Reporting profit or loss and other comprehensive income involve two concepts related to the decrease of economic benefits to the business entity: expenses and losses.

| GAAP | Expenses are ‘decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrence of liabilities that result in decreases in equity, other than those relating to distributions to equity participants’. |

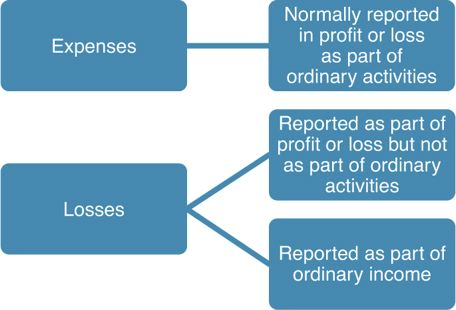

Losses are decreases in economic benefits that meet the definition of expenses. The terms ‘expense’ and ‘loss’ are interchangeable: an expense or loss could be reported in profit or loss or other comprehensive income. For example, a business may suffer major financial damage to its facilities from the fire. In this case, we would normally say that a loss has occurred, and this loss would appear in profit or loss but not as part of ordinary activities.

However, in practice, an expense usually refers to an item in profit or loss reported as part of the ordinary activities of the business.

The term ‘losses’ is used for items reported in profit or loss but not as part of ordinary activities. Some losses are reported in other comprehensive income. Figure 1 illustrates how the terms expenses and losses are commonly used in practice.

Figure 1 Expenses and Losses

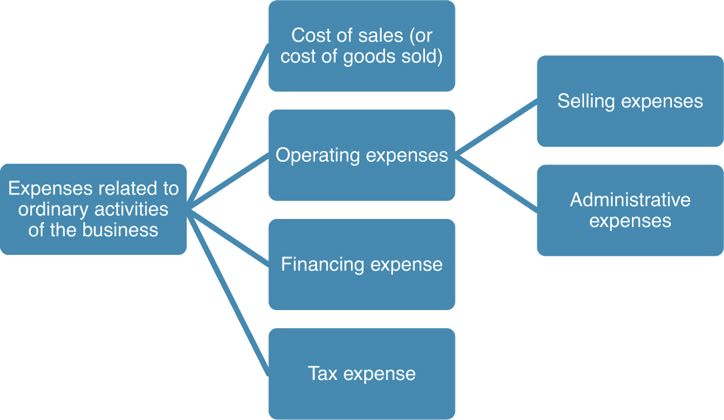

When reporting expenses associated with ordinary activities, businesses often classify expenses into the following line items:

- Cost of sales refers to an expense that is related to a good or service sold by the company during the reporting period.

- Operating expenses are those expenses that are not related to the good or service sold and are either:

1. Selling expenses, which include sales, marketing, advertising and distribution costs.

2. Administrative expenses, which include general administrative costs. Examples would be those expenses associated with the finance department and the human resources department.

- Financing expense (or interest expense) is the amount of interest and other financing costs – usually interest expense on debt – paid to banks and other creditors for borrowing money.

- Tax expense (or income tax expense) includes government taxes on the income for the period.

When the cost of sales is subtracted from revenue, the result is gross profit (or gross margin).

Revenue − Cost Of Sales = Gross Profit

Figure 2 graphically illustrates the classification of expenses related to the ordinary activities of the business.

Figure 2 Expense Classification