In this article, you will learn about:

- Why Your FICO Score Matters

- How Your FICO Score Is Determined

- Major Factor Affecting Your Credit Score

- The Least You Need to Know

All the information about you and your credit history is evaluated and used to determine your credit score—a very powerful predictor of your future bill-paying ability.

The best-known and most widely used score is the FICO score, which is based on a system developed by Fair Isaac Corporation. The mathematical equation used to calculate your score takes into account 22 pieces of data from your credit report, and the resulting number identifies you either as a low-risk or high-risk candidate for a lender.

Why Your FICO Score Matters

A potential lender looks at your credit report and your credit score when deciding whether or not to give you a loan. The lower your score, the less likely it is you’ll be offered a loan. If you are offered one, it undoubtedly will come with a higher interest rate or more restrictive terms.

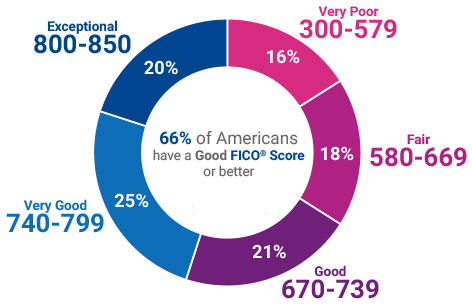

FICO scores are regarded as providing the best guides to future risk based solely on credit report data. The scale ranges from 300 (the lowest) to 850 (the highest). Lenders look most favorably to those whose scores are 740 or higher.

The general rule of thumb is that the higher your score, the less risk you pose to a lender. Historically, people with high FICO scores have repaid loans and credit cards more consistently than people with low FICO scores. Although there’s no single “cutoff score” used by all lenders, it’s important to know and understand your score.

Your credit score has quite an effect on the interest rates available to you when you want to borrow money. An example of mortgage rates available for different FICO score averages are shown in the following table.

| FICO Score | Mortgage Rate |

| 760 to 850 | 5.92% |

| 700 to 759 | 6.142% |

| 680 to 699 | 6.319% |

| 660 to 679 | 6.533% |

| 640 to 659 | 6.963% |

| 620 to 639 | 7.509% |

| 600 to 619 | 9.224% |

| 580 to 599 | 9.679% |

| 550 to 579 | 10.275% |

| 500 to 549 | 10.612% |

With many younger people saddled with significant college debt and credit still fairly tight, mortgages and other loans recently available to those with credit scores below 640 won’t be as readily available in the future. Therefore, it’s very important to maintain good credit or improve your credit score if necessary.

You can work to improve your score by paying off credit cards, getting rid of excess cards and using only one or two, and paying all your bills by the due date. Over time, your credit score should increase.

How Your FICO Score Is Determined

Your credit rating is calculated by compiling information in five categories:

- Your payment history constitutes 35 percent of the rating. One or two late payments won’t make a difference in your score, but a pattern of late payments will.

- The duration of your credit history counts for 15 percent of the rating.

- The amount of new credit counts for 10 percent, so watch how many credit cards you sign up for.

- The types of credit you’ve used (think home equity as compared to an uncollaterized loan) factor in for 10 percent.

- The debt you have counts for 30 percent.

Income is not a factor in determining FICO scores. Usually, the FICO score is given with four reason codes, in order from the strongest negative reason to impact your score, the second strongest factor, and so on.

It’s important to understand how you scored, so be sure to review your credit report at least once a year and especially before making a large purchase, like a house or a car. If your score isn’t what you’d like it to be, work to improve your score.

Major Factor Affecting Your Credit Score

Your level of revolving debt This is one of the most important factors considered for the FICO score. Even if you pay off your credit cards each month, your credit card may show the last billing statement in relation to your total available credit on revolving charges. If you think your FICO score should be higher, work to pay down your revolving account balances.

Shifting balances Don’t shift your credit card balances from one card to another to make it appear that you’re being diligent about paying off debt. And don’t open new revolving accounts. These tactics won’t improve your credit score.

The length of time your accounts have been established This can hurt you when you’re first starting out, but consumers with longer credit histories tend to be lower risk than those with shorter credit histories.

Too many accounts with balances Too many credit card accounts with balances is a dangerous sign that you won’t be able to make that many payments should your employment status change.

Too many credit inquiries within the last 12 months Borrowers who are seeking several new credit accounts are riskier than persons who aren’t seeking credit, although these have only a small impact on your FICO score. Inquiries have much less impact than late payments, the amount you owe, and the length of time you’ve used credit.

