Watches, and other products sold and services provided.

The liabilities that arise from operating activities can be of different types. For example, if a corporation purchases goods on credit from a supplier, the obligation to repay the supplier is called an account payable. Other examples of liabilities created by operating activities include wages payable (amounts owed to employees for work performed) and income taxes payable (taxes owed to the government).

The results of a company’s operating activities can be determined by comparing revenues to expenses. If revenues are greater than expenses, a corporation has earned net income. If expenses are greater than revenues, a corporation has incurred a net loss.

Key Takeaways

Understanding the various forms of business organization and the types of business activities is essential for making informed decisions in establishing and managing a company. Each organizational form offers distinct advantages and challenges that affect ownership, liability, and financial flexibility, while the core business activities—financing, investing, and operating—serve as the foundation for generating revenue and ensuring long-term growth. Recognizing how these elements work together helps entrepreneurs and managers effectively plan, control, and sustain their businesses in a competitive environment.