The process of allocating a fixed asset’s cost to expense over its useful life is referred to as depreciation. Depreciation matches an asset’s expense against the revenue generated from using the asset, thereby adhering to the matching principle.

In accounting, the “using up” of a fixed asset is also referred to as depreciation. For example, a delivery truck can only go so many miles before it is worn out, or used up. As the truck is driven, it depreciates, or is used up. Physical factors like age and weather also contribute to the depreciation of assets.

So, depreciation refers to the “using up” of a fixed asset and to the process of allocating the asset’s cost to expense over the asset’s useful life.

Measuring Depreciation

Depreciation of a fixed asset is based on three factors:

- Cost

- Estimated useful life

- Estimated residual value

Cost is known and includes all amounts incurred to prepare the asset for its intended purpose. The other two factors are estimates.

Estimated useful life represents the expected life of an asset during which it is anticipated to generate revenues. Useful life may be measured in years or in units of output.

Estimated residual value—also called salvage value—is an asset’s expected cash value at the end of its useful life. A delivery truck’s useful life may be 150,000 miles. When the truck has driven that distance, the company will sell or scrap it. The expected cash value at the end of the truck’s life is the truck’s estimated residual value.

Depreciation Methods

Three depreciation methods are most commonly used:

- Straight line

- Units of production

- Double-declining balance

To demonstrate the different depreciation methods, let’s assume that Bold City purchased and placed in service a new delivery truck on January 1. The data related to Bold City’s new delivery truck is presented next:

Straight-Line Method

Depreciation method in which an equal amount of depreciation expense is assigned to each year of asset use

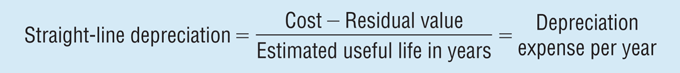

The straight-line (SL) depreciation method allocates an equal amount of depreciation to each year. Use the following equation to find yearly depreciation using SL depreciation:

Example of Straight-Line Method

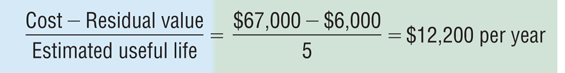

Bold City might want to use this method for the truck if it thinks time is the best indicator of the truck’s depreciation. The yearly depreciation expense for Bold City’s delivery truck is:

Because Bold City purchased the delivery truck on January 1, an entire year’s worth of depreciation will be recorded for the first year on December 31:

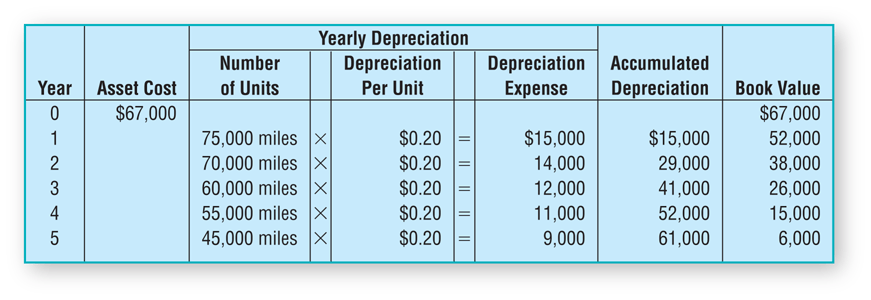

Exhibit 1 demonstrates an SL depreciation schedule that has been prepared for Bold City’s delivery truck.

Exhibit 1

The final column shows the asset’s book value, which is its cost less accumulated depreciation.

Notice that as an asset depreciates, its accumulated depreciation increases and its book value decreases. Observe the Accumulated Depreciation and Book Value columns in Exhibit 1. At the end of its useful life, the asset is said to be fully depreciated. Once an asset has been fully depreciated, its final book value should equal its residual value, $6,000 in this case.

Fully Depreciated

An asset that has reached the end of its estimated useful life; no more depreciation is recorded for the asset.

Units of Production Method

Depreciation method by which a fixed amount of depreciation is assigned to each unit of output produced by an asset.

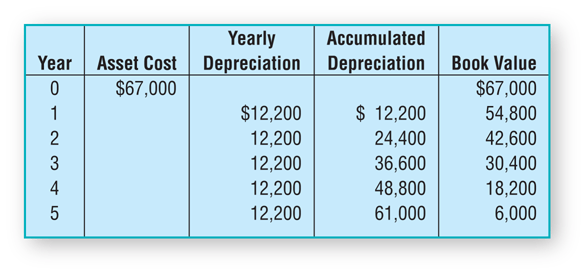

The units of production (UOP) depreciation method allocates a fixed amount of depreciation to each unit of output:

Example of Units of Production Method

Assume that, instead of SL depreciation, Bold City depreciates its delivery truck using UOP depreciation. Bold City might want to use this method of depreciation for the truck if it thinks miles are the best measure of the truck’s depreciation.

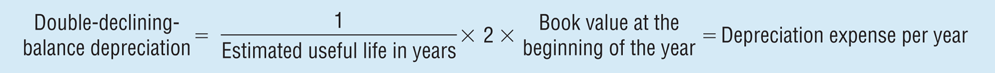

The delivery truck is estimated to be driven 75,000 miles the first year, 70,000 the second, 60,000 the third, 55,000 the fourth, and 45,000 during the fifth (for a total of 305,000 miles). The UOP depreciation each period varies with the number of units the asset produces (miles, in the case of the truck).

