The article explains how to calculate the present value of an investment with non-annual compounding, emphasizing the need to adjust the interest rate for the specific compounding period. It provides a formula and example to demonstrate the calculation process.

When the compounding period is not annual we must be sure to use a periodic interest rate that reflects the length of the period. The periodic rate is simply i/m, where m is the number of compounding periods in a year. For example, if the nominal rate is 10% (i=10%) and the compounding period is semi-annual (m=2), then the periodic rate is 10%/2 or 5%.

Formula

The formula for present value with non-annual compounding is analogous to the formula for the future value with non-annual compounding:

\[P{{V}_{0}}=F{{V}_{n}}\times \frac{1}{{{\left( 1{{+}^{i}}{{/}_{m}} \right)}^{n\times m}}}\]

Example 1 Solving for the Present Value with Non-Annual Compounding

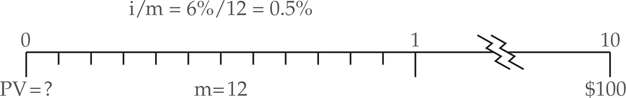

What is the present value of $100, which will be received in 10 years, if the annual interest rate is 6% and there is monthly compounding of invested funds?

Solution

\[\begin{align} & FV=\$100\\&i=0.06\\&n=10years\\&n*m=1\text{20months}\\&i/m=0.06/12=0.005/month\\\end{align}\]

\[\begin{align} & P{{V}_{o}}=F{{V}_{n}}*\frac{1}{{{\left( 1+{}^{i}/{}_{m} \right)}^{n*m}}} \\ & P{{V}_{o}}=\$100*\frac{1}{{{1.005}^{120}}}=\$54.96\\\end{align}\]

Present Value Key Takeaways

How to calculate present value with non-annual compounding is crucial for making accurate investment decisions, especially in cases where interest is compounded more frequently than annually. This method allows individuals and businesses to assess the true value of future cash flows by considering the compounding effect, ensuring more precise financial planning and forecasting for various investment opportunities.