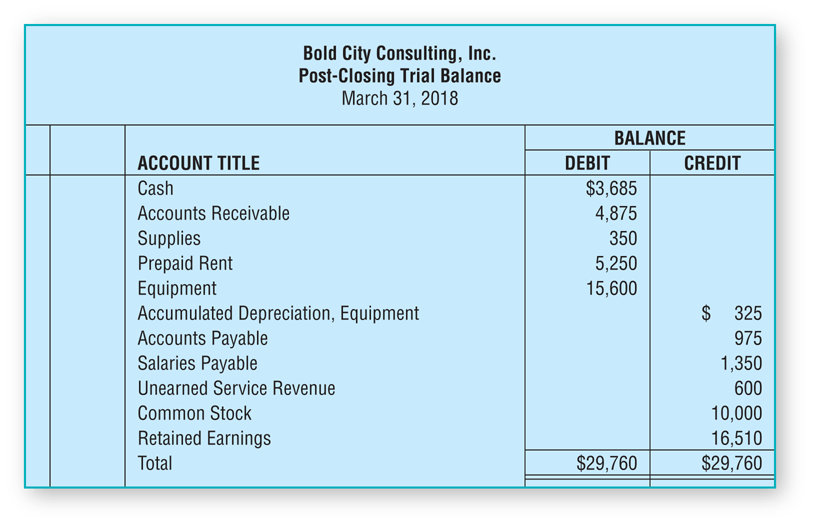

A list of the accounts and their balances at the end of the accounting period after closing entries have been journalized and posted.

The accounting cycle ends with the preparation of a post-closing trial balance. This trial balance lists the accounts and their adjusted balances after closing.

Only assets, liabilities, common stock, and retained earnings appear on the post-closing trial balance.

No temporary accounts—revenues, expenses, or dividends—are included because they have been closed. The accounts in the ledger are now up to date and ready for the next period’s transactions.

Example

The following post-closing trial balance was prepared after posting the closing entries of Bold City Consulting to its general ledger and calculating new account balances.

Figure 1: Post- Closing Trial Balance