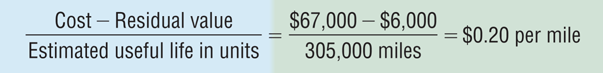

The depreciation per unit for Bold City’s delivery truck is calculated as:

Bold City would record 15,000 dollars (75,000 miles × $0.20) of depreciation at December 31 of the first year as:

A depreciation schedule similar to the one prepared for SL depreciation is presented in Exhibit 2 for UOP depreciation.

Exhibit 2

Notice once again that the ending book value of the delivery truck, $6,000, equals its residual value, as it did with SL depreciation.

Double-Declining Balance Method

An accelerated depreciation method that computes annual depreciation by multiplying an asset’s decreasing book value by a constant percentage that is two times the straight-line depreciation rate.

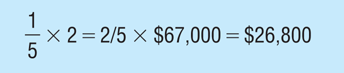

The double-declining balance (DDB) method is known as an accelerated depreciation method, which writes off more depreciation near the start of an asset’s life and less at the end. The DDB method multiplies an asset’s decreasing book value by a constant rate that is twice the SL depreciation rate. DDB amounts can be computed using the following formula:

Note that residual value is not included in the formula. Unlike SL and UOP depreciation, DDB depreciation ignores residual value until the end of an asset’s life.

Example of Units of Double-Declining Method

For the first year of the delivery truck’s life as an asset, the calculation would be:

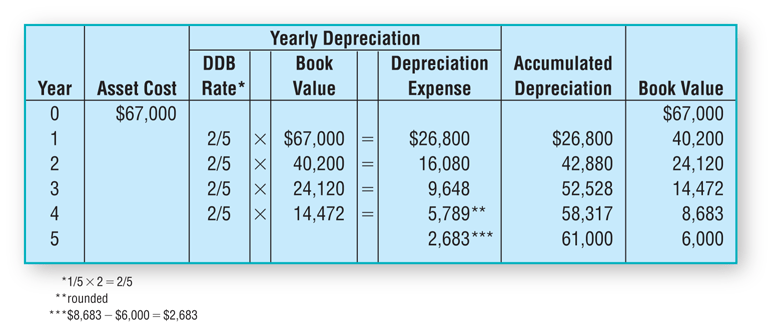

Exhibit 3 presents a depreciation schedule for the delivery truck using DDB depreciation.

Exhibit 3

Under the double-declining balance method, the depreciation schedule is altered in the final years to prevent the asset from being depreciated below the residual value.

In the case of Bold City’s delivery truck, the residual value was given as $6,000. In the DDB schedule in Exhibit 3, notice that after year 4, the truck’s book value is 8,683 dollars. In year 5, depreciation expense calculated using DDB would reduce the book value below the residual value. Therefore, in the final year, the depreciation expense is reduced to 2,683 dollars, which is the book value of 8,683 dollars less the 6,000 dollars residual value.

If the residual value is high enough, it is possible that the depreciation expense during the second-to-last year could be reduced, and there would be no depreciation in the final year.

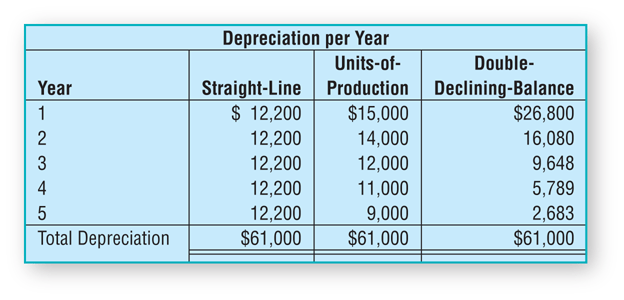

Comparing Depreciation Methods

Let’s compare the depreciation methods. Annual amounts vary, but total accumulated depreciation equals $61,000 for all three methods.

Which method is best? That depends on the asset. A business should match an asset’s expense against the revenue that the asset produces. Here are some guidelines:

Straight-Line. For an asset that generates revenue evenly over time, the SL method follows the matching principle. Each period shows an equal amount of depreciation.

Units of Production. The UOP method works best for an asset whose use varies from year to year. More use causes greater depreciation.

Double-Declining Balance. The DDB method works best for assets that produce more revenue in their early years and less in their later years. Under the DDB method, higher depreciation expense is taken in the early years to match it with the higher revenue the asset generated.

Decision Guidelines

| Decision | Guideline | Analyze |

|---|---|---|

| Which depreciation method should a business use? | The choice of depreciation method depends on the specific asset and its intended use. The best method is one that most closely matches the cost of an asset against the future revenues it generates. | Straight-line (SL) depreciation is best for assets that will be used evenly throughout their lives and that will incur repair and maintenance costs evenly.

Units of production (UOP) depreciation is best for assets that will be used on an irregular basis throughout their lives. Double-declining balance (DDB) depreciation is best for assets that will be used significantly more in the early years of their lives. It is also best for assets that will require significantly more repair and maintenance expenditures in the later years of the asset’s life. |