Sometimes, we want to define what the value is today of sums that we’ll receive in the future. For example, if a firm is evaluating an investment that will generate future income, it must compare today’s expenditures with expected future revenues. In order to compare sums across time, future values must be adjusted to what they’re worth today.

Present Value Formula

Take another look at the future value formula:

\[F{{V}_{n}}=P{{V}_{o}}{{\left( 1+i \right)}^{n}}\]

The future value is defined in terms of present value. To find the equation for computing present value, we need to rearrange the above formula. If both sides are divided by (1+i)n, we get the equation for present value:

\[\begin{matrix}P{{V}_{0}}=\frac{F{{V}_{n}}}{{{\left( 1+i \right)}^{n}}}=F{{V}_{n}}{{\left( 1+i \right)}^{-n}} & {} & \left( 1 \right) \\\end{matrix}\]

The term 1/(1+i)n (or (1+i)−n) is called the present value interest factor.

Example 1 Solving for the Present Value

What is the present value of $100, which will be received in 10 years, if the interest rate is 5%?

Solution

\[\begin{align}& FV=\$100\\&n=10\\&i=0.05\\\end{align}\]

\[\begin{align}& P{{V}_{0}}=F{{V}_{n}}\times \frac{1}{{{\left( 1+i \right)}^{n}}} \\& =\$100\times\frac{1}{{{\left(1.05\right)}^{10}}}=\$100\times0.61391=\$61.39\\\end{align}\]

Some Insights about Present Values

- The present value interest factor, 1/(1+i)n is just the inverse of the future value factor, (1+i)n.

- If i=0, then 1/(1+i)n=1. If interest rates are zero, then future values will be equal to present values.

- Present value and the interest rate are inversely linked. When the present value decreases, the interest rate increases.

- The method of calculating the present value of a future sum is known as discounting. For converting future amounts to their respective present values, the future amount must be decreased, or discounted.

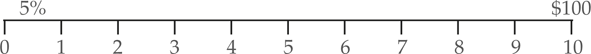

- You can think up discounting as moving dollars to the left on the timeline. If dollars are moved to the left, their value decreases. The further to the left and the greater the interest rate, the little the dollars are worth.

- You don’t want to move cash flows all the way to time period 0 every time. Present value computations include moving future sums to any former period.