Your personal credit report includes information such as your name, Social Security number, date of birth, your address from the time you first got a credit card until now, everywhere you’ve worked during that time, and how you pay your bills. Whenever you apply for a loan or for credit, the place at which you applied will check out your report with a credit agency. In turn, it will give the credit agency any additional information it’s picked up on you.

Important

Each of the top three credit agencies, Equifax, TransUnion, and Experian, probably has the same information about you and your credit history. They get it from banks, finance companies, credit card suppliers, department stores, mail-order companies, and various other places that have had the pleasure of doing business with you. Smaller, regional credit bureaus supplement the information.

Credit Report Release

The Fair Credit Reporting Act limits who can see your credit report. Of course, the list is pretty long, but it does set some guidelines. Your credit report can be released by a reporting agency under the following circumstances:

- In response to a court order or a federal grand jury subpoena

- To anyone to whom you’ve given written permission

- To anyone considering you for credit or collection of an account

- To anyone who will use the report for insurance purposes

- To determine your eligibility for a government license or benefits

- To anyone with a legitimate business need for the report in connection with a business transaction with which you’re involved (This includes your landlord when you apply to rent an apartment as well as the cell phone and utility companies.)

When you realize how often your credit report can be accessed, you can begin to see how important it is that you keep it clean. But even if your credit record is perfect, your report might not be, and that could affect your credit score. With so much credit information floating around out there, it’s easy for mistakes to be made with that information. Human error is a big factor, and somebody who misreads some information about you can mess up your credit report royally. A study showed that one out of four people who took the time to thoroughly review their credit reports discovered a mistake that eventually was corrected.

You’re going to learn more about why it’s important to keep an eye on your credit report and exactly how to go about getting a copy of it.

Important

Be aware that every time an inquiry is made for your credit report, it’s automatically logged into your report. Although this isn’t necessarily bad, numerous inquiries may need to be explained to a potential lender.

Getting a Copy of Your Credit Report

Even if you don’t plan to apply for a car loan, mortgage, or credit card anytime soon, it’s a good idea to take a look at your credit report once a year. You can get a copy of your report from Annual Credit Report (annualcreditreport.com), which summarizes your credit reports from each of the three largest credit bureaus:

- Equifax Credit Services (equifax.com)

- TransUnion Credit Information Services, Consumer Disclosure Center (transunion.com)

- Experian (experian.com)

You can get the report for free, but you’ll have to pay a fee if you want to know your FICO score. Unless you’ve experienced credit problems, there’s no need to get your score every year; the report will suffice.

Dollars and Sense

Experts recommend you read your credit report carefully about once a year, especially before you apply for credit or when you know the credit report will be checked (as when you rent an apartment). This is the only way to be sure no mistakes have been made that will damage your credit record.

You also can get your credit report by contacting any of the three credit agencies. When requesting your credit report from any of these agencies, be prepared to provide your name, address, Social Security number, and maybe your date of birth as identification.

When you receive your report, look it over carefully. If you discover a mistake, contact all three credit agencies by certified mail, inform them of the mistake you’ve discovered, and request that they investigate. If you don’t get a reply within 60 days, send another letter. Remind the companies that they are required by law to investigate incorrect information or provide an updated credit report with the incorrect information removed. With financial breeches and identity theft at an all-time high, you need to be vigilant and scrutinize your report for anything that doesn’t look right.

Dollars and Sense

You have a legal right to submit a letter up to 100 words long to the credit agency, disputing something you’ve discovered on your credit report. The letter must be included in your file. If you do this, be sure your letter is clear, concise, and to the point.

If you see information you don’t like on your credit report that, unfortunately, isn’t a mistake, don’t despair. The Fair Credit Reporting Act mandates that negative information on your report be removed after a certain period of time. Even if you declare bankruptcy, that information is supposed to be removed from your report after 10 years. The trick, of course, is keeping your credit report healthy and in good shape. In this case, preventive maintenance works best.

The Least You Need to Know

- It pays to be aware of your credit history because it affects so many areas of your life.

- Despite how you feel about credit cards, you’ll need one or more to establish a credit history for your future.

- It’s not how much credit you have, but how you handle it, that affects your credit history.

- Recognizing credit and debt problems early and getting help if you need it can stop the situation from getting out of control.

- You should know what your credit report contains, how you can get a copy of it, and ways to correct mistakes when necessary.