Rolling Budget is an approach to budgeting that uses a continuous updating approach to forecasting, the time period of the budget remains constant.

With traditional budgeting being criticized for having fixed targets, often on a 12-month basis, rolling budgets overcome this by offering continual reassessment of the environment within which the budget is set. Changes in the environment will result in changes to the budget.

Rolling budgets are popular within organizations because they are less detailed than traditional budgets. This results in managers having a clearer picture of what is important, rather than been confused by a level of detail that traditional budgets are often criticized for.

In addition, rolling budgets do not have a set end date; managers are encouraged to continually think about the future. Using budgets which cover shorter periods, such as quarterly forecasts, while having predicted forecasts for the next six to eight quarters provides an opportunity for changes to be made, as and when they are required.

Example

In practice if a company is working on a two-year rolling budget plan, with monthly revisions, and the budget period begins in January 2012, as soon as January 2012 is complete they will then forecast January 2014. There is always a two-year plan ahead; there is no fixed end date.

Advantages and Disadvantages

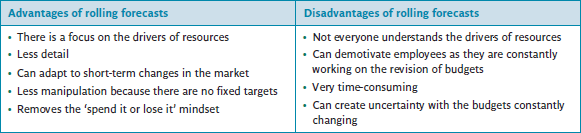

Rather than focusing on detailed fixed plans, rolling budgets analyze the drivers of the resources and focus on these issues within the budget. See Figure 1 for advantages and disadvantages of rolling budgets.

Figure 1: Advantages and disadvantages of rolling budgets